You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Did you know that according to a survey, 55% of Americans with credit card debt are trying to consolidate it to lower interest rates and simplify payments?

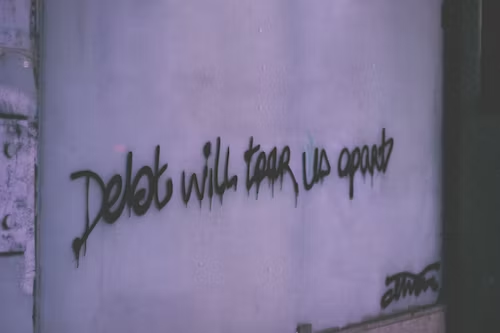

Debt can be a heavy burden to carry, impacting your financial well-being and overall quality of life. Fortunately, there's a solution that can help you regain control of your finances and be debt free: debt consolidation.

Before we dive more into the topic, it is recommended that you read more about Why loans don’t always work for debt consolidation!

This comprehensive guide will explore the ins and outs of debt consolidation, its benefits, and how you can find reputable debt consolidators like the Bright Money App. So, if you're ready to take the first step towards a debt-free future, let's get started.

What is Debt Consolidation?

Debt consolidation aims to simplify a person's financial situation by merging their debt payments, which can lower interest rates and establish a clear repayment plan.

With debt consolidation, a borrower takes out a new loan, often at a lower interest rate, to pay off their existing debts. This new loan consolidates all the outstanding debts into one account. As a result, the borrower no longer needs to deal with multiple creditors and different due dates, making it easier to keep track of finances and avoid missing payments.

Debt consolidation can be pursued through various methods, such as obtaining a personal loan, using a home equity loan or line of credit, or enrolling in a debt consolidation program through a reputable financial institution or credit counseling agency.

When Should You Consider Debt Consolidation?

Debt consolidation is a financial strategy that can help individuals manage their multiple debts more effectively by combining them into a single loan or credit facility. It is a suitable option for certain situations, and considering debt consolidation can be beneficial under the following scenarios:

- Multiple High-Interest Debts: Amidst an economic scenario of lowered Fed rates, strategically consolidating multiple high-interest debts – credit card balances, personal loans, or payday loans – into a single loan with reduced interest can yield substantial savings on interest payments.

- Difficulty in Managing Payments: Struggling to keep track of various due dates, minimum payments, and creditors can lead to missed payments, late fees, and even negative impacts on your credit score. Debt consolidation simplifies your finances by requiring just one monthly payment.

- Lower Monthly Payments: Debt consolidation might lower your monthly payments by extending the repayment time. This might relieve financial pressure by giving your budget more breathing room.

- Improved Credit Score: Consolidating debt can positively impact your credit score if you consistently make timely payments on the new loan. A higher credit score can open doors to better interest rates and improved financial opportunities.

- Variable Interest Rates: If you have variable interest rate debts, consolidating them into a fixed-rate loan can provide stability and protect you from future interest rate fluctuations.

- Positive Change in Financial Situation: If your financial situation has improved since you initially took on the debts, you might qualify for a lower interest rate or better loan terms, making debt consolidation a favorable option.

- Simplifying Student Loan Repayment: For individuals with multiple student loans, consolidating them through a federal direct consolidation loan can simplify repayment and potentially lead to more favorable repayment plans.

However, it's crucial to remember that debt consolidation is not a one-size-fits-all solution, and its effectiveness depends on individual circumstances. Before considering debt consolidation, it's essential to assess your financial situation, explore available options, and seek advice from a financial counselor or advisor to ensure it aligns with your goals and needs.

What Are The Benefits of Debt Consolidation?

The Federal Reserve reported that outstanding consumer debt reached $4.19 trillion, indicating the growing need for debt consolidation solutions. Debt consolidation offers several advantages that can significantly improve your financial situation:

1. Simplified Finances

One of the most noteworthy benefits of debt consolidation is simplifying your finances. Instead of dealing with multiple creditors and juggling various due dates, you'll have just one monthly payment to make, making it easier to stay organized.

2. Lower Interest Rates

High-interest rates can be a major obstacle to paying off debts. With debt consolidation, you may qualify for a lower interest rate on the consolidated loan, which can save you money over time and help you become debt-free faster.

3. Improved Credit Score

Consistently making on-time payments towards your consolidated loan can positively impact your credit score. As you reduce your outstanding debt, your creditworthiness improves, making it easier to obtain credit in the future.

4. Reduced Stress

Dealing with debt-related stress can be emotionally taxing. By consolidating your debts, you'll gain a sense of control over your financial situation, leading to reduced stress and improved overall well-being.

Where to Search for Debt Consolidators?

Now that you understand the benefits of debt consolidation, it's time to find the right debt consolidator for your needs. Follow these steps to begin your search:

Finding Online Debt Consolidators Across the USA

Discover the convenience of finding debt consolidators online within the USA. With a few clicks, you can explore a range of reputable services and connect with experts who can help you manage and consolidate your debts effectively.

- National Debt Relief(Based in New York, USA.): Operating across the nation, National Debt Relief specializes in providing effective debt relief solutions. With a focus on reducing financial burdens, they offer comprehensive strategies to help individuals regain control of their finances.

- CuraDebt(Headquartered in Hollywood, Florida, USA): Covering the entire USA, CuraDebt offers expert assistance in navigating debt challenges. Their personalized approach helps clients understand and address their debt issues, offering tailored solutions for debt consolidation and relief.

- Freedom Debt Relief(Located in San Mateo, California, USA): Serving clients nationwide, Freedom Debt Relief specializes in negotiating and settling debts. Their comprehensive approach aims to alleviate financial stress and create a path toward debt-free living.

- Accredited Debt Relief(Based in San Diego, California, USA): Available nationwide, Accredited Debt Relief empowers clients with proven strategies to manage and overcome debt. They offer a range of services to help individuals regain financial stability and achieve their long-term goals.

- Consolidated Credit(Headquartered in Fort Lauderdale, Florida, USA): Providing credit counseling and debt consolidation services across the country, Consolidated Credit helps clients create structured repayment plans. Their guidance assists individuals in managing multiple debts effectively.

- Debt.com(Based in Fort Lauderdale, Florida, USA): A nationwide resource, Debt.com connects individuals with expert guidance for managing debt-related challenges. They provide valuable insights and options to help clients make informed decisions about their financial future.

- Pacific Debt(Located in San Diego, California, USA): Operating nationwide, Pacific Debt offers personalized debt consolidation plans. By tailoring their services, they assist clients in streamlining their debt repayment journey and achieving financial freedom.

- CreditAssociates(Headquartered in Plano, Texas, USA): Serving clients nationwide, CreditAssociates specializes in debt settlement solutions. Through negotiation and settlement strategies, they work to reduce debt burdens and help clients on the path to recovery.

- American Debt Enders(Based in Clearwater, Florida, USA): Available across the USA, American Debt Enders offers comprehensive debt relief services. Their experienced team assists clients in exploring various options to regain control over their financial situation.

- InCharge Debt Solutions(Located in Orlando, Florida, USA): With a nationwide presence, InCharge Debt Solutions provides online resources and services to help individuals manage their debts. They guide clients toward creating sustainable repayment plans and achieving financial success.

- Consolidation Plus(Based in Plano, Texas, USA): Nationwide, Consolidation Plus focuses on providing effective consolidation solutions. Their streamlined approach helps clients simplify their debt repayment process for greater financial stability.

- Debt Rx USA(Located in Atlanta, Georgia, USA): Serving clients across the nation, Debt Rx USA offers debt management and consolidation solutions. Their expertise helps individuals develop customized strategies to overcome financial challenges.

- CreditGUARD(Headquartered in Boca Raton, Florida, USA): Covering the entire USA, CreditGUARD specializes in credit counseling services. Their professional guidance supports clients in understanding their financial situation and making informed decisions.

- Guardian Debt Relief(Based in New York, New York, USA): With a nationwide reach, Guardian Debt Relief focuses on debt negotiation and settlement. They work to reduce debt burdens and provide clients with a path to financial recovery.

- Pacific Debt Inc.(Located in San Diego, California, USA): Nationwide, Pacific Debt Inc. offers personalized debt consolidation plans to help clients effectively manage their debts. Their tailored solutions contribute to a more secure financial future.

- National Credit Card Relief(Based in Irvine, California, USA): Specializing in nationwide debt relief, National Credit Card Relief specifically focuses on addressing credit card debts. Their negotiation strategies aim to reduce these specific financial burdens.

- Golden Financial Services(Located in Jersey City, New Jersey, USA): Serving clients across the USA, Golden Financial Services offers comprehensive debt relief services. Their experienced team helps clients explore various options for debt management.

- New Era Debt Solutions(Based in Camarillo, California, USA): Operating nationwide, New Era Debt Solutions provides holistic debt relief solutions. Their expertise assists clients in identifying effective strategies to overcome financial difficulties.

- DebtWave Credit Counseling(Located in San Diego, California, USA): Nationwide, DebtWave Credit Counseling specializes in credit counseling services. They equip clients with the knowledge and tools to manage their debts responsibly.

- Oak View Law Group(Based in Stafford, Virginia, USA): With a nationwide presence, Oak View Law Group offers legal assistance and debt management solutions. Their comprehensive approach helps clients navigate complex financial challenges.

Say goodbye to the hassle of searching locally and embrace the simplicity of accessing debt consolidation solutions right from the comfort of your home. Whether you're dealing with credit card balances, personal loans, or other debts, the online landscape offers a convenient and efficient way to find the assistance you need to achieve financial stability.

How to Find Debt Consolidators Near Me?

When seeking debt consolidation assistance across various geographies in the USA, the digital landscape offers a seamless way to connect with reputable services. Explore the list below for a selection of online debt consolidators, categorized by different regions, along with their areas of operation and corresponding links:

East Coast: National Debt Relief

West Coast: CuraDebt

Midwest: Freedom Debt Relief

South: Accredited Debt Relief

Nationwide: Consolidated Credit, Debt.com

Various Regions: Pacific Debt , CreditAssociates

Multiple Locations: American Debt Enders

Online Platform: InCharge Debt Solutions

These online debt consolidation services offer a convenient and accessible way to address your financial challenges, regardless of your geographical location. Remember to thoroughly research each service, review their terms, and choose the one that best aligns with your specific needs and goals.

Check Online Accreditations and Reviews

Verify the accreditation and legitimacy of the online debt consolidators you're considering. Look for affiliations with reputable organizations like the Better Business Bureau (BBB) and read online reviews from real customers to gauge their satisfaction.

For a seamless online debt consolidation experience, check out Bright Credit, a trusted platform that consolidates credit card debt. Click here to discover how they can help you regain financial control and alleviate your debt burden.

Qualities to Look for in Debt Consolidators

Not all debt consolidators are created equal, and finding a trustworthy and reputable service is crucial. Consider the following qualities as you evaluate potential debt consolidators:

1. Experience and Expertise

Choose a debt consolidator with a track record of successfully assisting clients in similar financial situations. Experience and expertise are essential when navigating complex debt consolidation processes.

2. Transparent Fee Structure

A reliable debt consolidation service will be transparent about its fees and costs. Avoid services that have hidden charges or seem hesitant to discuss their fee structure.

3. Good Customer Service

Effective communication and support are vital during the debt consolidation process. Look for a company that values its customers and provides prompt, helpful assistance.

4. Variety of Debt Solutions

Each individual's financial situation is unique, so it's essential to choose a debt consolidator that offers a variety of debt solutions. They should tailor their approach to your specific needs and financial goals.

Avoiding Scams and Shady Practices

While there are many legitimate debt consolidation services available like the Bright Money App, some unscrupulous actors may try to take advantage of vulnerable individuals. Protect yourself by being vigilant and avoiding services that exhibit the following red flags:

1. Promise Unrealistic Results

Be wary of debt consolidators who promise to eliminate all your debts or drastically reduce them overnight. Legitimate debt consolidation takes time and effort.

2. Charge Exorbitant Upfront Fees

Reputable debt consolidation services typically charge reasonable fees based on your debt amount or a percentage of the amount saved. Avoid those demanding exorbitant upfront fees before providing any service.

3. Lack Proper Accreditation or Licensing

Always verify the credentials of a debt consolidator before proceeding. Accreditation from organizations like the BBB adds credibility to the service. Bright Money is rated a solid A+ debt consolidator by BBB, so make sure to check it out!

The Debt Consolidation Process Explained

Research by Experian shows that 71% of personal loan borrowers used the funds to consolidate existing debts, making debt consolidation one of the top reasons for personal loans.

Understanding the debt consolidation process can help you prepare for what lies ahead. Here's a breakdown of the typical steps involved:

Step 1: Initial Consultation The debt consolidation process begins with an initial consultation with a reputable debt consolidator. During this crucial step, you'll meet with a financial advisor or counselor who specializes in debt consolidation. The purpose of this meeting is to gain a comprehensive understanding of your current financial situation.

You'll be required to provide details about your outstanding debts, which may include credit card balances, personal loans, medical bills, and any other forms of debt. The advisor will also inquire about your income sources, such as your salary, investments, or other earnings.

Additionally, they will ask about your monthly expenses, including rent or mortgage payments, utility bills, groceries, transportation costs, and any other regular expenditures.

By collecting this information, the debt consolidator can assess your overall financial health, including your debt-to-income ratio and your ability to repay the debt consolidated loan. This assessment will determine whether debt consolidation is a suitable option for you.

Step 2: Assessment and Offer Following the initial consultation, the debt consolidator will conduct a thorough assessment of your financial situation. They will carefully analyze the details provided during the consultation, paying close attention to your debt balances, interest rates, and repayment terms.

With this information, the debt consolidator will create a personalized debt consolidation plan tailored to your specific needs and financial capabilities. The plan will outline the terms of the consolidated loan, including the interest rate, repayment period, and the amount of the new loan.

The primary goal of the consolidation plan is to make your debt more manageable by reducing the overall monthly payment and simplifying your financial obligations. This can be achieved through a combination of negotiating with creditors for better terms and consolidating your multiple debts into a single loan.

Once the debt consolidator has formulated the consolidation plan, they will present you with an offer that outlines the details of the new loan. This offer will also specify the new repayment schedule, providing you with a clear picture of how your monthly payments will be structured under the consolidation plan.

Step 3: Consolidation and Repayment If you find the consolidation plan and offer to be

agreeable, you can accept the proposal, and the consolidation process will begin. The debt consolidator will take on the responsibility of negotiating with your creditors on your behalf.

Negotiating with creditors is a crucial aspect of debt consolidation. The debt consolidator will advocate for you, aiming to secure favorable terms, such as reduced interest rates, the elimination of late fees, or the waiving of penalties. These negotiations are crucial to making the consolidated loan more advantageous to you and improving your ability to repay the debt.

Once the negotiations are successful, and the terms of the consolidated loan have been finalized, your multiple debts will be combined into one single loan. This is the consolidation phase, where the debt consolidator effectively gathers all your outstanding debts under one umbrella.

From this point on, you'll make a single monthly payment to the debt consolidator, who will take care of distributing the funds to your individual creditors as per the agreed-upon terms. The consolidator ensures that each creditor receives the correct amount, and your new loan is serviced appropriately.

Alternatives to Debt Consolidation

While debt consolidation is an effective strategy for many, it may not be the best fit for everyone's financial situation. Consider these alternatives based on your specific needs:

1. Debt Management Plan

If you're struggling with debt, a debt management plan can be a helpful solution. This involves partnering with a credit counseling agency to negotiate lower interest rates and manageable monthly payments with your creditors. This option is especially beneficial for individuals with manageable debts, as it can help create a sustainable repayment plan.

2. Debt Settlement

Debt settlement involves negotiating with the creditors in order to accept a lump-sum payment that's less than the total amount owed. While this can help you reduce your debt burden, it may have a negative impact on your credit score.

3. Bankruptcy

Bankruptcy should be considered as the last resort, as it has severe and long-lasting consequences for your creditworthiness. However, for those with overwhelming debt and no viable alternatives, bankruptcy can provide a fresh start.

Maintaining Financial Stability After Consolidation

Achieving debt consolidation is a significant accomplishment, but it's essential to maintain financial discipline to avoid falling back into debt. Here are some tips to stay financially stable after consolidation:

1. Create a Budget and Stick to It

Develop a realistic budget that outlines your income, expenses, and debt payments. Stick to this budget diligently to ensure you live within your means and avoid overspending.

2. Build an Emergency Fund

An emergency fund is essential for handling unexpected expenses without relying on credit. Aim to save around 3-6 months' worth of living expenses in an easily accessible account.

3. Avoid Incurring New Debts

Resist the temptation to take on new debts, such as credit card purchases or personal loans. Focus on repaying your consolidated loan and improving your financial situation.

Conclusion

Finding reputable debt consolidators near you is crucial for regaining financial control and achieving a debt-free future. Debt consolidation offers benefits such as simplified finances, lower interest rates, and improved credit scores. To begin your search, utilize online resources, local directories, and seek recommendations from friends and family. Verify the credentials of potential debt consolidators through organizations like the Better Business Bureau.

The Bright Money App stands out as an excellent option, offering personalized debt consolidation plans and advanced financial tools like the Bright Builder. Their expert advisors ensure favorable terms and provide continuous support throughout the consolidation process. With debt consolidation and Bright Money's assistance, you can embark on a path to financial stability and work towards long-term financial goals, building a brighter financial future.

Recommended Reads:

1. Why loans don’t always work for debt consolidation

FAQs

- Is debt consolidation suitable for all types of debt?

A: Debt consolidation is most effective for unsecured debts, like credit card debts and personal loans. Secured debts, like mortgages or car loans, may not be eligible for consolidation.

- Will debt consolidation affect my credit score?

A: Initially, debt consolidation may cause a slight dip in your credit score due to the application for a new loan. However, as you make consistent payments on the consolidated loan, your credit score should improve over time.

- Can I still use my credit cards even after debt consolidation?

A: While it is technically possible to continue using credit cards after debt consolidation, it's generally advisable to avoid doing so to prevent incurring new debts.

- Are debt consolidation services free?

A: Debt consolidation services typically come with fees. However, these fees should be transparent and reasonable. Avoid services that charge exorbitant upfront fees.

- Can I switch debt consolidation services if I'm unsatisfied?

A: Yes, you can switch debt consolidation services if you are unsatisfied with the current one. However, be sure to review any contracts or agreements carefully to understand the terms and potential costs associated with switching.

- Can debt collectors sue you?

A: Yes, debt collectors can sue you to recover unpaid debts.