You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Effective debt management is a critical task, and two proven solutions are widely used: Balance Transfer and Debt Consolidation. Each offers distinct approaches to handling debt.

Should you pick balance transfer or debt consolidation?

Balance Transfer involves shifting existing high-interest credit card debt to a new card with a lower or zero introductory APR, typically for a period of 12 to 21 months. On the other hand, applying for a debt Consolidation involves combining multiple debts into a single loan, usually with a lower interest rate and a longer repayment term. This approach is beneficial for those seeking a simplified payment structure and potentially lower overall interest payments, applying to a debt consolidation can be beneficial.

Both strategies require careful consideration of one's financial situation, including the amount of debt, repayment ability, and the impact on credit scores.

Balance Transfers

A balance transfer involves shifting the outstanding balance from one or more credit cards to another card, typically offering a lower Annual Percentage Rate (APR).

The primary appeal of a balance transfer is the introductory offer, often a 0% APR for a period ranging from 12 to 21 months. This period allows the cardholder to pay off debt faster without accruing interest, potentially leading to faster debt reduction.

However, balance transfers entail certain considerations. A fee, usually 3% to 5% of the transferred amount, is commonly charged, adding to the total debt. Post-promotional APRs are an important aspect to consider- once the introductory period concludes, the interest rate on any remaining balance can increase significantly.

Additionally, balance transfers require a good credit score for approval, and the credit limit on the new card may not cover the total desired transfer amount.

Debt Consolidation Loans

Debt consolidation loans, typically unsecured personal loans, are used to pay off multiple debts, consolidating them into a single loan with one monthly payment. These loans often offer lower interest rates than the average rates on existing debts, particularly credit card debts, making them an effective tool for debt restructuring.

The benefits of debt consolidation loans extend to their repayment structure. They provide a fixed repayment schedule, with terms usually ranging from one to seven years, aiding in budget planning and offering a clear timeline for debt elimination. These loans can consolidate various unsecured debts, offering flexibility in managing debt.

However, applying for a debt consolidation loan has its considerations. Interest accrues immediately, unlike the interest-free period of balance transfer cards. While generally lower and fixed, the rates depend on the individual's credit profile.

Some loans may include origination fees or prepayment penalties, adding to the cost. Qualifying for a debt consolidation loan with favorable terms typically requires a good to excellent credit score.

Understanding the Long-term Implications

Before applying for a debt consolidation, here are some considerations that can affect your financial health and credit score.

Impact on Financial Health

- Balance Transfers: While initially attractive due to the 0% APR, it's important to plan for the end of the promotional period. Failing to pay off the entire balance can lead to high-interest charges, potentially negating the initial benefits.

- Debt Consolidation Loans: These loans convert multiple debt payments into one, often with a lower interest rate. This can lead to significant savings over time. However, the longer repayment terms might mean paying more interest over the life of the loan compared to a quicker repayment strategy.

Credit Score Considerations

- Balance Transfers: Opening a new credit card for a balance transfer can initially lower your credit score due to a hard inquiry. However, if managed well, it can improve your credit score by lowering your credit utilization ratio.

Debt Consolidation Loans: Taking out a new loan also results in a hard inquiry, which can temporarily lower your credit score. Over time, consistent payments can improve your credit score. It's important to avoid accumulating new debt on cleared credit cards, which can harm your credit score and financial health after applying for a debt consolidation.

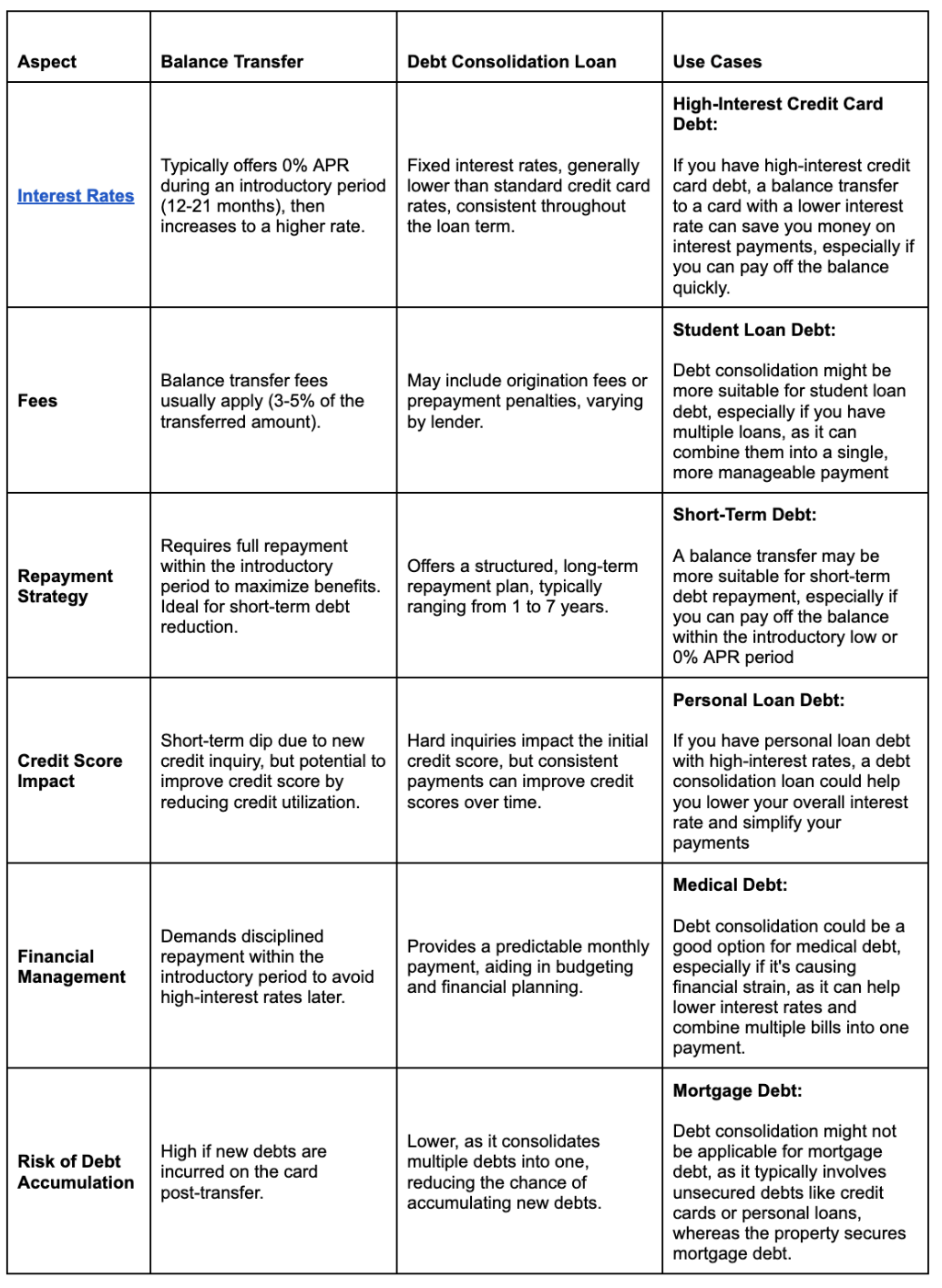

Quick Comparison

Conclusion

The choice between a balance transfer and a debt consolidation loan should be based on a thorough analysis of your debt amount, types of debt, repayment ability, and the impact on your credit score. Both options have their merits, but they serve different financial situations and goals to consider when applying for a debt consolidation or a balance transfer.

By carefully considering your unique circumstances and using available tools and resources, you can make an informed decision that aligns with your long-term financial health and objectives. Remember, the key to successful debt management lies in disciplined budgeting, strategic planning, and staying informed about your financial choices. For a strategic approach to managing your debt.

Discover how Bright Money’s solutions can align with your financial goals and enhance your credit-building journey. Explore Bright Builder to see how Bright Builder can assist in your financial restructuring.

Suggested readings

- Do consolidation loans hurt your credit?

- 5 ways to pay off debts comfortably

- Who has the best debt consolidation loans?

FAQ

1. Should I Choose Debt Consolidation?

When applying for a debt consolidation, assess if you have multiple high-interest debts, such as credit card balances, personal loans, or medical bills. Applying for a debt consolidation loan can be a good idea if it simplifies your financial management by merging these debts into one loan with a single repayment term. This strategy often reduces the overall interest you pay, especially if you qualify for a loan with a lower interest rate than your existing debts.

2. Why Would Someone Decide to Use a Balance Transfer?

A balance transfer is often chosen by individuals looking to manage or pay off high-interest credit card debt more efficiently. By transferring existing debt to a new credit card with a lower introductory APR (often 0%), you can save significantly on interest charges. This method is particularly effective if you can pay off the transferred balance within the promotional period.

3. Is Debt Consolidation the Best Way to Get Out of Debt?

Debt consolidation can be an effective way to get out of debt, especially for those juggling multiple debts with high interest debts. By consolidating these debts into a single loan with potentially lower interest rates and fixed repayment terms, you can streamline your payments and often save money on interest. However, it's not a one-size-fits-all solution.

4. Does Debt Consolidation Ruin Your Credit?

Debt consolidation does not inherently ruin your credit. In fact, it can positively impact your credit score over time if managed responsibly. When you consolidate your debt, a hard inquiry is made on your credit report, which can temporarily lower your score. However, by reducing your credit utilization ratio and making consistent, on-time payments, you can improve your credit profile. The key is to avoid accruing new debt on cleared accounts, as this can negatively affect your credit score and overall financial health..

Disclaimer: Payment history has the biggest impact on credit score, accounting for 40% of how the score is calculated per TransUnion (https://www.transunion.com/credit-score). Bright Builder helps you build a payment history that may positively improve your credit score. A credit score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will hurt your credit score. Products and services are subject to state residency and regulatory requirements. Bright Builder is currently not available in all states