You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Financial wellness is a critical aspect of a person's life, especially for students and young adults who are just beginning their journey into financial independence. Two common financial tools that students often encounter are Credit Cards and Student Loans. Both can have a significant impact on one's financial well-being, but they serve very different purposes and come with distinct advantages and disadvantages.

In this comprehensive article, we will delve into the world of Credit Cards and Student Loans, exploring their roles in financial wellness, how they work, the potential pitfalls, and strategies for making informed financial decisions. By the end of this article, readers will have a clearer understanding of the pros and cons of Credit Cards and Student Loans and will be better equipped to manage their financial well-being.

Read more: The best day to pay your Credit Cards

Which is more beneficial for building a Credit history, Credit Cards or Student Loans?

Building a Credit history as a student can be challenging since traditional Credit Cards often require an existing Credit Score. In this scenario, alternatives like Credit builder loans or secured Credit Cards can serve as effective tools to establish initial Credit history. Once a Credit history is established, responsibly managed Credit Cards can further enhance your Credit profile. Student Loans, while beneficial for education financing and demonstrating responsible Credit use, may not be the primary choice for initiating Credit building for students due to their lower impact on Credit history.

Start your journey to Build Credit* with Bright Builder today!

Read more: 12 better ways to use a Credit Card

# Credit Cards

Credit Cards are a ubiquitous financial tool that millions of people around the world use daily. They offer convenience, flexibility, and the opportunity to build a Credit history. However, they also carry risks, such as high-interest rates and the potential for Debt accumulation.

Credit Cards are essentially a form of borrowing money on a short-term basis. When you use a Credit Card to make a purchase, you are essentially borrowing money from the card issuer (usually a bank or a financial institution) with the agreement that you will repay the borrowed amount at a later date.[1]

Here's how the process typically works:

a. Application: To obtain a Credit Card, you must apply for one with a card issuer. The issuer evaluates your Creditworthiness, which includes factors like your Credit Score, income, and existing Debts. Based on this assessment, they decide whether to approve your application and, if so, your Credit limit

b. Credit Limit: Your Credit limit is the maximum amount of money you can borrow using a Credit Card. It is determined by the card issuer and depends on your financial profile. It's essential to note that exceeding your Credit limit can result in penalties and negatively impact your Credit Score

c. Making Purchases: Once you have a Credit Card, you can use it to make purchases at various merchants, both online and in-store. You can also use it to withdraw cash from ATMs, although this typically incurs higher interest rates and fees

d. Monthly Statements: The card issuer sends you a monthly statement summarizing all the transactions made with the card during that billing period. The statement includes details of your purchases, the minimum payment due, the due date, and the total balance owed.

e. Repayment Options: When you receive your monthly statement, you have several repayment options:

- Paying the Full Balance: You can choose to pay the entire balance owed, including any interest charges, by the due date. This option typically avoids accruing interest

- Making a Minimum Payment: You can make a minimum payment, which is a small percentage of the total balance. However, if you only pay the minimum, you will incur interest on the remaining balance

- Paying More than the Minimum: You can also choose to pay more than the minimum payment, which can help you reduce your Debt faster and save on interest

f. Interest Charges: If you don't pay the full balance by the due date, the card issuer will charge you interest on the remaining balance. Credit Card interest rates can be relatively high, making it important to manage your balances to avoid excessive interest charges.[1]

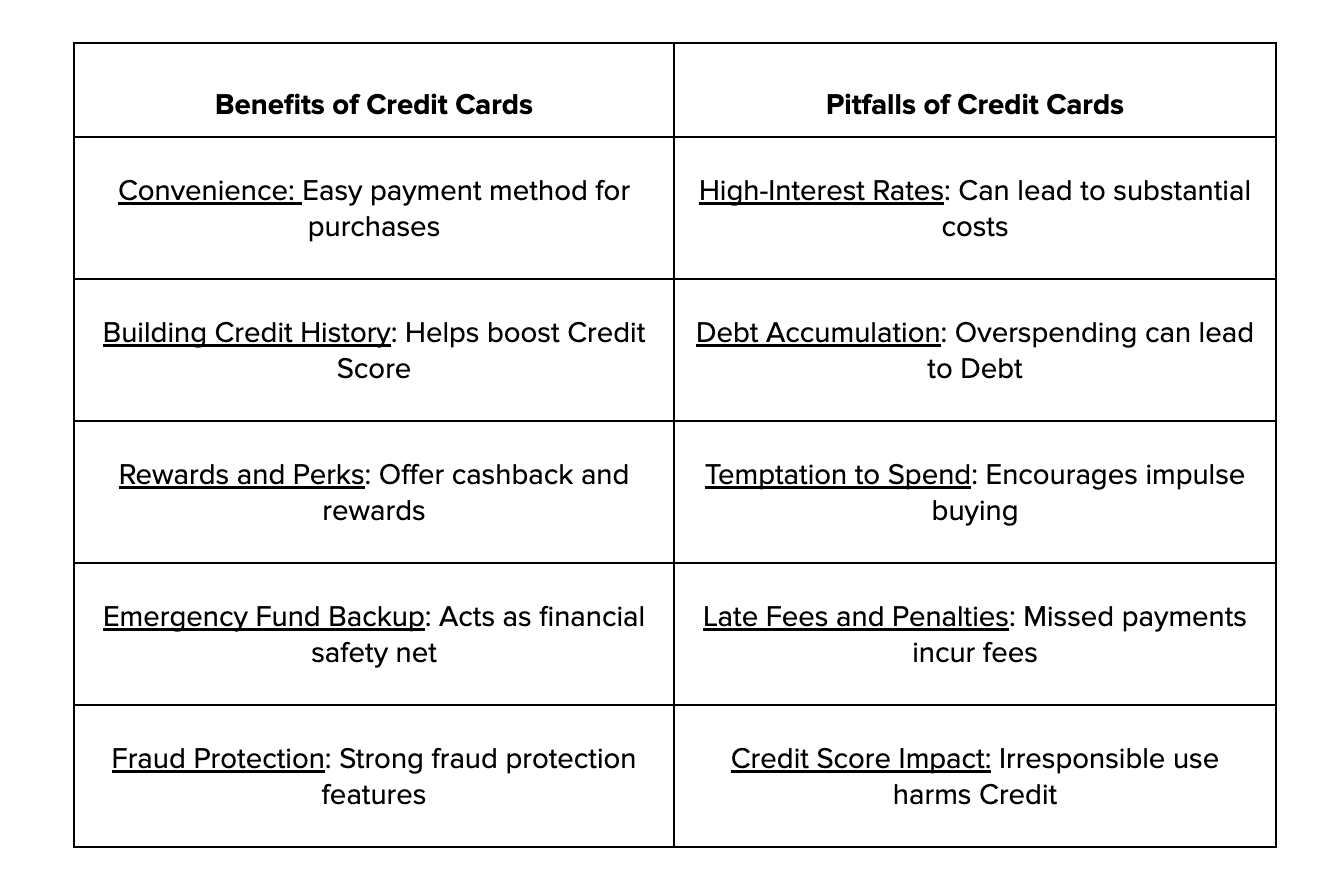

Certainly, here's a table summarizing the benefits and pitfalls of Credit Cards:

Start your journey to Build Credit* with Bright Builder today!

# Student Loans

Student Loans are a common means of financing higher education for many students. They provide access to education and the opportunity to invest in one's future, but they also entail repayment obligations.

Student Loans are specifically designed to help students and their families pay for educational expenses, such as tuition, books, and living expenses.[2]

Here's how Student Loans typically work:

a. Application: To apply for a Student Loan, you must complete the Free Application for Federal Student Aid (FAFSA) in the United States or the equivalent application process in other countries. Based on your financial need and other factors, you may qualify for different types of Student Loans.

b. Types of Student Loans: There are several types of Student Loans, including federal loans, private loans, and state-specific loans. Federal loans are often preferred due to their lower interest rates and more favorable repayment terms.

c. Disbursement: Once approved, the loan funds are disbursed directly to your educational institution to cover tuition and related expenses. Any remaining funds are typically returned to you to use for other educational costs.

d. Interest Rates: Student Loans may have fixed or variable interest rates, depending on the type of loan. Federal loans generally offer fixed interest rates, which means your interest rate remains constant throughout the life of the loan. Private loans may have variable rates that can change over time.

e. Repayment: Most Student Loans offer a grace period, which is a period of time after you graduate, leave school, or drop below half-time enrollment when you are not required to make payments. Once the grace period ends, you will enter the repayment phase, which can last for several years.

f. Repayment Plans: Student Loan borrowers can choose from various repayment plans, such as standard, income-driven, or graduated plans. The choice of plan can significantly impact the monthly payment amount and the total interest paid over the life of the loan.

g. Forgiveness and Repayment Assistance: Some borrowers may qualify for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) in the United States, which forgive remaining loan balances after a certain number of qualifying payments. There are also income-driven repayment plans that cap monthly payments based on income and family size.[2]

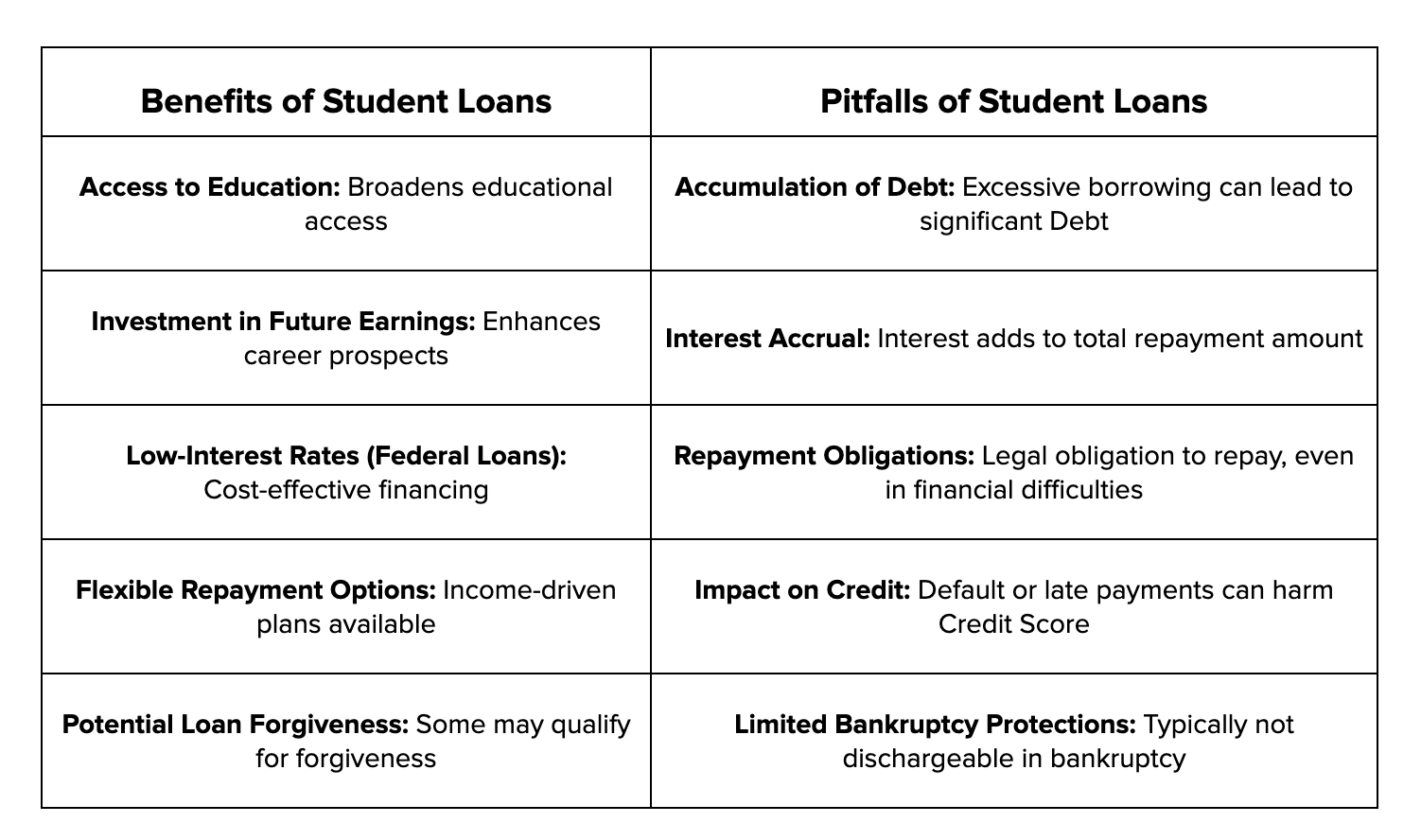

Certainly, here's a table summarizing the benefits and pitfalls of Student Loans:

Ready to take charge of your finances? Get started with Bright Money today and transform your financial future.

Credit Cards vs. Student Loans: A Comparative Analysis

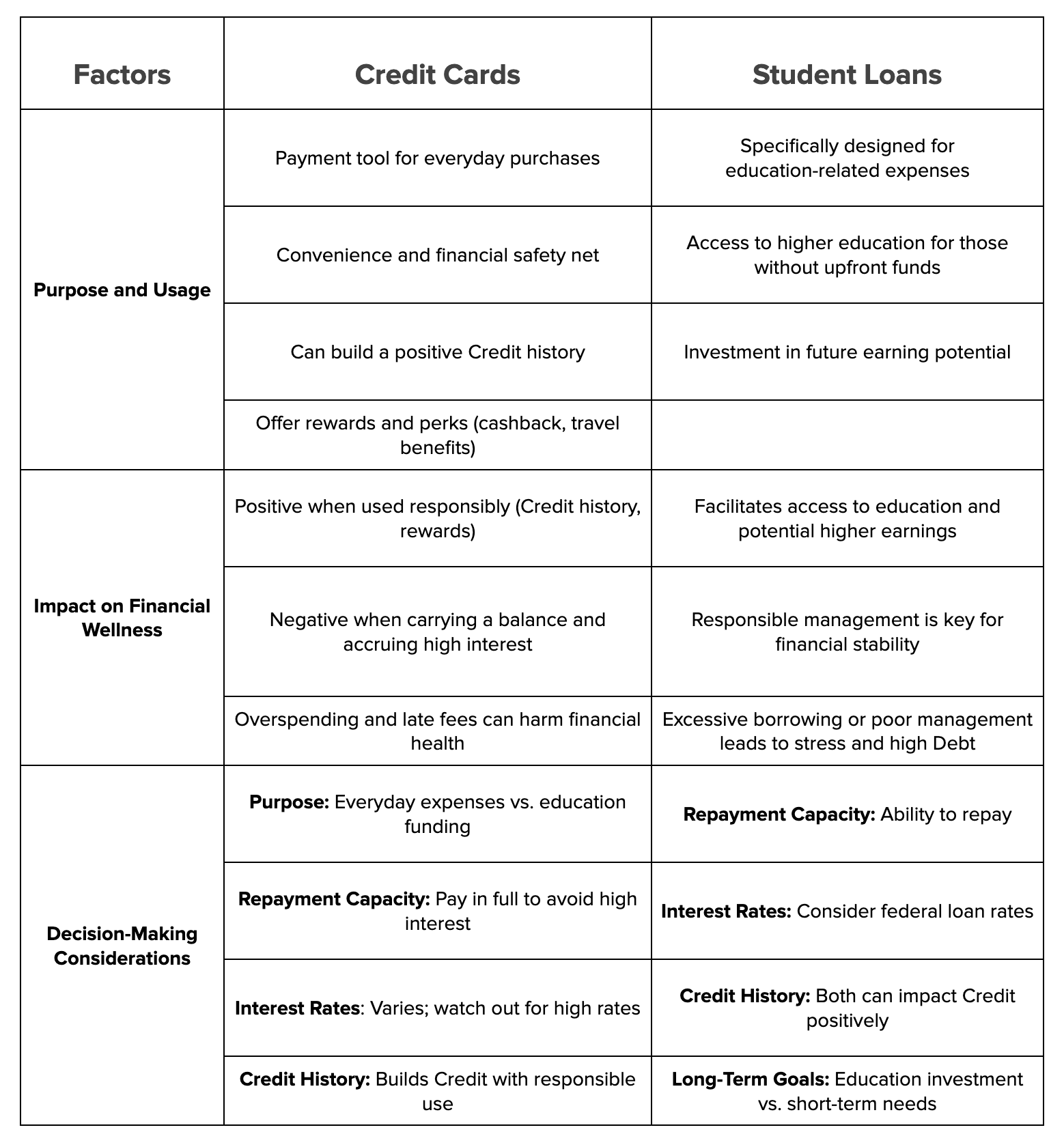

Now that we have examined Credit Cards and Student Loans individually, let's compare the two in terms of their impact on financial wellness, their purposes, and the scenarios in which each might be a more suitable option.[3]

Start your journey to Build Credit* with Bright Builder today!

Strategies for Financial Wellness

To achieve financial wellness while managing both Credit Cards and Student Loans, consider the following strategies:

a. Budgeting: Create a budget to track income and expenses, ensuring that you can meet both Credit Card and Student Loan obligations while saving for other financial goals

b. Responsible Credit Card Use: Pay Credit Card balances in full each month to avoid interest charges. Use Credit Cards for planned expenses and emergencies, not as a source of uncontrolled Debt

c. Student Loan Repayment Plans: Choose a Student Loan repayment plan that aligns with your income and financial goals. Explore income-driven plans that offer flexibility based on your earnings

d. Loan Forgiveness and Assistance: Investigate loan forgiveness programs and income-based repayment options that can alleviate the burden of Student Loan Debt

e. Financial Education: Continuously educate yourself about personal finance. Understanding Credit, interest rates, and financial management principles can help you make informed decisions

f. Seek Professional Guidance: Consult with financial advisors or Credit counselors if you are struggling with managing Credit Card Debt or Student Loans. They can provide tailored guidance to improve your financial wellness[3]

Read more: 3 reasons to use personal loans to pay off Debt

Conclusion

Credit Cards and Student Loans are essential financial tools that serve different purposes and come with their own set of advantages and disadvantages. Credit Cards offer convenience and can contribute to a positive Credit history but carry the risk of Debt accumulation if not used responsibly. Student Loans enable access to education and potential career opportunities but require careful management to avoid excessive Debt.

Ultimately, the choice between Credit Cards and Student Loans depends on individual financial goals, circumstances, and responsible financial management. By understanding the nuances of both options, individuals can make informed decisions that contribute to their long-term financial wellness. Building a strong financial foundation through responsible Credit Card use and prudent Student Loan management is essential for achieving financial stability and success in the future.

Start your journey to Build Credit* with Bright Builder today!

References:

- https://www.investopedia.com/terms/c/Creditcard.asp

- https://www.investopedia.com/terms/e/education-loan.asp

- https://www.northwestern.edu/financial-wellness/student-loan-management/Credit-cards-vs-loans.html#:~:text=Credit%20cards%20typically%20carry%20higher,the%20student%20is%20in%20school.

FAQs

Q. How does Bright Money ensure my financial data is secure?

Bright Money takes data security seriously. We use the latest encryption and security protocols to protect your sensitive financial information. Our platform adheres to industry-standard security practices and undergoes regular security audits to ensure the safety of your data. Additionally, we do not store your bank login credentials, adding an extra layer of protection.

Q. Can Bright Money help me reduce my Debt?

Yes, Bright Money can assist you in reducing your Debt. Our platform analyzes your financial situation and provides personalized recommendations to help you pay down Debt faster. We'll suggest strategies like Debt consolidation or refinancing to lower interest rates and create a customized Debt repayment plan that fits your budget.

Q. What makes Bright Money different from other financial apps?

Bright Money stands out for its AI-powered approach to financial wellness. We use advanced algorithms to analyze your financial data and provide tailored recommendations. Unlike many other apps, we don't rely solely on manual input; we securely connect to your financial accounts to give you a real-time, holistic view of your finances.

Q. Can Bright Money help me save for specific goals?

Absolutely! Bright Money enables you to set and track financial goals, whether it's saving for a vacation, an emergency fund, or retirement. We'll provide guidance on how much to save and where to allocate your funds to achieve your goals faster.

Q. Is Bright Money suitable for people with varying income levels?

Yes, Bright Money is designed to assist people with diverse income levels. Our platform adapts to your financial situation, whether you have a consistent income or irregular earnings. We'll help you manage your finances effectively, regardless of your income level, by providing personalized strategies and insights tailored to your unique circumstances.

*Payment history has the biggest impact on credit score accounting for 40% of how score is calculated per TransUnion (https://www.transunion.com/credit-score). Bright Builder helps you build payment history that may positively improve your credit score. Credit score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will have a negative effect on your credit score. Products and services subject to state residency and regulatory requirements. Bright Builder is currently not available in all states.

.jpg)