You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Handling financial obligations, particularly when faced with multiple high-interest debts, can be daunting. However, the debt consolidation approach is handy in almost all circumstances and can cut a lot of mess.

Debt consolidation offers a clarified solution, but understanding its long-term impact on your credit record is important for anyone considering this financial move. A debt consolidation loan you take out will stay on your credit report for the duration of the loan.

This can work to your advantage if you make your loan payments on time and have good credit. Later payments, however, may remain on your credit report for up to seven years if you fail to make a payment.

How long does Debt Consolidation stay on your record?

Debt consolidation typically stays on your credit report for up to seven years. This duration is consistent with other debt management solutions like debt settlement, which remain on your record for the same period [3][5]. Debt consolidation's impact on your credit report may vary depending on factors such as missed payments or credit inquiries during the consolidation process. Still, the record of the consolidation itself remains visible for seven years.

Understanding Debt Consolidation

Debt consolidation involves combining several high-interest debts, such as credit card balances, into one loan. This new loan typically has more favorable terms, like a lower interest rate or an extended repayment period. The goal is to simplify debt management and reduce the total interest paid over time. By consolidating your debts, you replace multiple payments with a single monthly payment, potentially at a lower interest rate, helping you pay off your debt more efficiently.

Debt consolidation typically stays on your credit record for about seven years. This duration is a standard period in the credit industry, influenced by regulations like the Fair Credit Reporting Act in the United States.

This action is recorded on your credit report when you consolidate your debts. It's a significant step in managing your finances, as it can affect how future lenders view your creditworthiness. The seven-year period starts from the date of the first delinquency on the original account before consolidation.

It's crucial to understand that this seven-year mark is an average. The exact time can vary depending on the specifics of your debts and your financial actions post-consolidation. For instance, if you continue making timely payments on the new consolidated loan, your credit report reflects this positive behavior.

Key Factors Affecting Credit Score Post-Debt Consolidation:

- Credit Inquiries: Applying for a consolidation loan involves a credit check, which can slightly lower your score initially.

- Credit Utilization Ratio: Consolidating debts often reduces overall credit utilization, positively influencing your score.

- Account Age: New consolidation loans may lower the average age of your credit accounts, potentially impacting your score.

- Payment History: Regular, on-time payments on the new loan can improve your score, while missed payments can harm it.

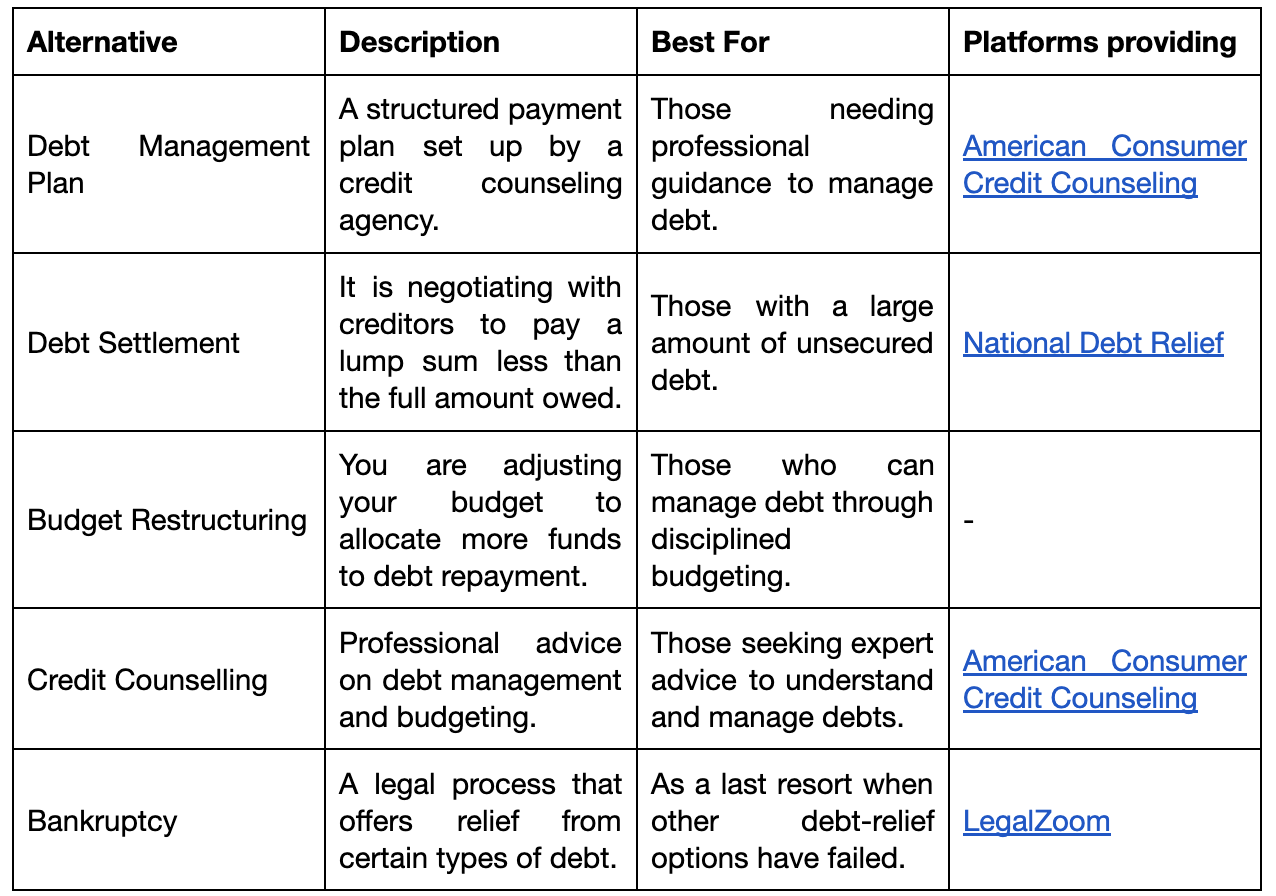

Alternatives to Debt Consolidation

Steps to Rebuild Credit After Debt Consolidation:

- Consistent On-Time Payments: Prioritize timely payments on your consolidated loan. This is the most influential factor in credit scoring

- Maintain Low Credit Utilization: Aim to use a small portion of your available credit. Keeping utilization under 30% is ideal

- Regular Credit Report Checks: Monitor your credit reports for inaccuracies. Promptly dispute any errors with the credit bureaus

- Control New Credit Applications: Limit applying for new credit lines. Frequent applications can negatively impact your score

- Strategic Credit Mix: If feasible, maintain a mix of credit types (like revolving and installment credit) to show your ability to manage different credit forms

- Budget and Emergency Fund: Establish a solid budget and build an emergency fund. This helps avoid new debts and demonstrates financial responsibility

Conclusion

Debt consolidation is more than just combining multiple debts into one. It's a strategic financial decision that requires careful consideration of various factors, including loan terms, impact on credit score, and long-term financial goals. Adopting a holistic approach to debt consolidation ensures it is a positive step in your financial journey, contributing to a healthier credit profile and opening doors to future financial opportunities.

Therefore, a debt consolidation loan will appear on your credit report for the duration of the loan. If you make your loan payments on schedule and have good credit, this can work in your favor. If you fail to make a payment, later payments may remain on your credit report for up to seven years. Start your journey towards financial freedom with Bright Builder – the smart way to build credit and manage debt. Apply now and take the first step towards a brighter financial future!

Suggested readings

- Do consolidation loans hurt your credit?

- How does the Debt Consolidation Calculator work?

- How can I Consolidate Credit Card Debt? 5 effective ways

FAQs

1. What happens after 7 years of not paying debt?

After seven years, unpaid debts typically fall off your credit report, which can improve your credit profile. However, this doesn't mean the debt is forgiven, or creditors can't pursue it. When applying for a debt consolidation loan, especially if you have multiple old debts, it's a good idea to understand the impact on your credit history. Remember, consolidation can help pay off your debt faster and save you money on interest. Still, it's important to adhere to the new loan's repayment terms to avoid similar issues in the future.

2. Is it true that after 7 years, your credit is clear?

It's a common misconception that your credit is completely clear after seven years. While most negative information, like unpaid debts, does fall off your credit report after seven years, this doesn't erase the debt itself. If you're considering applying for a debt consolidation loan to manage high-interest debts, remember that the consolidation will become part of your credit history. Managing these new loan funds responsibly is crucial to maintaining a positive credit profile.

3. How long until the debt is forgiven?

Debt forgiveness depends on the type of debt and your agreements with creditors. Some debts, like federal student loans, may have forgiveness programs after a certain period. However, most consumer debts, like credit cards, are not automatically forgiven. If you're struggling with existing debt, consolidating your debt can be a strategic move. It often simplifies repayment terms and can save you money on interest, but it's not a means of debt forgiveness. Always read the loan agreements carefully when consolidating, especially if you have bad credit loans.

4. How do I remove old debt from my credit report?

Old debt typically falls off your credit report after seven years, but if you notice old debts lingering, you can dispute them with the credit bureaus. Reviewing your credit report for accuracy when consolidating debts, especially if you're using secured loans or trying to pay off high-interest debts, is important. This ensures that your efforts to consolidate your debt and improve your credit profile are accurately reflected. Regularly reviewing your credit history is a key part of managing your finances.

5. How do I remove debt from my credit report?

Removing debt from your credit report before the seven-year mark is challenging unless the debt is inaccurately reported. You can file a dispute with the credit bureaus if you find inaccuracies. When applying for a debt consolidation loan, it's essential to understand that this won't remove existing debt from your report. Instead, consolidation helps you manage multiple debts more effectively and can be a good idea if it saves you money on interest and helps you pay off your debt faster. However, the consolidated loan will be part of your credit history, so managing it wisely is important to affect your credit score positively.

References

https://www.incharge.org/debt-relief/debt-settlement/effect-on-credit-report/

https://www.investopedia.com/ask/answers/110614/how-will-debt-settlement-affect-my-credit-score.asp

https://www.experian.com/blogs/ask-experian/how-long-does-debt-consolidation-stay-on-credit-report/

Disclaimer: Payment history has the biggest impact on credit score, accounting for 40% of how the score is calculated per TransUnion (https://www.transunion.com/credit-score). Bright Builder helps you build a payment history that may positively improve your credit score. A credit score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will hurt your credit score. Products and services are subject to state residency and regulatory requirements. Bright Builder is currently not available in all states.

.jpg)