Fast

Compare multiple loan offers from partners on a single App.

Build Credit history with on-time payments¹

Customized debt pay-off and budgeting plan

Round up everyday purchases and save effortlessly

Rebuild your credit history with rent payments

Multiple loan offers from partners in minutes

Multiple offers of up to $750. All credit scores can apply

Build Credit history with on-time payments¹

Customized debt pay-off and budgeting plan

Round up everyday purchases and save effortlessly

Rebuild your credit history with rent payments

Multiple loan offers from partners in minutes

Multiple offers of up to $750. All credit scores can apply

Get matched to multiple loan offers of up to $10,000¹.

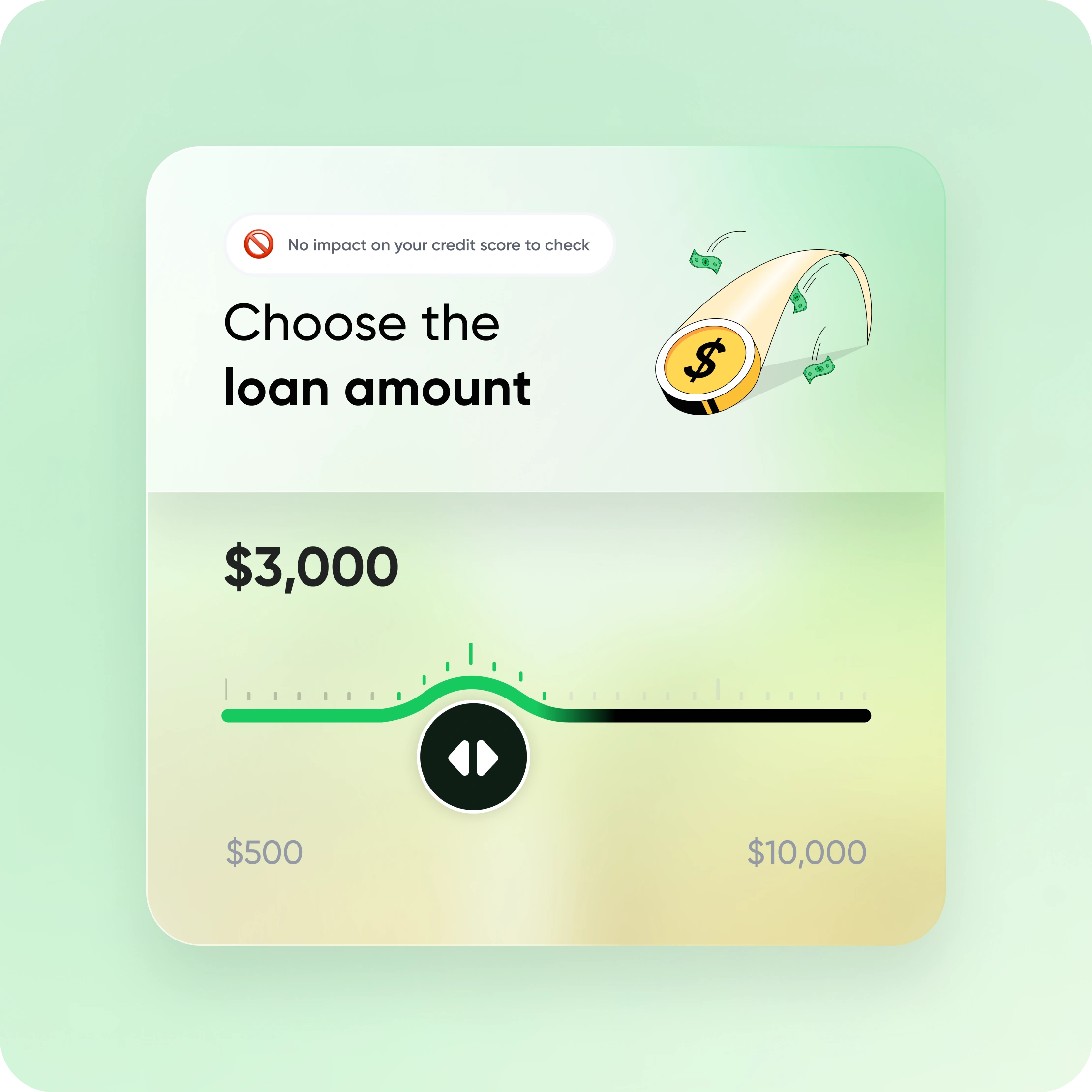

No impact on your score to check eligibility.²

Personal Loan offers are provided by Bright's Network partners¹.

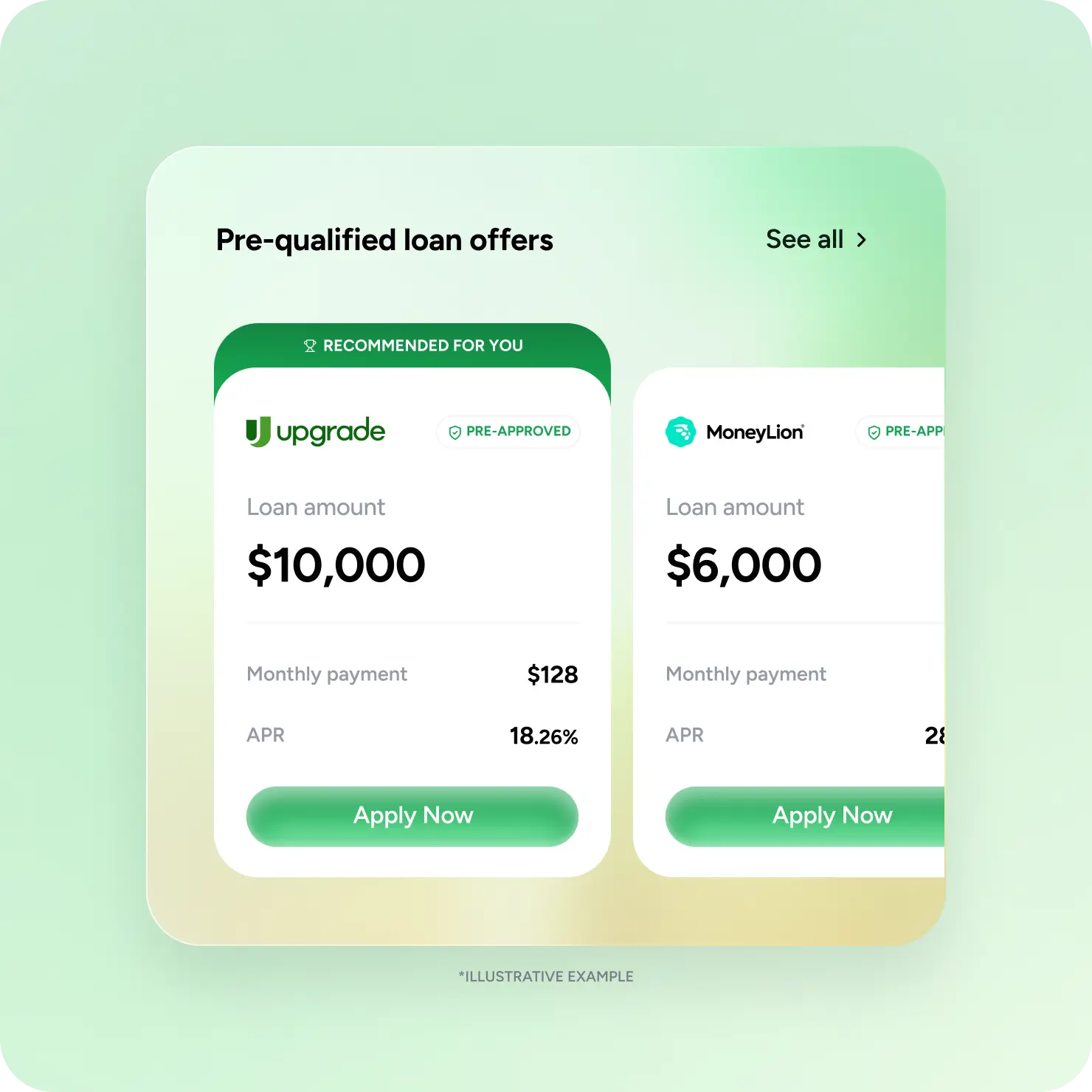

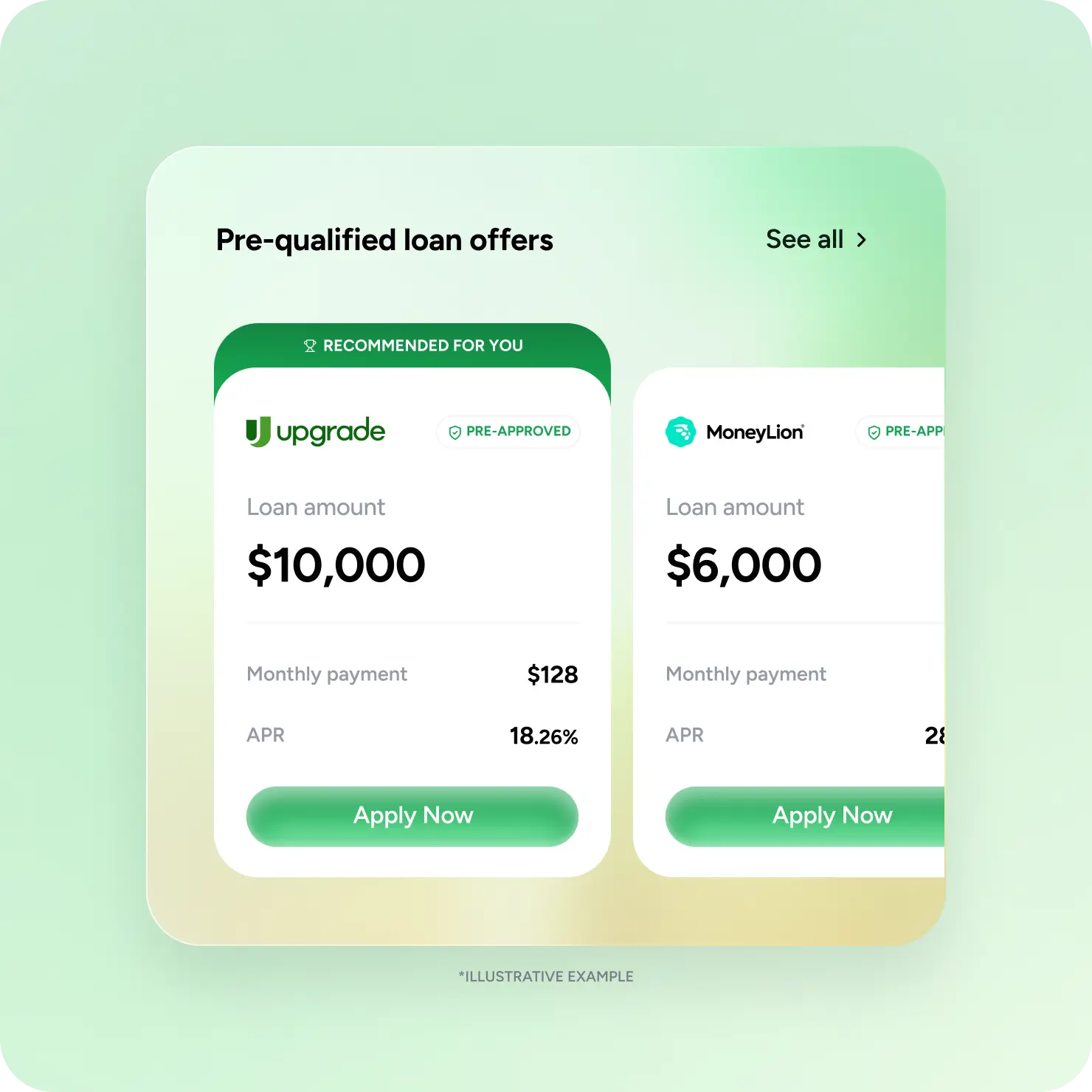

Compare multiple loan offers from partners on a single App.

Choose the best offer customized to your situation.

to check eligibility².

Share some details for the eligibility check. It will not impact score².

Once qualified, see and confirm the rate.

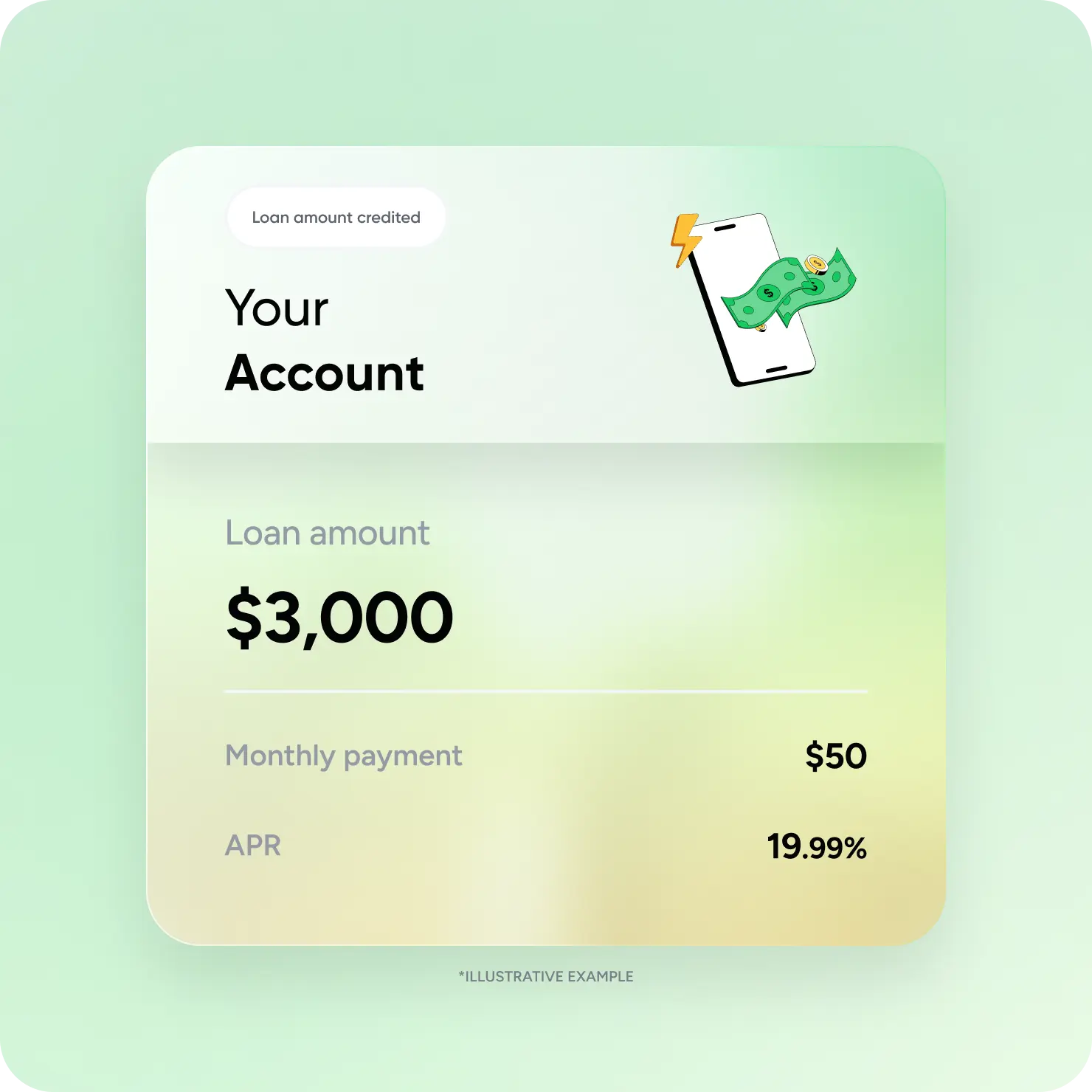

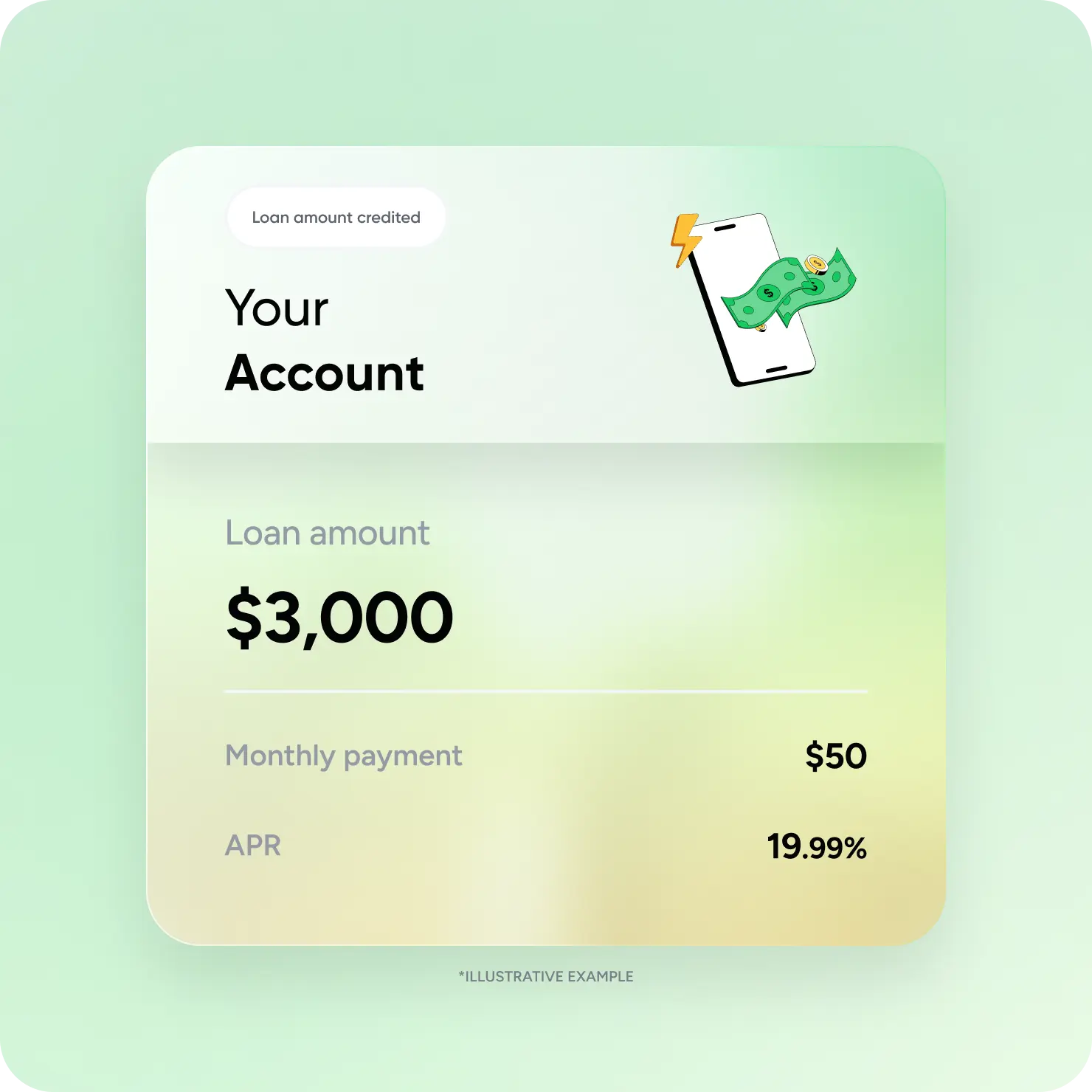

Once approved, get the loan amount credited.

Up to $10,000

Bright helps you match with multiple loan offers from third-party providers. Based on the information you provide, you could get matched with offers for up to $10,000. You'll be able to compare rates, terms, and fees from different lenders and choose the best offer for you. Plus, you can use the loan funds to pay off other existing debts like your credit cards.

You can get matched with loan offers of $500 to $10,000 from our loan marketplace. If eligible, you will receive multiple offers from lenders with specific loan amounts and terms. It is important to carefully consider the offers and ensure they are the right fit for your needs and situation.

You can get matched with customized loan offers in the Bright App once you create an account.

Personal loans with bad credit depend on the borrower’s needs and preferences. Some of these loans may have higher interest rates, origination fees, or other costs compared to good credit loans.

Bright helps you match with multiple loan offers from third-party providers. Based on the information you provide, you could get matched with offers for up to $10,000. You'll be able to compare rates, terms, and fees from different lenders and choose the best offer for you. Plus, you can use the loan funds to pay off other existing debts like your credit cards.

You can get matched with loan offers of $500 to $10,000 from our loan marketplace. If eligible, you will receive multiple offers from lenders with specific loan amounts and terms. It is important to carefully consider the offers and ensure they are the right fit for your needs and situation.

You can get matched with customized loan offers in the Bright App once you create an account.

Personal loans with bad credit depend on the borrower’s needs and preferences. Some of these loans may have higher interest rates, origination fees, or other costs compared to good credit loans.

Bright Capital Inc

50 California St, Suite 1621,

San Francisco CA 94111

2025 Bright Capital Inc.

Secured revolving lines of credit (“Bright Builder”) are made by

Bright Capital Inc., NMLS (2410428) only,

subject to state residency.

Bright currently does not offer Unsecured Lines of Credit (“Bright

Credit”) to new customers. Personal loan offers are available

through Bright Money’s Network Partners, subject to credit approval

and applicable state restrictions. Loan amounts and terms vary.

Deposit accounts are provided by Evolve Bank & Trust and Continental

Bank, Members FDIC. FDIC insurance will only cover the failure of

Evolve Bank & Trust and Continental Bank, Members FDIC.

Learn more

here.

Bright is a financial technology company, not a bank.

When you join Bright and if you choose to start a Premium Membership you will be charged a recurring fee of $14 per month, $39 for a three-month term, $68 for a six-month term or $97 for an annual term. Your Premium Membership will auto-renew until you cancel membership. Cancel anytime. See Membership Terms and Conditions. Bright Premium Membership is not required for Bright Builder or Personal Loan offers.

1. Personal loan offers are provided by third parties and are subject to credit approval and state-specific restrictions. Loan amounts, terms, and conditions may vary. By clicking to view offers, you will be redirected to third-party websites, which are solely responsible for their products, services, and website content. The inclusion of third-party products on the Bright Money platform does not constitute an endorsement or recommendation by Bright Money. Bright Money may receive compensation for referrals to these third-party products or websites. Please note that these products and services may not be FDIC insured or guaranteed by a bank. Review individual offers for applicable terms and conditions.

For more details, please see our full Loan Disclosures

2. With your authorization, a soft credit pull may be conducted to facilitate the offer process, but it will not affect your credit score. If after receiving your offer(s) you choose to apply for a loan directly with a lender, the lender may conduct a hard credit pull that can affect your credit score.

The product images shown are for illustration purposes only.