You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Ever wondered, What's a credit score, and why does it matter to buy a house? Simply put, a credit score is like a financial report card. It tells lenders how responsible you've been with your money. When you dream of buying a house, this score helps you secure a mortgage. Think of it as the bridge between you and your dream home.

However, do you know our emotions and psychology play a role in how we manage credit? Intriguing, right? Let’s dig deeper to understand credit scores, requirements to buy a house and more actionable insights

What is Role of Credit Scores In Home Buying

Credit scores play a central role in the home-buying process. Lenders lean heavily on these scores to determine the risk associated with potential homeowners. A high credit score is like a gold star, signaling trustworthiness to lenders.

While securing a loan is a significant milestone, an excellent score offers the added perk of favorable interest rates. Over time, this can lead to considerable savings on a mortgage.

Looking to understand how your credit score can impact your financial options? Explore Bright Credit for a flexible line of credit that adapts to your needs. Visit Bright Money to learn more.

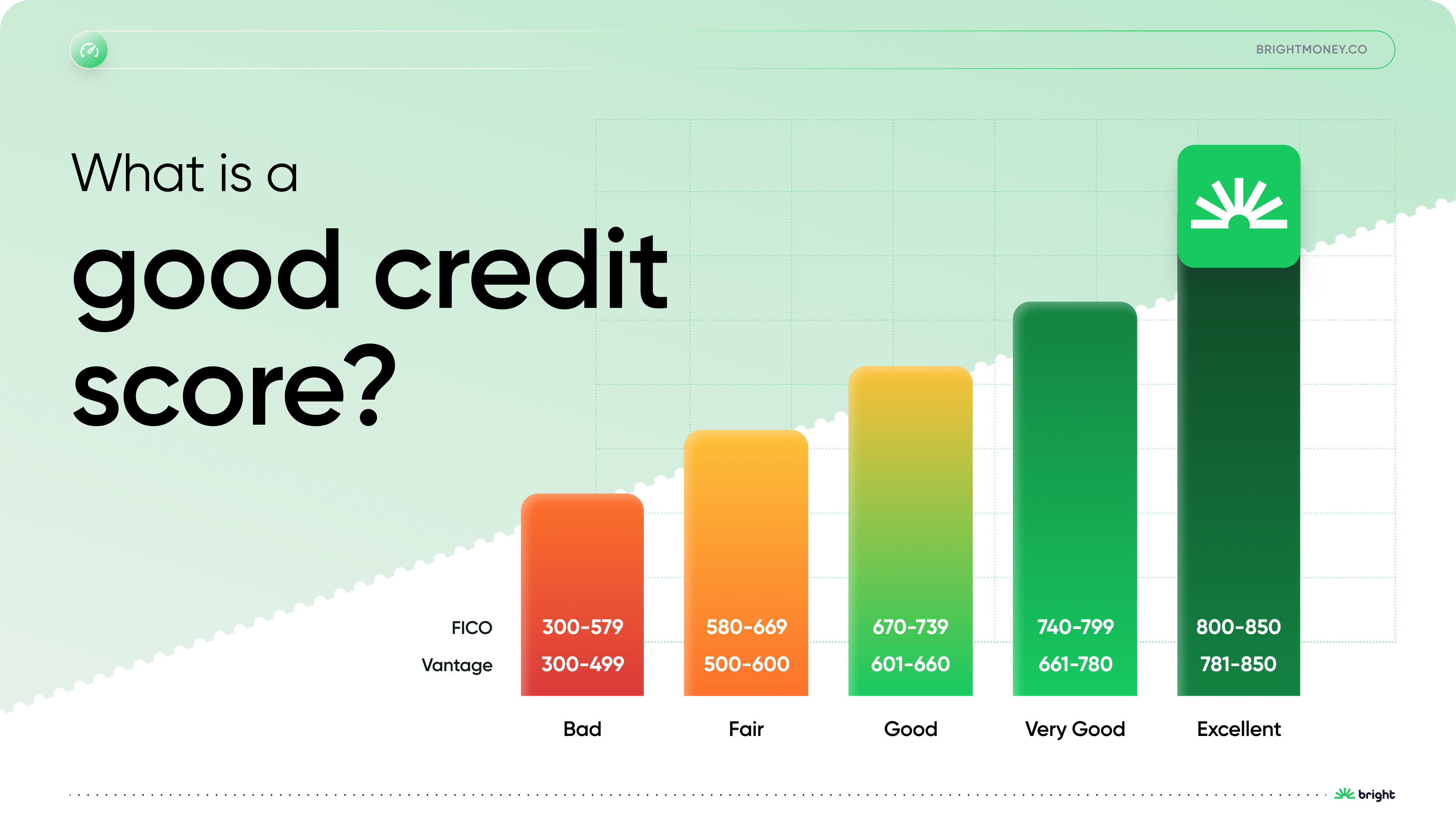

What is the ideal credit score range for home buying

The home-buying process begins with understanding where your credit score stands. Here's a breakdown to guide you:

- Excellent (800+): With this score, you're in the driver's seat! You're primed to get the best interest rates available. Moreover, With a score in this range, securing a home loan is relatively easy. Lenders see you as a low-risk borrower. JPMorgan Chase, Bank of America, and Wells Fargo are among the top lenders that would be more than willing to offer you a home loan

- Good (740-799): Still in a strong position. You can expect favorable rates, though there might be a few hoops to jump through. While not as seamless as the excellent range, you're still in a favorable position. Most lenders will be open to offering you a loan, but they might ask for some additional documentation. Citibank, US Bank, and PNC Bank are some of the major lenders that cater to individuals in this score range

- Fair (670-739): Here, you'll face higher interest rates and a closer examination of your financial health. This is where things start to get a bit challenging. Lenders will scrutinize your financial health more closely, and there might be additional requirements. Capital One, Santander, and TD Bank are known to work with individuals in this credit score range, but terms might vary

- Poor (<670): Tread with caution. Approval becomes trickier, and if you do get a nod, it's often at steeper rates. It's tough here. Lenders are wary of borrowers in this range due to the perceived high risk. You'll need to be prepared for a rigorous application process. Moreover, some regional banks and credit unions might be more flexible, but national banks like Fifth Third Bank, SunTrust, and KeyBank might still consider, albeit with stricter terms

Recognizing these ranges is about financial foresight and mental readiness. Knowing where you stand helps in planning and sets clear expectations.

Which Factors Steer the Credit Score Bar?

Primarily, there are four factors that steer the credit score bar, and it is a must to consider all. They are:

1. Debt-to-Income Ratio

Lenders love a low ratio. It's a sign you're not biting off more than you can chew.

2. Mortgage Types:

- Conventional: These are the gold standard, demanding higher scores.

- FHA: A friendlier option, especially if your score isn't top-tier.

- VA: Tailored for veterans, these come with adaptable requirements.

3. Down Payment

Think of this as your wildcard. A heftier down payment might just offset a not-so-great score.

4. Economic Climate

The broader economy plays its part. A booming market might be more lenient, while a recession could mean stricter checks.

Navigating the world of mortgages can be complex. Simplify your journey with Bright Debt Plan, a comprehensive solution to eliminate debt. Get started with Bright Debt Plan.

How to Boost Your Credit Score Before House Hunting?

Your credit score is your trusty sidekick, and giving it a boost can open doors to better mortgage deals. Here's how you can spruce up that score before you set out house hunting:

1. Spotting and Squashing Errors

Start by grabbing your free credit reports. It's surprising how often they contain mistakes. Found an error? Don't just let it slide. Dispute it. Every point counts when you're aiming for that dream home.

2. Tackling Debt Head-On

High credit card balances can be a drag on your score.Remember, swiping your card to the max is a no-go. It's all about balance – in your finances and life.

3. Steering Clear of New Credit Inquiries

Tempted to apply for that new credit card offer? Hold off. Each hard inquiry, like those from loan or credit card applications, can nick your score.

4. Clearing the Collection Cloud

Got outstanding collections? It's time to clear the air. Whether you pay off the full amount or negotiate a settlement, addressing these can lift your score and your spirits.

5. Aim for Higher Credit Ceilings

Consider requesting an increase in your credit limits. However, higher limits don't mean a green light to spend more. It's about improving your credit utilization ratio, not your shopping spree frequency.

Did you know that responsible credit card usage can be a boon for your credit score? Explore credit card options at Bright Money to make informed decisions

Impact of Various Credit Scores on Mortgage Approvals

lenders juggle various factors: your credit score, existing debt, the size of your down payment, and your payment track record. It's a holistic view of your financial health.

- Stellar Score but Towering Debt: Boasting an excellent credit score? Great! But if paired with high debt, lenders might raise an eyebrow. The advice here is straightforward: work on whittling down that debt

- Moderate Score with a Generous Down Payment: A fair credit score can be balanced with a hefty down payment. At the same time, this might win you approval and brace for potentially steeper interest rates

- Good Score with a Blemish of Late Payments: A commendable score can be overshadowed by recent late payments. Lenders might offer a nod but at higher rates. Be prepared to shed light on any extenuating circumstances that led to those payment delays

Struggling with a less-than-perfect credit score (Doc Link)? With Bright Builder, you can enhance your credit through timely payments. Discover Bright Builder today.

What is the Long-term Impact of Credit Scores on Homeownership?

As discussed, a good score can be your ticket to lower interest rates, translating to substantial savings over the course of your loan.

Imagine the difference between a good and an excellent score: it could mean thousands less paid in interest, money that stays in your pocket.

Apart from it, maintaining a robust credit score is vital for future financial endeavors, be it refinancing your home or taking on other significant investments.

What are Other Things to Consider When Buying a Home?

- Stable Employment: Minimum two years in the same job preferred by lenders

- Savings and Emergency Funds: Enough to cover down payment, closing costs, and unexpected expenses. These funds ensure you can manage the down payment, closing costs, and any surprises that come your way

- Future Expenses: Expenses like property taxes, routine maintenance, and insurance are all part of the homeownership package. Plan wisely, and let your dream home be a source of joy, not stress

Conclusion

When searching to buy a new home, understanding your credit score can help you save a lot. Taking proactive financial steps goes hand in hand with cultivating a positive psychological approach. The synergy of a robust credit score, sound financial behavior, and mental readiness can make the path to homeownership smoother.

As you move on this journey, consider tools that can guide you. Bright Money can help you with personalized credit builder plans to help you improve your credit score.

Ready to take control of your financial future? From understanding credit to finding the right financial solutions, Bright Money has you covered. Dive into our offerings and embark on a brighter financial journey.

Suggested Readings

Frequently Asked Questions (FAQs)

- Can a good credit score offset a lower income when buying a house?

Yes, a strong credit score can indeed offset lower income when buying a house. Lenders view a high credit score as a sign of financial responsibility and reliability.

It may lead to better mortgage terms and interest rates, making homeownership accessible even with a modest income. This approach can sometimes open doors that might otherwise be closed due to income constraints.

- How does my credit score affect the neighborhood I can buy in?

While your credit score doesn't directly dictate the neighborhood you can buy in, it plays a significant role in determining the mortgage rate and loan amount you qualify for. A higher credit score may lead to more favorable loan terms, allowing you to afford a home in a more desirable or expensive area. Conversely, a lower score might limit your options to neighborhoods with more affordable housing.

- If I get a quote for a mortgage rate and then improve my credit score, will I get a better rate?

Improving your credit score after receiving a mortgage rate quote can potentially lead to a better rate. If the increase is substantial, it may change the lender's assessment of your credit risk, allowing you to qualify for a more favorable interest rate.

However, this depends on the lender's policies, the time frame, and the specific improvements made to your credit profile.

- Does co-buying a house with someone who has a better credit score improve my chances?

Co-buying a house with someone who has a higher credit score can improve your chances of securing a mortgage with favorable terms.

Lenders will consider both parties' credit scores, incomes, and debts, potentially leading to a more attractive loan offer. However, it's essential to understand the legal and financial responsibilities involved in co-buying, as both parties will be equally accountable for the mortgage payments and other obligations related to the property.

.jpg)