You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Did you know that According to recent data, the approval rate for mortgage applications from borrowers with credit scores below 620 is only about 10%?

Having a low credit score doesn't necessarily mean you have to give up on your dreams of homeownership or finding a place to rent.

In this article, we'll explore various options available how to buy a house with bad credit or secure a rental property. We'll discuss rent-to-own programs, different loan options, strategies for building credit, and much more. Let's dive in and explore the possibilities!

Can Someone Buy a House With Bad Credit?

Buying a house with bad credit is possible, although it may require a different approach than those with good credit scores. Statistics reveal that buyers with lower credit scores can face higher interest rates up to 1-2% than those with excellent credit. Although if you want to increase your credit score you can check out Bright Money’s web app! Let's explore some options that can help you achieve homeownership despite your credit challenges.

1. Rent-to-Own Programs

According to industry reports, rent-to-own agreements accounted for approximately 5% to 7% of the residential real estate market in the United States. For those with poor credit, rent-to-own programs such as HomePath, Home Partners of America, and Rent-A-Center provide an alternate route to homeownership. These programs offer you the choice to rent a home today and potentially purchase it later. As part of the agreement, you set away a percentage of your monthly rent as a down payment, which can be used towards the purchase price if you decide to exercise the buying option.

2. FHA Loans

Federal Housing Administration (FHA) are tailored to meet the needs of individuals with bad credit. FHA-insured mortgages account for approximately 15% to 20% of all new home loans originated in the country.These loans offer more lenient credit standards, making them an attractive option for borrowers with less-than-perfect credit. To qualify for an FHA loan, applicants typically need a credit score of at least 580, although some may be eligible with scores between 500 and 579 by making a higher down payment.

The specific APR for FHA loans can vary based on market conditions, lenders, and the borrower's credit profile. Overall, FHA loans provide a viable path to homeownership for those with bad credit, offering smaller down payments and more forgiving eligibility requirements. However, it's crucial to understand the loan terms and assess repayment capabilities before proceeding with any financial commitment.

3. USDA Loans

The U.S. Department of Agriculture offers loans through its USDA Rural Development Program to help individuals in rural areas achieve homeownership. USDA loans provide attractive terms, including low-interest rates and zero down payment options, making them accessible to those with less-than-perfect credit.

Eligibility criteria consider factors beyond credit scores, such as income and property location, widening opportunities for prospective homebuyers. Interested applicants can apply or check property eligibility on the official USDA Rural Development website (https://www.rd.usda.gov/), which aims to support rural communities and make homeownership more attainable for individuals with diverse financial backgrounds.

4. Subprime Mortgages

Subprime Mortgages are designed for borrowers with low credit scores or financial challenges, offering a chance to secure a home loan despite bad credit. Examples of subprime lenders include Carrington Mortgage Services, New American Funding, and Quicken Loans' Rocket Mortgage. While these mortgages may have higher interest rates and fees, they present an opportunity for homeownership.

However, careful consideration of the terms and long-term financial implications is essential. Prospective borrowers can explore subprime mortgage options and apply through reputable lenders' websites like ttps://www.carringtonhomeloans.com/, https://www.newamericanfunding.com/, and https://www.rocketmortgage.com/.

5. Veteran Affair (VA) Loans

You could be eligible for a VA loan if you have served in the military or are currently on active duty. These loans are accessible to qualified borrowers and are insured by the U.S. Department of Veterans Affairs. VA loans sometimes have fewer strict restrictions for credit scores, making them available to those with poor credit. They can be a great choice for service members and their families who are wanting to buy a home.

Exploring Options for Rental

If buying a house is not currently feasible, there are still viable options for renting, even with bad credit. Let's explore some strategies to secure a rental property despite credit challenges.

1. Co-Signers and Guarantors

Having a co-signer or guarantor with good credit can significantly improve your chances of renting a property. A co-signer is a person who agrees to take responsibility for the lease if the primary tenant fails to make payments. A guarantor provides a financial guarantee to the landlord, assuring them that the rent will be paid. These options can alleviate concerns related to bad credit and provide peace of mind to landlords.

2. Renting from Private Landlords

Private landlords may be more open to renting to individuals with bad credit than larger property management companies. They often have more flexibility and can consider other factors, such as rental history and employment stability. Look for rental listings from individual landlords and communicate your situation honestly and respectfully.

3. Building Credit for Rental

Improving your credit score can enhance your chances of securing a rental property in the future. Focus on paying your bills on time, thus reducing outstanding debts, and resolving any collection accounts. Building a positive rental history by paying rent consistently and responsibly can also help offset the impact of a low credit score.

Which one to choose between Buying a House or Renting?

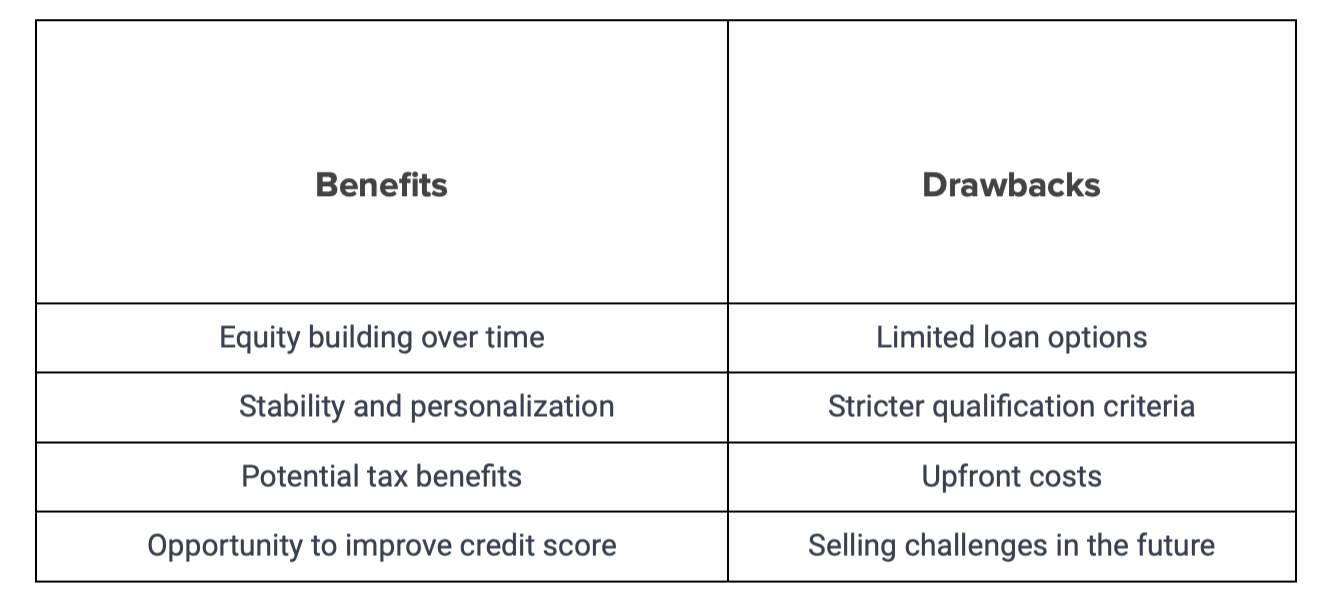

Benefits and Drawbacks of Buying a House with Bad Credit

Benefits and Drawbacks of Renting a House with Bad Credit

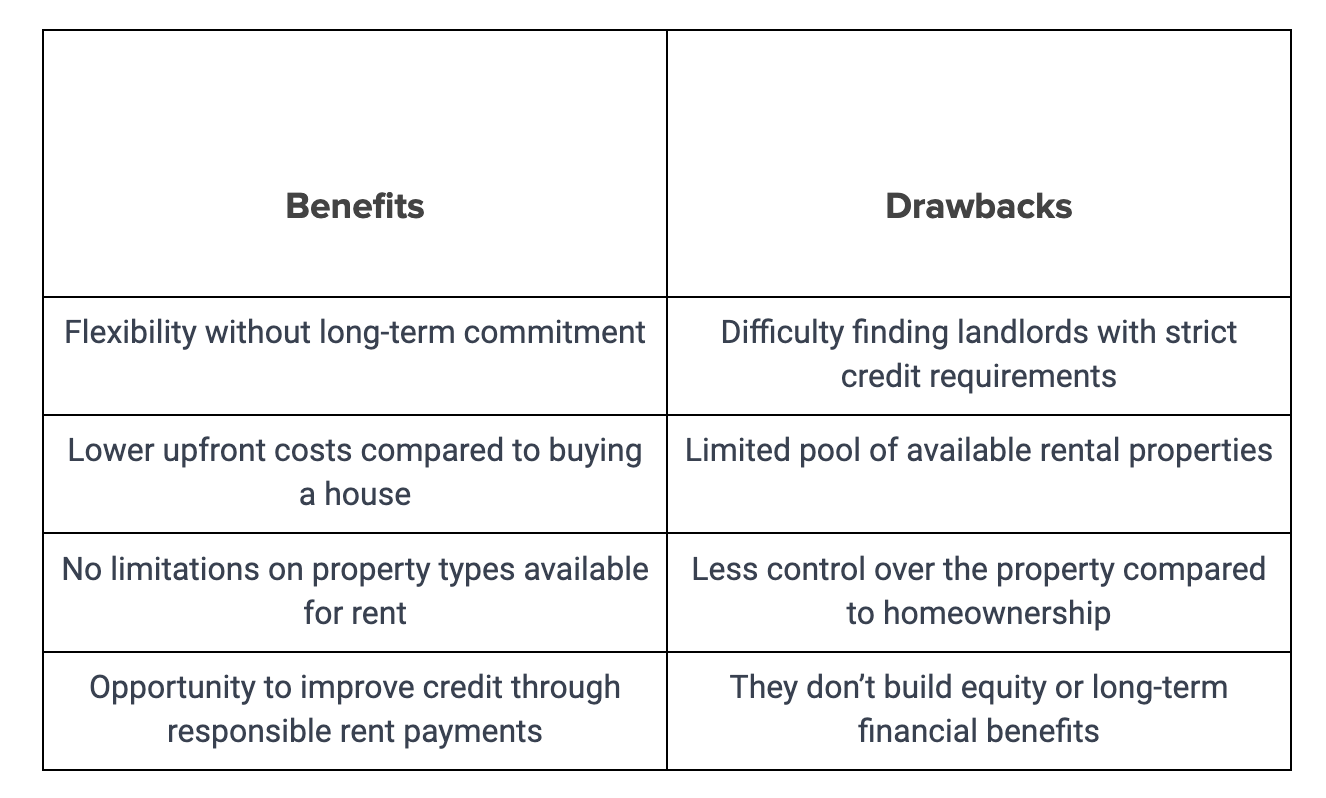

Renting with bad credit also comes with its own set of benefits and drawbacks. Let's examine them to help you make an informed decision.

Here are the benefits and drawbacks of renting with bad credit:

Although it is feasible to buy a house with bad credit, it is crucial to consider the advantages and disadvantages of such a choice carefully. The same applies to renting. After reviewing the pros mentioned above and cons, make an informed decision about which option you wish to pursue

Summing Up

In conclusion, having bad credit doesn't have to be a roadblock to homeownership or securing a rental property. You can still achieve your housing goals by seeking professional advice from experts like Bright Money and exploring alternative options, such as rent-to-own programs, FHA loans, and renting from private landlords.

Remember to take steps to improve your credit score and consider the benefits and drawbacks of each option. With persistence and the right strategy, you can overcome credit challenges and find a path towards homeownership or rental. Start exploring your options today!

Recommended Readings:

- From Debt to Prosperity: 5 Inspiring Stories of Building Credit with Credit Cards

- Whose credit score is used when co-signing for a loan?

References:

- https://www.rocketmortgage.com/learn/how-to-buy-house-with-bad-credit

- https://www.federalreserve.gov/econresdata/feds/2016/files/2016098pap.pdf

- https://m.economictimes.com/wealth/save/what-high-and-low-credit-score-determine/articleshow/77235639.cms

- https://www.moodysanalytics.com/-/media/article/2022/lease-to-purchase-how-build-homeownership.pdf

- https://sgp.fas.org/crs/misc/RS20530.pdf

Frequently Asked Questions

Q1: Can I buy a house with no credit?

A: While having no credit history can pose challenges, alternative mortgage options exist for individuals with limited or no credit history, such as FHA loans.

Q2: Will my bad credit affect my partner's ability to get a mortgage?

A: Yes, if you apply for a joint mortgage, your bad credit may affect your partner's ability to get approved. Lenders consider both applicants' credit scores, and a low credit score could result in higher interest rates or a denial of the mortgage application altogether.

Alternatively, your partner might be eligible for a mortgage on their own, but the terms and borrowing capacity may be impacted by your financial situation.

Q3: Should I Wait to Buy a House Until My Credit Improves?

A: While waiting to improve your credit can open up more mortgage options and potentially secure better interest rates, it is not always necessary to delay homeownership. With alternative financing options like FHA loans, you can start building equity and homeownership while working to improve your credit for future refinancing opportunities.

Q4: Will I Pay Higher Interest Rates with Bad Credit?

A: Yes, borrowers with bad credit are generally considered higher risk by lenders, which may result in higher interest rates on their mortgage loans. However, with time and efforts to improve your credit, refinancing in the future to secure a lower interest rate is a possibility.

Q5: How Can I Rebuild My Credit After Buying a House?

A: Buying a house with bad credit can actually be an opportunity to rebuild your credit. Making timely mortgage payments and managing other debts responsibly will positively impact your credit score over time. Consistent and responsible financial behavior is key to rebuilding credit.

Q6: Can I Get Down Payment Assistance with Bad Credit?

A: Yes, there are down payment assistance programs available for homebuyers with bad credit. These programs, offered by state and local governments or non-profit organizations, provide grants or low-interest loans to help with down payment and closing costs.

*Payment history has the biggest impact on credit score accounting for 40% of how score is calculated per TransUnion (https://www.transunion.com/credit-score). Bright Builder helps you build payment history that may positively improve your credit score. Credit score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will have a negative effect on your credit score. Products and services subject to state residency and regulatory requirements. Bright Builder is currently not available in all states.