You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Debt is a tricky beast. According to Experian, the average American has about $90,460 in Debt. Many of us face financial obligations at some point in our lives. Whether it's credit card Debt, student loans, a mortgage, or other forms of borrowing, the question often arises: Is it better to pay off Debt all at once or take a more gradual approach? In this comprehensive guide, we will walk you through the decision-making process, considering different types of Debt and various strategies for repayment.

Should You Pay Off Debt Slowly Or All At Once?

This decision is very personal to you. You need to consider different factors and weigh the options that suit you the best.

Step 1: Identify the Type of Debt

Before deciding whether to pay off Debt quickly or slowly, it's crucial to understand your Debt type. Here's a breakdown of common Debt categories and how to approach them:

High-Interest Debt: Pay ASAP

- High-interest Debt includes credit card balances and personal loans with exorbitant interest rates. These Debts should be prioritized for rapid repayment because the interest can compound quickly, making it costlier over time

- Why? Paying off high-interest Debt quickly reduces the total interest you'll pay, freeing up more money for other financial goals or investments

Low-Interest Debt: Pay Slowly

- Low-interest Debt includes loans or credit lines with comparatively lower interest rates, such as some auto loans or certain personal loans

- Why? Since the interest rates are manageable, paying these Debts off more slowly might be more financially beneficial. You can use your funds for higher-return investments or emergency savings

Student Loans and Home Loans: Pay as Slow as Possible

- Student loans and mortgages typically come with lower interest rates and longer repayment terms. These types of Debt don't require immediate aggressive repayment

- Why? Paying these loans slowly is often better, especially when interest rates are low. You can benefit from the tax advantages of mortgage interest deductions and invest your money elsewhere for potentially higher returns

Step 2: Why Different Debts Require Different Approaches

The decision to pay off Debt quickly or slowly is not one-size-fits-all. Here's why different types of Debt warrant distinct approaches:

High-Interest Debt: Pay ASAP

- High-interest Debt can become a financial burden due to the compounding effect of interest. By paying it off quickly, you save money on interest and break free from the cycle of Debt

- Additionally, high-interest Debt often needs more tax benefits or investment opportunities that would justify delaying repayment

Low-Interest Debt: Pay Slowly

- Low-interest Debt, like some auto loans or low-rate personal loans, poses a manageable financial threat. Paying it off slowly allows you to allocate funds to more pressing financial goals, such as building an emergency fund or investing

- By maintaining these low-interest loans and managing them responsibly, you can also build a positive credit history, improving your credit score

Student Loans and Home Loans: Pay as Slow as Possible

- Student loans and mortgages usually have relatively low-interest rates compared to other forms of Debt. These loans often come with tax advantages and potential investment returns that outweigh the interest costs

- Prioritizing saving for retirement, emergencies, and other financial goals is wise before accelerating payments on these loans

Step 3: Managing Credit Card Debt

Credit card Debt is notorious for its high-interest rates and its detrimental effect on your financial health. To effectively manage credit card Debt, consider the following strategies:

- Debt Avalanche: This method involves paying off credit card Debts with the highest interest rates first while making minimum payments on other cards. Once the highest-interest Debt is cleared, move to the next one

Why? The Debt avalanche minimizes the total interest paid, helping you get out of Debt faster

- Debt Snowball: The Debt snowball approach focuses on paying off the smallest credit card balance first while maintaining minimum payments on the others. Once the smallest Debt is cleared, tackle the next smallest

Why? The Debt snowball method provides psychological satisfaction by eliminating smaller Debts quickly, motivating you to continue paying off more significant balances.

Step 4: Debt Consolidation

Debt consolidation is another strategy to consider when managing your Debts. This approach combines multiple Debts into a more manageable loan or credit line. Here are the benefits of Debt consolidation:

- Lower Interest Rates: Debt consolidation loans often come with lower interest rates than credit cards, reducing the overall cost of Debt

- Simplified Repayment: By consolidating your Debts, you streamline your payments into one, making it easier to manage your finances

- Potential for Better Credit: Managing your Debts responsibly through consolidation can positively impact your credit score

However, it's essential to weigh the pros and cons of Debt consolidation and ensure that you are not just shifting your Debt burden but actively working towards Debt-free.

Bright Money aims to help you pay off Debt faster and save on interest costs. By optimizing your Debt repayment, you can pay less in interest and achieve financial freedom sooner.

Conclusion

The Final Word on Debt Repayment Strategies: we are at the crossroads of financial decisions. The journey to this point has been filled with numbers, terms, and real-world scenarios, all aimed at answering one crucial question: Is it better to use a personal loan to pay off Debt all at once or to do it gradually?

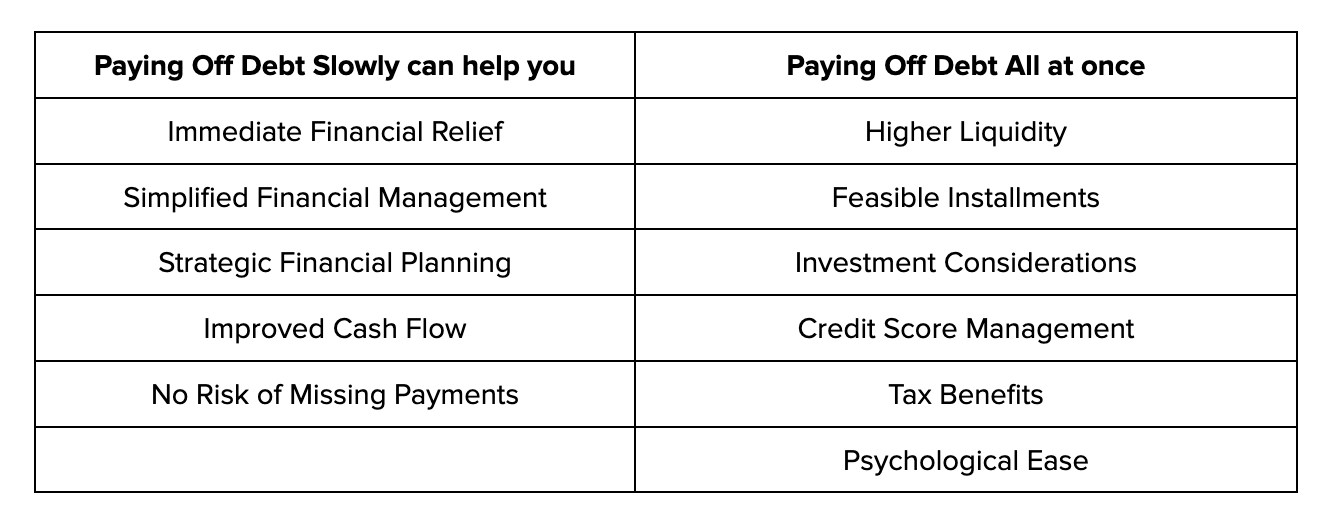

Remember the immediate relief it brings if you're leaning towards paying off Debt immediately. You'll save on interest, simplify your finances, and free up your budget for future opportunities. Conversely, paying off Debt slowly gives you room to breathe. It allows you to maintain a safety net of liquid assets, offers a budget-friendly approach, and even provides investment opportunities.

In both scenarios, using a personal loan to pay off Debt has its merits and drawbacks. It can be a tool for financial freedom or a misstep if not carefully considered.

Your financial management plan is particular to you. Explore the gateway to financial health with Bright Money!

Read More:

- How Does Bright Builder Help You Build Credit?

- 14 Debt Pay-Off Tips You Can’t Miss

- Top 10 Financial Podcasts to Master Money Management

FAQs

1. How Does Paying Off Debt All at Once Compare to Gradual Payments in Terms of Credit Score Impact?

Paying off Debt all at once can dramatically improve your credit utilization ratio, which accounts for 30% of your credit score. This immediate reduction in outstanding Debt can quickly boost your credit score. However, it may also shorten your credit history if the Debt paid off is one of your older accounts, which can have a slight negative impact.

On the other hand, making gradual payments contributes to a history of on-time payments, which is the most significant factor in credit scoring models. It also allows you to maintain a mix of different types of credit, which is beneficial for your credit profile. Therefore, both methods have pros and cons, and the best choice may vary depending on your unique financial situation.

2. What Are the Psychological Benefits of Paying Off Debt All at Once Versus Slowly?

The psychological aspects of Debt repayment are often overlooked but are crucial. Paying off Debt in one go can offer immediate emotional relief and a sense of accomplishment, freeing you from the mental burden that Debt often carries.

However, if carefully planned, this approach might only be feasible for some and could lead to financial strain. In contrast, making gradual payments can instill financial discipline and make the task seem less daunting. This method allows for better budgeting and can offer a more sustainable long-term approach to financial management.

3. How Do Interest Rates Affect the Decision to Pay Off Debt All at Once or Gradually?

Interest rates play a pivotal role in the decision-making process. If you're dealing with high-interest Debt, the total amount you'll pay can be substantially higher if you opt for gradual payments. In such cases, paying off the Debt can result in significant savings.

On the other hand, if the interest rate is low, the financial urgency to pay off the Debt immediately diminishes. In this scenario, you might be better off making gradual payments and using the extra funds for investments that offer higher returns, optimizing your overall financial portfolio.

References

- https://www.equifax.com/personal/education/Debt-management/Debt-repayment-vs-saving-money/

- https://www.experian.com/blogs/ask-experian/should-i-pay-off-my-credit-card-Debt-immediately-or-over-time/

- https://www.cnbc.com/select/paying-off-too-much-Debt/