You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Did you know that according to recent surveys, around 40% of Americans would struggle to cover an unexpected expense of $400 without borrowing money or selling possessions? Navigating financial challenges can sometimes feel like walking on a tightrope, especially when faced with a less-than-ideal credit score. Life's unexpected emergencies, however, don't discriminate based on credit history. If you find yourself in need of urgent funds but are plagued by bad credit, the situation might seem daunting.

The good news? Securing an emergency loan with bad credit is not only possible but also a step towards regaining financial stability.

This guide illuminates the pathway to obtaining that much-needed lifeline, exploring options, strategies, and tips to help you secure an emergency loan, even when your credit score isn't on your side.

But before we get into the topic, it is recommended to first read about What credit is in detail by Bright Money!

So, let's delve into the world of pragmatic solutions and financial empowerment, where bad credit doesn't have to stand in the way of addressing unforeseen challenges.

Understanding Your Situation

In the process of seeking an emergency loan for bad credit, it's crucial to start by understanding your current situation. This involves two key aspects: assessing the urgency of your financial need and evaluating your credit score.

- Assessing the Urgency

Before delving into the intricacies of obtaining an emergency loan, it's wise to take a step back and assess the urgency of your situation. Consider whether your financial need is immediate or if you have some leeway to explore various loan options. By gauging the level of urgency, you can make more informed decisions about the type of loan that suits your circumstances and how swiftly you need to secure it.

For instance, if you're facing a medical emergency or need to make a critical repair, such as fixing a broken-down vehicle, the urgency might demand a quicker loan approval process.

On the other hand, if you're dealing with a less time-sensitive situation, you might have the luxury of investigating different loan sources and comparing their terms before making a choice.

Recognizing the urgency of your need is the first step toward identifying the appropriate course of action.

- Evaluating Your Credit Score

In the world of loans, credit scores play a very important role in determining your eligibility for traditional borrowing avenues. However, having bad credit doesn't automatically render you without options. Many financial institutions and lenders specialize in extending loans to individuals with lower credit scores.

As you embark on your quest for an emergency loan, it's essential to become intimately acquainted with your credit score and grasp how it might influence the application process.

Based on variables like payment history, credit usage, length of credit history, categories of credit, and current credit inquiries, your credit score is a numerical indication of your creditworthiness. Even though traditional lenders might be reluctant to give loans to those with bad credit, things have changed in the financial world.

Lenders that specialize in serving borrowers with imperfect credit histories exist. These lenders frequently examine your financial status holistically, taking into account elements other than your credit score including your salary and security of work.

By comprehending your credit score and its implications, you empower yourself to make strategic decisions. You'll be equipped to choose lenders who are more likely to consider your application and offer terms that align with your financial capabilities. Additionally, understanding your credit score enables you to proactively address any inaccuracies or areas that could be improved, which could potentially lead to better loan terms in the future.

Pros & Cons of Emergency Loan

What are the Possible Loan Options?

Whenever it comes to securing an emergency loan for bad credit, understanding your options is key. Exploring various types of loans can help you make an informed decision that aligns with your financial needs and capabilities. Here are three common loan options to consider:

1. Personal Loans

Personal loans stand out as a versatile solution for individuals with bad credit who require emergency funds. These loans are typically unsecured, meaning you don't need to provide collateral to back the loan. This can be a relief for those who might not possess valuable assets to use as security. While individuals with bad credit might face higher interest rates compared to those ones with good credit, personal loans offer valuable benefits. Companies like LendingClub offers personal loans!

The flexibility offered by personal loans is a big plus. It is the flexibility of the borrower to select the loan amount and payback period that best fit their needs. By doing this, you can make sure that your monthly payments are within your budget and doable.

Furthermore, a fixed interest rate is another feature of many personal loans that guarantees regular monthly payments throughout the loan duration. It is important to thoroughly examine the conditions, interest rates, and repayment schedule of a personal loan prior to signing on.

2. Payday Loans

Payday loans, often known as cash advance loans, are short-term loans used to meet unexpected needs. The term comes from the fact that these loans are normally due on your following payday.

Payday loans are available to people with terrible credit, making them a viable choice for those with urgent financial requirements. However, because of their particular qualities, payday loans should be approached with prudence. Companies like 1stpremierLending can offer you payday Loans!

While payday loans give you quick access to cash, they sometimes have exorbitant interest rates and costs. Payday loan APRs (Annual Percentage Rates) can be far higher than typical loan APRs, resulting in severe financial pressure if not managed appropriately.

Make sure you completely grasp the conditions, repayment structure, and the repercussions of not repaying the loan on time before making an informed decision regarding payday loans. Consider this choice only if you are sure in your capacity to repay the loan on time.

3. Online Lenders

Approximately 65% of lenders believe that alternative data helps them make more accurate lending decisions, thus expanding opportunities for bad credit borrowers. The advent of online lending platforms has revolutionized the lending landscape, especially for individuals with bad credit. Online lenders like Upstart provide you with an alternative to traditional banks, often offering loans with less stringent eligibility criteria. This increased accessibility can be a game-changer for those who may have been rejected by traditional lenders due to their credit history.

When considering online lenders, it's essential to conduct thorough research. Look for reputable online lending platforms with a track record of transparent practices and positive customer reviews. Online lenders should clearly present their terms, interest rates, fees, and repayment options on their website. Take the time to read reviews and gather information about the lender's customer service quality, as a reliable and responsive lender can make the loan process smoother.

4. Secured Loans

Although a lot of loans are unsecured, or without collateral, secured loans are an additional option to think about. Assets such as expensive property, cars or you can even deposit as low as $50 if you’re choosing Bright Builder for taking a secured loan which serves as a collateral for secured loans. By serving as a safety net, this collateral lowers the lender's risk in the event that you default on the loan. People with poor credit can more easily obtain secured loans since the collateral gives the lender confidence.

Nonetheless, it's critical to understand the possible repercussions of secured loans. The lender has the right to take possession of the collateral if you're unable to pay back the loan. This means you could lose valuable assets if you're not diligent about making payments on time. Before opting for a secured loan, carefully weigh the benefits and risks, and only use assets you can afford to part with if necessary.

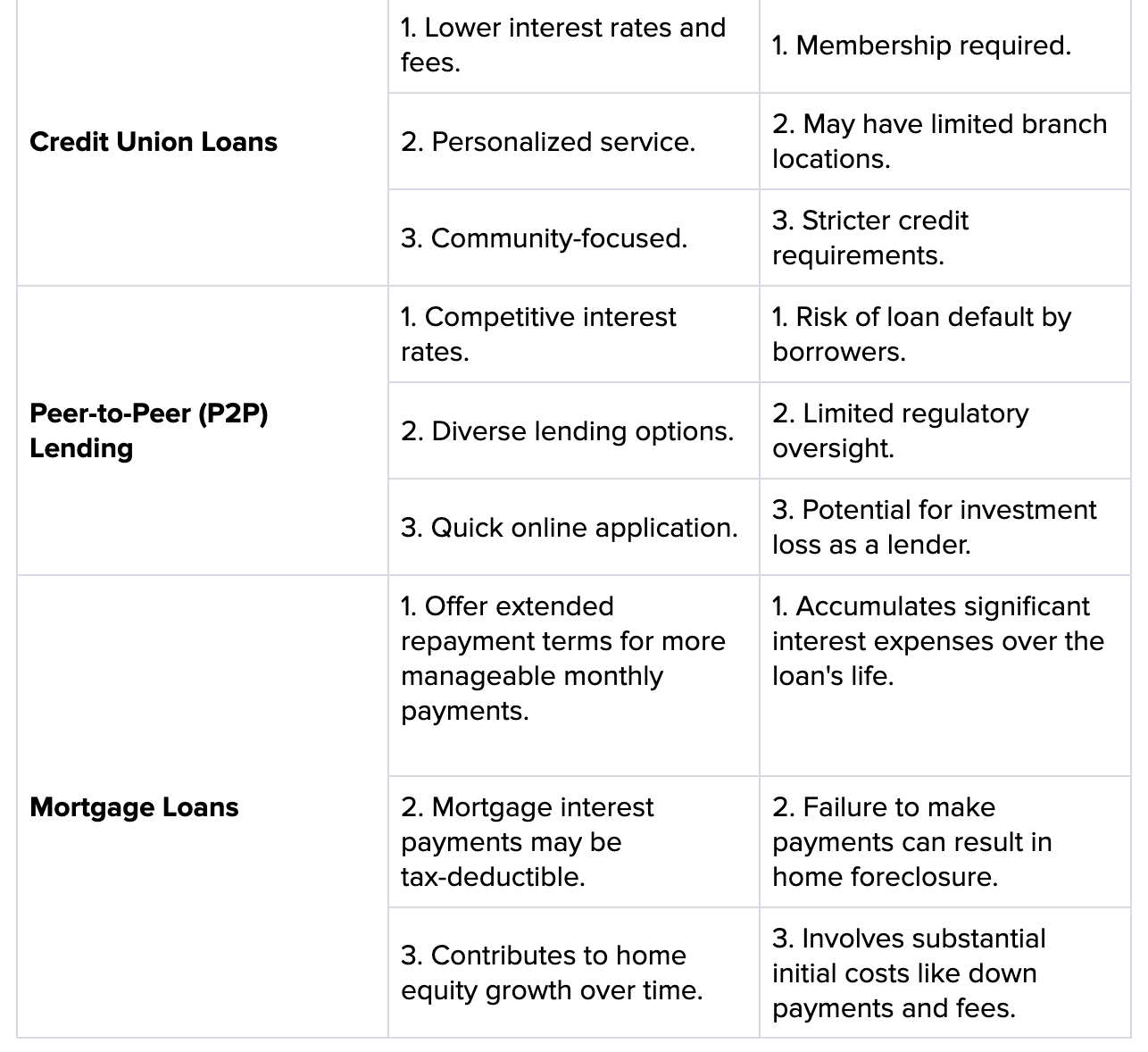

5. Credit Union Loans

Compared to typical banks, credit unions, which are member-owned financial entities, frequently provide better conditions. Credit unions like PenFed put its members' financial security first and could be more accommodating to those with poor credit. Typically, they provide individualized customer attention together with reasonable interest rates.

You must register for an account, become a member, and fulfill certain requirements before you may apply for credit union loans. This might entail living in a certain location or being a member of a specific profession or community. Investigating credit unions might be a good option, particularly if you're seeking a financing experience that is more focused on the community.

6. Peer-to-Peer (P2P) Lending

Peer-to-peer lending is a modern approach that connects borrowers directly with individual lenders through online platforms. The peer-to-peer lending market has witnessed substantial growth, with estimates indicating that it reached a value of over $67 billion in recent years. P2P lending can be particularly beneficial for those with bad credit, as some platforms consider factors beyond credit scores when evaluating loan applications. This might include your employment history, income, and other financial indicators.

P2P lending offers a great alternative to traditional lending institutions and might provide more flexible terms. However, it's important to note that interest rates can still vary based on your credit profile. When considering P2P lending, research different platforms like Prosper, review their terms, and choose a reputable platform with positive user feedback.

7. Mortgage Loans

Using a mortgage loan as an emergency loan for bad credit is a financial option that individuals with poor credit may consider in times of crisis. While traditional lenders may be hesitant to provide loans to those with bad credit, some specialized lenders, like "New American Funding," offer mortgage loans that cater to borrowers with less-than-perfect credit histories.

These emergency mortgage loans typically come with certain terms and conditions, including potentially higher interest rates and stricter qualification criteria. It's crucial for borrowers to thoroughly research and understand the terms of such loans and only consider them as a last resort.

You can learn more about the mortgage loan options for bad credit individuals and explore what New American Funding has to offer by visiting their official website: New American Funding.

Tips for Securing an Emergency Loan

Obtaining an emergency loan with bad credit requires strategic planning and careful execution. Here are additional tips to enhance your chances of success:

1. Research and Compare Lenders

Don't settle for the first lender you come across. Research and compare multiple lenders to find the one that offers the most favorable terms for your situation. Look beyond just interest rates; consider factors like repayment flexibility, customer reviews, and overall reputation.

2. Explain Your Circumstances

If you've faced financial setbacks that contributed to your bad credit, consider writing a brief explanation to accompany your loan application. While not all lenders will take this into consideration, some might appreciate your honesty and willingness to provide context for your credit history.

3. Avoid Applying for Multiple Loans Simultaneously

Submitting multiple loan applications within a short period can negatively impact your credit score. Lenders may interpret this as a sign of financial instability or desperation. Instead, focus on carefully selecting a few potential lenders based on your research and then submitting applications to those select few.

4. Beware of Predatory Lenders

While you're eager to secure a loan, be vigilant against predatory lenders. These are individuals or institutions that take advantage of desperate borrowers by offering loans with exorbitant interest rates and hidden fees. Always review the terms and conditions, and if something seems too good to be true, it probably is.

5. Consider Alternative Income Sources

If you have additional income sources beyond your regular job, such as freelance work, part-time jobs, or side gigs, consider including these when disclosing your income to lenders. Demonstrating a diversified income stream could bolster your credibility as a borrower.

6. Provide a Detailed Budget

In addition to demonstrating your income, consider providing a detailed budget which outlines your monthly expenses. This gives lenders insight into how you manage your finances and whether you have the capacity to handle loan repayments on top of your existing obligations.

7. Be Prepared for Rejections

It's essential to prepare mentally for the possibility of loan rejections. Not all applications will be approved, even with the best efforts. If you do receive rejections, don't be disheartened. Instead, use the feedback to understand why your application was unsuccessful and work on improving those aspects for future attempts.

8. Negotiate Terms

If a lender expresses interest in working with you but presents terms that you find challenging, don't hesitate to negotiate. While lenders have certain criteria, they may be willing to adjust interest rates, repayment schedules, or other terms to accommodate your needs.

9. Read the Fine Print

Before accepting any loan offer, first thoroughly read and understand the loan agreement. Pay attention to the interest rates, repayment schedule, fees, and any potential penalties for late payments. If anything is unclear, seek clarification from the lender before proceeding.

Final Thoughts

Securing an emergency loan with bad credit might seem challenging, but it's not impossible. By understanding your situation, exploring different loan options, and taking proactive steps, you may increase your chances of obtaining the funds you need when you need them most. Remember, financial emergencies can happen to anyone, and having a plan in place can provide peace of mind during difficult times.

Recommended Reads:

How to improve your credit score?

5 mistakes to avoid while building credit

FAQs

1. Can I get an emergency loan with bad credit?

Yes, you can. While traditional lenders might be hesitant, there are specialized lenders, online platforms, and credit unions that offer loans tailored to individuals with bad credit.

2. What are the options for emergency loans with bad credit?

Options include payday loans, installment loans, secured loans, personal loans from online lenders, borrowing from friends or family, and credit union loans designed for members with poor credit.

3. How can I increase the chances of approval?

Provide accurate information on your application, have a stable income source, and consider a co-signer or collateral to secure the loan. Be prepared to explain your plan for repayment.

4. How do payday loans work?

Payday loans are short-term, high-interest loans that are typically due on your next payday. They're relatively easy to get, but be cautious of the high interest rates and potential debt trap.

5. Are there alternatives to payday loans?

Yes, you can explore alternatives like installment loans, which offer more manageable repayment plans, or personal loans from online lenders that consider other factors beyond credit score.

6. What are secured loans?

Secured loans require collateral, like a car or valuable asset, which reduces the risk for the lender. This can lead to better terms and higher approval rates, even with bad credit.

7. Can I borrow from friends or family in an emergency?

Borrowing from loved ones is an option to consider, but ensure clear terms and open communication to avoid straining relationships.

8. How do credit union loans for bad credit work?

Credit unions often offer more lenient terms and lower interest rates to members with poor credit. They consider your relationship with the credit union and your ability to repay.

9. Are online lenders trustworthy for bad credit loans?

There are reputable online lenders, but also be cautious of scams and predatory practices. Research the lender's reviews, terms, and customer experiences before applying.

10. Should I consider a co-signer?

A co-signer with a good credit can increase the chances of your loan approval and secure better terms. However, remember that the co-signer is equally responsible for repayment.

11. What steps can I take to rebuild my credit?

Make timely payments, reduce outstanding debt, and consider getting a secured credit card or credit builder loan to gradually improve your credit score.

12. What should I watch out for when seeking an emergency loan?

Avoid lenders that guarantee approval without any checks or ask for upfront fees. Read the terms and fine print carefully to understand the total cost of the loan.

13. How much can I borrow with bad credit?

Loan amounts may vary depending on the lender and your financial situation. Generally, lower amounts are easier to get approved for with bad credit.

14. How quickly can I get funds in an emergency?

Some lenders offer same-day or next-day funding, especially online lenders. Traditional banks might take longer due to their approval processes.

15. Can I get an emergency loan with bankruptcy on my credit report?

It might be more challenging, but some lenders specialize in loans for individuals with bankruptcy on their record. Expect stricter terms and higher interest rates.

References:

- https://www.alliedmarketresearch.com/press-release/peer-to-peer-lending-market.html#:~:text=According%20to%20a%20recent%20report,is%20projected%20to%20reach%20%24558.91

- https://www.fdic.gov/analysis/cfr/consumer/2022/papers/ratnadiwakara-paper.pdf

- https://fortune.com/2023/05/23/inflation-economy-consumer-finances-americans-cant-cover-emergency-expense-federal-reserve/#:~:text=According%20to%20the%20Fed's%202022,up%20from%2032%25%20in%202021

- https://www.timesunion.com/marketplace/article/best-online-payday-loans-16746822.php

- https://www.forbes.com/advisor/personal-loans/best-credit-union-personal-loans/