You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Have you ever wondered how lenders determine those monthly loan payments that have a profound impact on your financial life? Whether it's your dream home, car, or business, loans play a pivotal role in achieving your aspirations. As you explore various loan types – fixed-rate, variable-rate, amortizing, interest-only, balloon, and installment loans – you'll encounter a complex world of financial tools.

Comprehending this process is essential, empowering you to make informed financial decisions and avoid potential pitfalls. After all, these monthly installments will shape your budget for years to come, influencing your daily life and long-term financial health.

This comprehensive guide will demystify the calculations behind loan installments, covering formulas, considerations, and factors across various loan types. It's your roadmap to mastering your financial future, where numbers converge with dreams, turning them into reality.

Read more: How to Avoid Interest on Credit Cards?

Understanding Standard Loan Installments

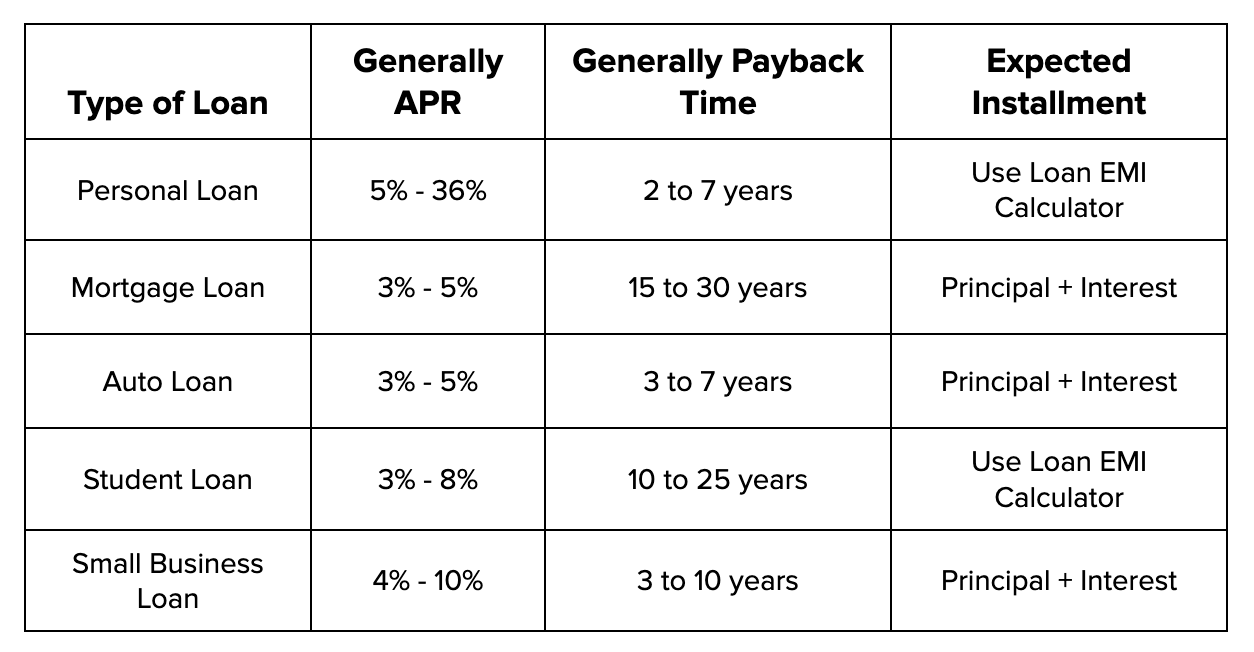

Here's a table summarizing standard loan installments, including the type of loan, typical APR (Annual Percentage Rate), general payback time, and the expected installment amount:

To calculate the monthly installment for a standard loan, you can use the following formula:

- Monthly Installment = Loan Amount × (Monthly Interest Rate) / (1 - (1 + Monthly Interest Rate)^(-Number of Monthly Payments))

Where:

- Loan Amount is the total amount borrowed

- Monthly Interest Rate is the annual interest rate divided by 12 (for monthly payments)

- Number of Monthly Payments is the total number of monthly payments over the loan term

Keep in mind that loan terms and interest rates can vary widely depending on the lender, your creditworthiness, and the type of loan, so it's essential to check with your specific lender for accurate details.

Understanding Loan Basics

Before diving into the calculations, it's essential to grasp the fundamental components of a loan:

- Principal Amount: The principal amount is the initial sum of money borrowed. It's the amount you receive from the lender, which you are obligated to repay

- Interest Rate: The interest rate is the cost of borrowing money and is usually expressed as an annual percentage. This rate is applied to the loan's outstanding balance to calculate each installment's interest portion

- Loan Term: The loan term, also known as the tenor, is the duration over which you will repay the loan. It's typically measured in months or years

- Monthly Installment: The monthly installment is the fixed amount you must pay monthly to repay the loan within the specified loan term[1]

Have a stress-free Finance Management with Bright - Join Today!

Different Types of Loans

There is a wide variety of loan types, each with its unique characteristics and methods for calculating installments. Here's a look at some common loan types along with popular examples:

- Fixed-Rate Loans: In a fixed-rate loan, the interest rate remains constant throughout the loan term. This means that your monthly installments stay the same from start to finish. A popular example is the 30-year fixed-rate mortgage

- Variable-Rate Loans (Adjustable-Rate Loans): Variable-rate loans have interest rates that can fluctuate over time, often tied to a benchmark interest rate like the prime rate. Your monthly installments can change as the interest rate changes. An example is the 5/1 adjustable-rate mortgage, where the rate is fixed for the first five years and then adjusts annually

- Amortizing Loans: Amortizing loans are structured so that each installment covers both the interest and a portion of the principal. Over time, a higher percentage of each payment goes toward reducing the principal balance. A common example is the 30-year fixed-rate mortgage

- Interest-Only Loans: Interest-only loans require borrowers to pay only the interest for a specific period, often the initial years of the loan. Afterwards, borrowers must start paying both interest and principal. A well-known example is the interest-only home equity line of credit (HELOC)

- Balloon Loans: Balloon loans feature smaller monthly installments for most of the loan term, with a large "balloon" payment due at the end. Borrowers should be prepared for a significant payment when the loan matures. One example is the 5/25 balloon mortgage, where the loan is amortized over 30 years but has a balloon payment after 5 years

- Installment Loans: Installment loans are straightforward, with fixed monthly payments and a predetermined loan term. They are often used for personal expenses such as auto loans, home renovations, and even student loans. A familiar example is the auto loan

Understanding these different types of loans and their payment structures is crucial for making informed financial decisions. Each type serves various purposes and comes with its own set of advantages and considerations.[2]

Ready to Shine Brighter? Sign Up Now! - Start your journey towards financial empowerment with Bright Money. Sign up today!

How to Calculate Loan Installments?

To calculate loan installments, use the formula:

Monthly Installment = Loan Amount × (Monthly Interest Rate) / (1 - (1 + Monthly Interest Rate)^(-Number of Monthly Payments))

Where the loan amount is the total borrowed sum, the monthly interest rate is the annual rate divided by 12, and the number of monthly payments represents the loan term in months. This formula provides the fixed monthly payment required to repay the loan over its specified duration.[3]

Let Bright Money Light the Path to Financial Success! - Sign up today and experience the difference Bright Money can make in your financial life.

Let's break down the calculations for the most common types:

Step 1: Loan Terms and Amount

First, you need to know the basic terms of your loan:

- Loan Amount (Principal): This is the total sum of money you borrow from a lender. It represents the amount you need to repay

- Annual Interest Rate: The annual interest rate is the cost you incur for borrowing money, expressed as a percentage of the principal. It's essentially the fee you pay to the lender for using their funds

Step 2: Loan Duration

Understanding the duration of your loan is essential. This is typically referred to as the "loan term" and is stated in years. It represents the number of years you have to repay the loan. It's essential to know if your loan term is stated in months; convert it to years.

Step 3: Monthly Interest Rate

To calculate monthly installments, you must convert the annual interest rate into a monthly rate. You do this by dividing the annual interest rate by 12, as there are 12 months in a year.

- Monthly Interest Rate = Annual Interest Rate / 12

For example, if your annual interest rate is 6%, your monthly interest rate would be

Monthly Interest Rate = 6% / 12 = 0.5%

Step 4: Total Number of Monthly Payments

The total number of monthly payments you'll make throughout the loan term is crucial. To find this, multiply the number of years in your loan term by 12, as there are 12 months in a year.

- Number of Monthly Payments = Loan Term (in years) x 12

For instance, if your loan term is 3 years, the total number of monthly payments would be:

Number of Monthly Payments = 3 years x 12 months/year = 36 months

Step 5: Calculating the Monthly Installment

Now that you have all the necessary information, you can calculate your monthly installment using a formula. Here's the formula:

- Monthly Installment = [P × (r × (1 + r)^n)] / [(1 + r)^n - 1]

Where:

- P represents the loan amount or principal.

- r is the monthly interest rate calculated in Step 3.

- n is the total number of monthly payments calculated in Step 4.

This formula will give you the fixed monthly payment you need to make to repay both the principal and the interest over the loan term.

Step 6: Total Repayment Amount

Understanding the total amount you'll repay over the life of the loan is essential for budgeting and financial planning. To find this, multiply the monthly installment by the total number of monthly payments:

- Total Repayment Amount = Monthly Installment x Number of Monthly Payments

In summary, calculating loan installments involves knowing the loan amount, annual interest rate, loan duration, converting the annual interest rate into a monthly rate, finding the total number of monthly payments, and applying the formula to calculate the monthly installment.

Remember, there are various online tools and loan calculators available that can simplify this process for you. Understanding your loan installments is crucial for managing your finances and making informed borrowing decisions.[3]

Don't Wait - Secure Your Financial Future! - Join thousands of satisfied users who trust Bright Money to make smart financial decisions. Sign up now!

Additional Considerations

Understanding your financial obligations requires you to calculate your loan installments, but there are other things to keep in mind as well:

1. Fees and Charges: Lenders may impose various fees and charges, such as origination fees, processing fees, and late payment penalties. These can affect the overall cost of your loan, so be sure to account for them

2. Prepayment Options: Some loans allow you to make extra payments or pay off the loan early without penalties. Understanding these options can help you save on interest costs

3. Credit Score: Your credit score can impact the interest rate you receive on a loan. A higher credit score typically results in a lower interest rate, which can reduce your monthly payments

4. Loan Amortization Schedule: An amortization schedule provides a detailed breakdown of each loan payment, showing how much goes toward interest and principal. Reviewing this schedule can help you visualize your loan repayment progress

5. Loan Refinancing: In some cases, you may be able to refinance your loan to secure a lower interest rate or extend the loan term, which can lower your monthly payments.[4]

Read more: These Budgeting Tips can help you stay on track financially

Conclusion

Calculating loan installments is a fundamental skill for anyone considering borrowing money. It allows you to understand your financial commitment and plan your budget accordingly. Whether you're dealing with a fixed-rate mortgage, a variable-rate business loan, or an installment loan for personal use, knowing how to calculate your monthly payments empowers you to make informed financial decisions.

Remember that while the formulas provided here can give you a good estimate of your monthly installments, they may not account for all the nuances of your specific loan agreement. Always consult your lender or loan documents for precise calculations and terms. Additionally, consider seeking financial advice from a qualified professional to ensure that taking on a loan aligns with your overall financial goals and budget.

Start Your Brighter Financial Future Now! - Take the first step towards financial wellness. Sign up with Bright Money and get on the path to a brighter future.

References:

- https://www.investopedia.com/loan-basics-4689731

- https://www.forbes.com/advisor/in/loans/types-of-loans/

- https://www.hdfc.com/home-loan-emi-calculator

- https://www.investopedia.com/articles/personal-finance/072316/how-installment-loans-work.asp

FAQs

1. How does loan term affect monthly payments?

The loan term, or tenor, significantly impacts your monthly payments. In general, longer loan terms result in lower monthly installments, while shorter terms lead to higher payments. This is because a longer-term spreads the principal and interest over more months, reducing the individual installment amount. However, longer terms often mean paying more interest over the life of the loan. Conversely, shorter terms have higher installments but lower overall interest costs. Choosing a term that aligns with your financial goals and budget is essential.

2. What factors influence the interest rate on a loan?

Several factors influence the interest rate you're offered on a loan, including your credit score, the loan type, market conditions, and the lender's policies. A higher credit score typically results in a lower interest rate, which signifies lower risk to the lender. Different loan types (e.g., fixed-rate vs. variable-rate) and market fluctuations can also affect rates. Shopping around and comparing offers from various lenders can help you secure a competitive interest rate.

3. Can I change the frequency of loan payments?

Yes, in many cases, you can change the frequency of your loan payments. While monthly installments are common, some lenders offer biweekly or weekly payment options. Smaller, more frequent payments can help you repay the loan faster and reduce overall interest costs. However, checking with your lender to ensure they allow payment frequency changes and understand any potential fees or restrictions is crucial.

4. How do extra payments impact loan repayment?

Making extra payments toward your loan principal can significantly impact your repayment timeline and interest costs. Paying more than the required monthly installment reduces the outstanding balance faster. This means you'll pay less interest over the life of the loan and potentially pay off the loan ahead of schedule. Check your loan agreement for any prepayment penalties and guidelines on how to apply extra payments to the principal.

5. What are the risks of balloon loans?

Balloon loans can be risky due to the large final payment, or "balloon," at the end of the loan term. If you don't have the means to make this final payment, you may need to refinance the loan, sell the asset, or face default. Additionally, the lower monthly installments at the beginning of the loan may lead to negative equity in the asset, making it challenging to sell or refinance. It's essential to thoroughly understand the terms of a balloon loan and have a clear plan for addressing the balloon payment when it comes due. Consider these risks carefully before choosing this loan type.