You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

The White House and Republican negotiators appeared to have secured a breakthrough agreement on extending the debt ceiling Saturday night, averting the country's first default in history. However, legislative approval of the proposal before June 5, when the Treasury's capacity to pay its commitments is expected to run out, was not guaranteed.

In this article, we will look at the existing debt ceiling, its significance, and the consequences of raising it. We will also share pertinent information and address frequently asked questions about this issue.

What Is The Debt Ceiling and The National Debt?

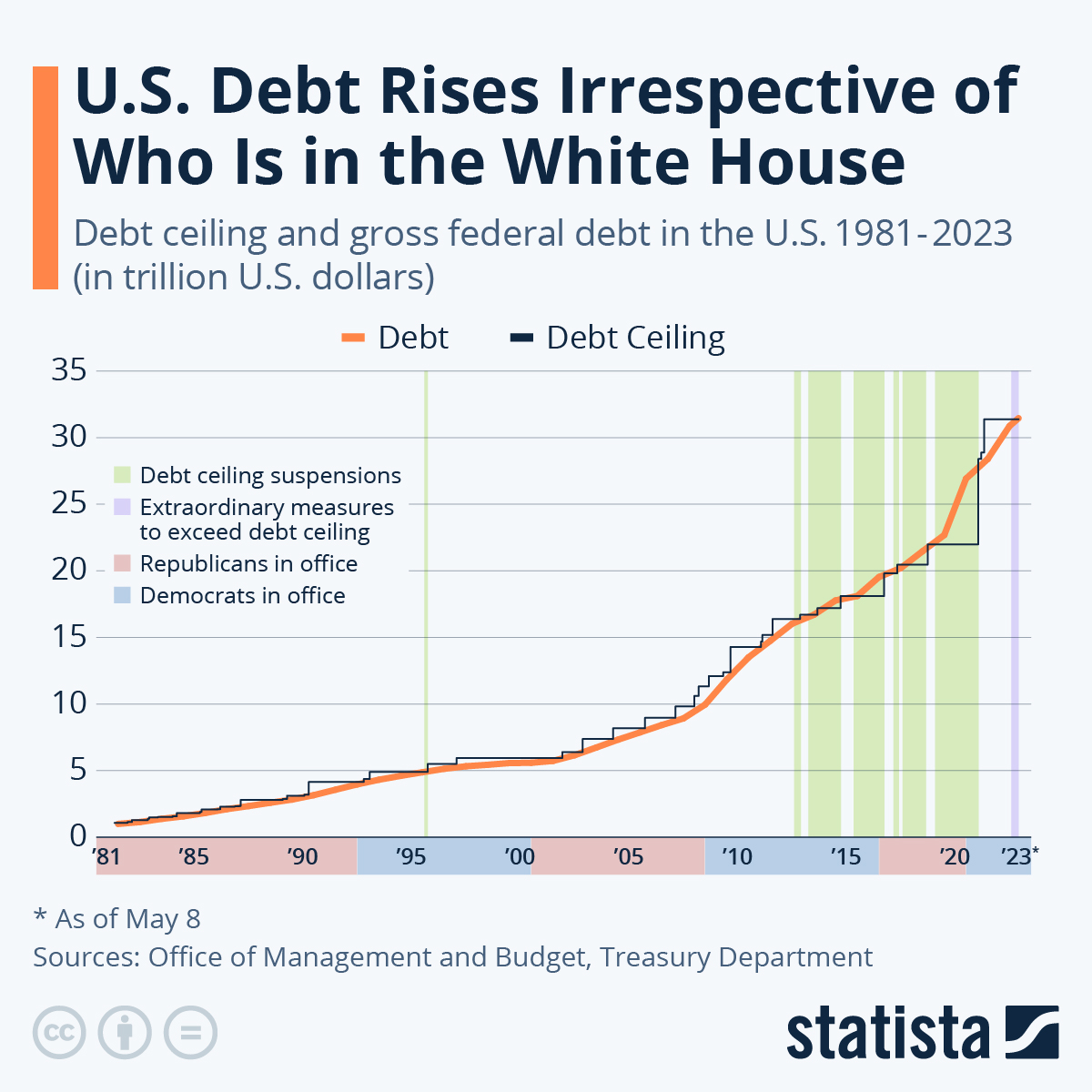

The debt ceiling was established by the Second Liberty Bond Act of 1917, and it is also known as the debt limit or the statutory debt limit. The Debt Ceiling/debt limit is the total amount of money that the United States can borrow cumulatively through issuing bonds. On January 10, 2023, the US federal debt was at $30.92 trillion, or 22% higher than the value of all products and services generated in the US economy this year.

Suppose the national debt of the United States approaches the ceiling. In that case, the Treasury Department must turn to additional exceptional measures to meet government commitments and expenditures until the ceiling is lifted again.

The debt limit has been increased or suspended multiple times throughout the years to avoid the worst-case scenario: the US government defaulting on its obligations.

The US government has borrowed a significant amount of money, and it can be categorized into different parts. The government itself owes one-fourth of this money. The Social Security Administration, for instance, has generated a surplus and invested it in government bonds, which now amounts to $2.8 trillion. Additionally, the Federal Reserve holds $5.5 trillion worth of US Treasury bonds.

The remaining portion of the debt is called public debt. This includes the money owed to foreign governments, corporations, and individuals, which adds up to $7.2 trillion as of October 2022. Japan and China are the largest holders of this debt, each owning approximately $1 trillion. Americans, corporations, state governments, and municipal governments owe the rest of the debt.

To simplify the concept of the "debt ceiling," imagine it as a credit limit on a credit card. Just like individuals have a limit on how much they can borrow on their credit cards, the debt ceiling sets the maximum amount of money that the US government can borrow to fund its activities.

When the government reaches this limit, it must either reduce its spending or raise the debt ceiling to continue borrowing. Failure to raise the debt ceiling can result in severe financial consequences for the government, similar to exceeding the credit limit on a credit card leading to penalties and restrictions.

Understanding the Debt Ceiling In Detail

Before the creation of the debt ceiling, Congress had complete control over the country's finances. During World War I, the debt ceiling was established to make the federal government economically responsible.

Whenever the United States reached the debt ceiling, it was lifted. The United States would be in default if it reached the limit and failed to make bondholders' interest payments, reducing its credit rating and raising the cost of its debt.

The constitutionality of the debt cap has been wondered. The 14th Amendment to the US Constitution states that “the validity of the public debt of America, authorized by the regulation shall no longer be questioned.” The United States is one of the uncommon exceptions to the rule that almost all democratic nations do now not have a debt cap.

Why Is There a Borrowing Limit?

Before 1917, Congress permitted the government to borrow a set amount of money for a set period. When debts were repaid, the government could not borrow again without the assent of Congress.

The debt cap was established by the Second Liberty Bond Act in 1917. It allowed for continuous debt rollovers without congressional permission.

Congress passed this bill to allow then-President Woodrow Wilson to spend the amount he thought necessary to fight World War I without having to wait for often-absent legislators to act.

However, because Congress did not want to give the president a blank check, it limited borrowing to $11.5 billion and required legislation for any increase.

Since then, the debt ceiling has been increased hundreds of times and suspended on several occasions. The most recent update was in December 2021, when it was upped to $31.38 trillion.

Delete Debt and Build Savings with Bright Money. Get App

Debt Ceiling Showdowns and Shutdowns

There were numerous run-ins with the debt ceiling, some of which have led to government shutdowns. Typically, the struggle is between the White House and Congress, and the debt ceiling is used as a bargaining chip to strengthen economic agendas.

For instance, in 1995, Republican members of Congress, led by then-House Speaker Newt Gingrich, threatened to refuse to elevate the debt ceiling to negotiate extra government expenditure cutbacks.

Former President Bill Clinton refused to make the price range cuts that resulted in the authorities' shutdown. The White House and Congress subsequently settled on balanced finances that included minor expenditure cuts and tax hikes.

Impact of the Newly Appointed House Speaker on the Debt Ceiling

Early in 2023, several economists and Wall Street experts anticipated that the recent election of Republican Kevin McCarthy of California as House Speaker would increase the likelihood that Congress would vote against raising the debt ceiling, increasing the likelihood that the United

States would default on their debt.

Impact of Debt Ceiling on Citizens

Conservative Republicans have said they would oppose lifting the debt ceiling without large cuts to federal spending as part of their support for McCarthy, creating the conditions for a political impasse that might cause the financial system to collapse.

The debt ceiling can have a significant impact on citizens' lives. It can lead to a government shutdown, disrupting essential services and programs. Economic instability and uncertainty may arise, affecting job security and overall financial well-being. Social security and healthcare programs like Medicare could face reductions or delayed payments. Taxes may increase, and budget cuts can limit resources and services available to citizens. Planning for the future becomes challenging due to the unpredictable nature of the debt ceiling debates. Citizens may experience inconvenience, financial strain, and difficulties in making long-term financial decisions.

Advantages and Disadvantages of the Debt Ceiling

Adopting a debt cap is practical because it enables the U.S. Treasury to readily issue bonds without requiring Congress' approval—a somewhat time-consuming process—every time the federal government wants to raise money. A debt cap sets the parameters for a speedier financial approval procedure.

The topic of whether the debt ceiling is a useful instrument for ensuring fiscal responsibility has been raised in light of the debt ceiling's notably flexible nature and frequent lifting. Over time, the U.S.'s debt has grown to historic heights.

Pros

- Controls the country's finances

- It can be used to pay for government functions

- Increases the government's capacity to efficiently pay its commitments, such as Social Security and Medicare benefits

Cons

- It Can be easily raised, thus encouraging fiscal irresponsibility

- It lowers the U.S. credit rating and also increases its cost of debt

- Controversies over whether the debt ceiling is constitutional

Delete Debt and Build Savings with Bright Money. Get App.

What Will Happen If the U.S. Defaults on Its Debts?

As trust in American debtors declines, a default on the nation's approximately $31.5 trillion in public debt would rock the world's financial markets.

According to credit monitoring company Moody's Analytics, a four-month default would cause the economy of the United States to shrink by almost 4%, stock values to drop by a third, and businesses to eliminate close to six million jobs. Additionally, their study shows that a default on U.S. Treasury bonds might result in a slump akin to the Great Recession of 2007–2009.

A decline in foreign investors' confidence in U.S. treasuries or a credit freeze would likely result in substantial declines in the value of the dollar and a flight from U.S. investments. Financial markets may get uneasy even when a default is imminent.

The United States credit rating was downgraded for the first time by rating agency S&P Global Ratings in 2011 after then-President Obama and House Republicans narrowly missed raising the debt ceiling. The crisis saw stock prices plummet and market volatility soar. Additionally, both consumer and small business optimism were harmed by the crisis.

Summing Up

Understanding the current debt ceiling and staying informed about the latest developments in 2023 is crucial for individuals, policymakers, and the economy as a whole. The debt ceiling is a control mechanism to limit the government's borrowing capacity and promote fiscal discipline. A U.S. debt default would cause economic instability and make it difficult for the government to perform essential duties like paying Social Security payments, upholding national security, and effectively supporting the healthcare system.

Staying informed about financial news helps individuals make informed decisions, adapt to changing economic conditions, and manage their finances effectively. It enables them to adjust investment strategies, make smart choices, and maintain financial health. Tools like the Bright Builder from BrightMoney offer personalized insights for better financial management.

FAQs

Q: Are there any recent developments related to the debt ceiling in 2023?

A: The latest developments regarding the debt ceiling in 2023 can vary. It is essential to stay informed through reliable news sources and official government announcements for the most

recent updates.

Q: How does the debt ceiling impact the economy and individuals?

A: The debt ceiling can impact the economy by affecting investor confidence, interest rates, and the government's ability to finance its operations. It indirectly affects individuals through its influence on government spending, fiscal policies, and economic stability.

Q: Can the debt ceiling be permanently eliminated?

A: Eliminating the debt ceiling would require significant changes to the legislative process and is a subject of political debate. It is not a decision that can be made unilaterally.

Q: What can individuals do to stay informed about the debt ceiling?

A: Individuals can stay informed about the debt ceiling by following reliable news sources, monitoring government announcements, and engaging in discussions with trusted financial advisors or experts.x