You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Introduction

Cash App has become one of the most popular peer-to-peer payment apps, allowing users to send and receive money from friends and family easily. According to Reuters, Cash App has 44 million active monthly users, portraying its vast usage.

However, what are cash advances, and how can the Cash App be used responsibly when leveraging this functionality? This blog will provide a comprehensive overview of how you can use a cash app for credit card cash advances, as well as its benefits and alternatives.

Understanding Cash App

Cash App is a mobile payment service developed by Square that allows users to transfer money to one another using a mobile phone app. It offers features like instant bank transfers, a free customizable debit card called Cash Card, and Boosts, which give discounts on purchases from certain merchants. Cash App differs from traditional banking services and credit card providers as it is focused on peer-to-peer transactions accessible through a user-friendly app.

Cash App Features and Benefits

Some of the key features and benefits of Cash App include:

- Peer-to-Peer Payments: Send and receive money instantly with anyone via your phone number or cash tag. Easily split bills with friends

- Cash Card: The free debit card links directly to your Cash App balance and can be used to spend money or make ATM withdrawals

- Direct Deposit: Set up a paycheck or tax refund direct deposits into your Cash App. Funds are available up to 2 days early

- Cash App Boosts: Discounts and offers for popular merchants when you use your Cash Card

- User Friendliness: Cash App provides an intuitive interface that's easy to navigate. Easily manage finances on the go from your smartphone

The Concept of a Cash Advance

A cash advance is a transaction that allows you to receive cash from a lender in advance of future incoming funds. It functions as a short-term loan, expecting you to repay the money borrowed just like a normal credit card cash advance.

Typical sources of cash advances include credit cards, payday loans, pawn shops, title loans, and employer programs. Cash advances can provide critical access to funds during emergencies like medical expenses, emergency travel, or essential home repairs.

Cash App Cash Advance Feature

Cash App offers cash advances of up to $200 monthly with its new Cash Advance feature. This functionality allows you to borrow against future direct deposits for quick access to cash in a pinch. Accessing an advance is straightforward within the app - simply tap the Clock icon in the upper left corner, press "Cash Advance", and review the terms before signing up.

Eligible users can advance up to $200 instantaneously. To qualify for a Cash App cash advance, you must have a recurring direct deposit of at least $500 within the last 31 days. Additional eligibility criteria may apply.

Minimize your debts and maximize your savings. Get the Bright Money app Today!

Cashing a Cash App Advance

Once approved, the cash advance funds will be immediately available in your Cash App balance. You can instantly transfer the money to your connected credit card or bank account. You can also leave the funds in the Cash App and spend them using your Cash Card, which pulls instantly from your Cash App balance.

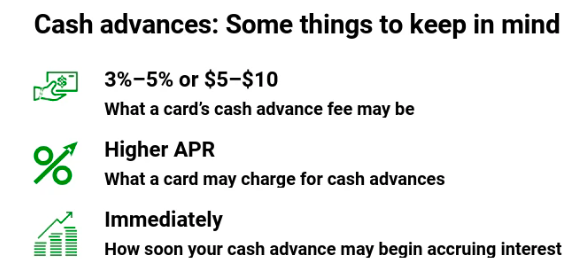

Costs and Fees

Cash advances carry costs and fees like any other loan or credit card. Cash App charges a 5% transaction fee for each cash advance but does not charge interest or late fees. This means a $100 cash advance will incur a $5 fee, reducing the net amount received to $95.

Repayment and Terms

Cash advances from Cash App must be repaid on your next direct deposit. The full balance is deducted automatically from your next deposit following the advance. This binds the cash advance to your next incoming payroll. Cash advances that remain unpaid for 35 days go into collections, impacting your credit score.

Accepting an amount you know you can repay on your next deposit is critical to avoid collections. Make payments manually or with a credit card to repay faster and minimize fees. Using Cash App advances responsibly prevents spiraling into unmanageable debt.

Credit Scores and Cash App Advances

Cash advances through Cash App do not require a credit check or directly impact your credit score. However, should an advance go unpaid and get sent to collections, that can lower your score. Avoiding late payments prevents credit damage when using Cash App advances.

Your overall creditworthiness still influences eligibility for Cash App advances. While they do not perform hard credit inquiries, excellent credit raises your chances of qualifying and getting approved for the maximum amount.

Read more: Everything you need to know about credit scores

Alternatives to Cash App Cash Advances

Conventional alternatives to Cash App advances include:

- Bank Loans: Approach your local bank or credit union to apply for a personal loan with structured repayment terms. Interest rates are often lower than other options

- Credit Card: Many credit card lenders offer cash advances up to a set limit. However, they charge significantly higher interest rates plus fees

- Other Fintech Platforms: Companies like Earnin and Dave offer cash advance features in their peer-to-peer money apps. Compare terms across providers

Each option carries pros and cons to weigh according to your financial situation and the urgency of cash needs. Cash advances should only serve as a last resort after exhausting safer alternatives.

Risks and Considerations

Cash advances carry notable risks that warrant caution:

- Potential Debt Traps: The short-term relief can lead to a harmful cycle of repeatedly borrowing against future deposits. Plan repayments carefully

- Irresponsible Borrowing: Do not take more than you can repay on your next deposit. Avoid the temptation to overborrow

- Importance of Planning: Budgeting and financial planning are key to ensuring cash advances are an occasional tool for emergencies rather than a crutch

Tips for Responsible Use

When considering a Credit card cash advance, remember to:

- Budget Properly: Do the math beforehand and ensure you can repay on your next direct deposit. Do not overextend

- Set Internal Limits: Be self-aware of your financial boundaries and only take what is truly needed. Avoid maxing out the $200 limit each period

- Have a Backup Plan: Be ready to make manual payments to repay faster than your next deposit's auto-deduction

Read more: How Bright pays off debts and builds more savings

Security and Fraud Protection

Since money can be rapidly sent and received through the Cash App, users must leverage all available security and fraud protection measures. This can help safeguard your funds against unauthorized access. Some important safety steps include:

- Enabling device passwords, PINs, and biometric logins like fingerprint or facial recognition when available. This prevents other people from accessing your Cash App account on your smartphone or tablet if it falls into the wrong hands

- Turning on two-factor authentication via SMS text verification codes and/or email confirmations for an extra layer of protection beyond your password alone

- Opt for transaction approval requests for withdrawals and transfers above certain dollar thresholds

- Monitor your Cash App account activity daily and scrutinize your statements. Look for any suspicious, fraudulent, or unfamiliar transactions and report them to the Cash App immediately. The sooner potential fraud is caught, the greater protection you have against losses under Cash App's policies

- Only share your unique cash tag with trusted individuals, never publicly posting it online. Be wary of phishing schemes attempting to gain login credentials

Diligent security habits are essential for any financial app allowing instant access to money. Enabling Cash App's available protections can help deter fraud and give you greater peace of mind.

Legal and Regulatory Considerations

When availing yourself of cash advances through apps or traditional institutions, researching and learning more about your rights pertaining to lending and debt collection laws is important. Understand how you are protected as a borrower before agreeing to any advance. The key laws that provide important protections include:

- The Truth in Lending Act requires transparent disclosure of all costs, fees, repayment terms, and annual percentage rate equivalent by lenders offering cash advances. This allows consumers to understand the full scope of the borrowing terms

- The Fair Credit Billing Act offers recourse for billing errors or fraudulent transactions when using cash advances

- The Fair Debt Collection Practices Act prevents harassment by debt collectors and affirms a consumer's right to verify and dispute any debts in collections, including unpaid cash advances

Conclusion

When used responsibly, the Cash App cash advance feature can serve as an occasional emergency fund buffer between credit card pay cycles. However, cash advances are risky when leaned on too heavily. Avoid debt traps by carefully evaluating your budget, making timely payments, and considering safer borrowing alternatives before accessing Cash App advances. Apply them judiciously for essential expenses only after prudent financial planning.

With adequate precautions, Cash App advances provide a convenient option for covering critical unforeseen costs for eligible consumers. If you wish to master your finances and work toward a debt-free future, turn to Bright Money. Bright Money's state-of-the-art technology and AI tools make financial management a breeze.

FAQS

1. Beyond the 5% fee, does Cash App charge interest or other costs for cash advances?

No, there are no other costs charged by the cash app except the 5% fee.

2. What are the key differences between a Cash App cash advance and a credit card cash advance?

Cash App advances avoid credit checks, interest charges, and impacting your credit score directly. Credit card cash advances directly impact and appear on your credit report, trigger higher interest rates and may require a credit score review.

3. How quickly should I pay the Cash App cash advance?

After taking the advance, the total balance is auto-deducted from your next direct deposit.

Minimize your debts and maximize your savings. Get the Bright Money app Today!

References

https://www.wallstreetmojo.com/cash-advance/

https://www.gobankingrates.com/banking/technology/cash-app-borrow/

https://www.creditkarma.com/credit-cards/i/what-is-a-cash-advance