You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

A Personal Loan is one of several loan products banks and other financial institutions offer to address various needs. The loan application procedure has changed throughout time as a result of developments in technology, which have become faster and more user-friendly. In the changing world of personal finance, finding the perfect Personal Loans to Address Credit Card Debt might be a game-changer.

Use Cases for Personal Loans

Personal Loans are applied to a variety of situations. Here are some typical scenarios when Personal Loans are used:

- Debt Consolidation: Many borrowers take out Personal Loans to combine their high-interest obligations, such as Credit Card bills.

- Renovation of the home: Personal Loans might be an excellent alternative if you're redesigning the kitchen, adding a bathroom, or doing other home modifications.

- Medical Costs: Unexpected medical expenses are expensive, and Personal Loans can assist in paying for medical costs.

- Education: Borrowers use Personal Loans to pay for their or their kids' college tuition.

- Travel: It provides you with the money you need for traveling, whether for your dream vacation or a family emergency.

- Weddings: Weddings are expensive events. Couples can use Personal Loans to pay for wedding expenditures.

Personal loans are standard in the US for a reason. Learn why these loans are popular among potential borrowers and how an essential factor in this is that these are unsecured personal loans. By clicking here, you may read more.

How can you pay off Credit Card Debt with a Personal Loan?

Credit Card Debt is notorious for its high interest rates, often exceeding 15% or even 20% APR (Annual Percentage Rate). This can result in substantial interest charges, challenging paying off the total costs. By utilizing a Personal Loan to consolidate your Credit Card Debt, you may benefit from a lower interest rate, ultimately reducing the overall cost of your Debt.

Bright Money can help you pay off your card Debts faster! Download the Bright App for a Debt-free financial future.

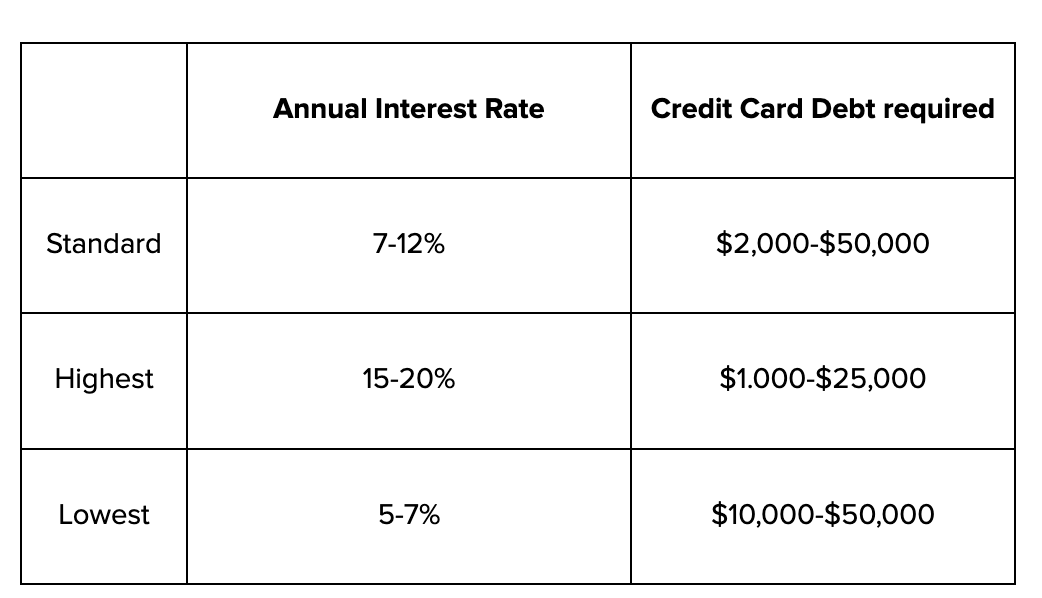

Note: These are just general guidelines; specific ANNUAL PERCENTAGE RATE and Credit Card Debt requirements will vary depending on the lender.

Additional advice:

- Generally, borrowers with solid credit ratings are eligible for reduced annual percentage rates

- Higher annual percentage rates may be available to borrowers with lower Credit Scores

- Before selecting a Personal Loan, borrowers should evaluate offers from several lenders

- Before agreeing to the terms of any Personal Loans, borrowers should thoroughly study them

Example: If you have a decent Credit Score and $10,000 in Credit Card Debt, you could be eligible for a Personal Loan with an annual rate of 6%. This would save you money on interest instead of continuing to pay down your Credit Card Debt at a higher interest rate.

Which are the Best Options for Personal Loans?

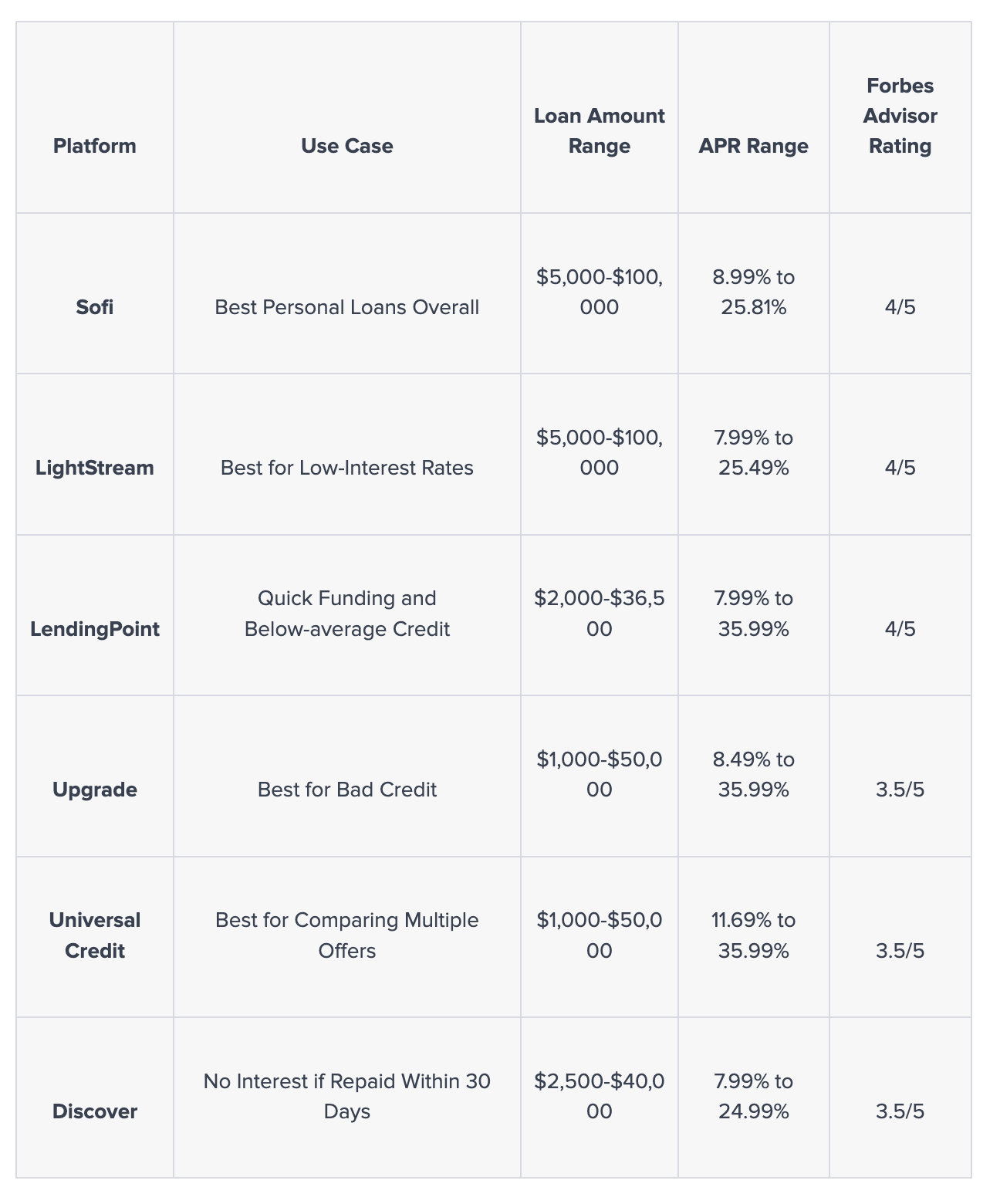

The top 6 Personal Loans deals for September 2023 have been compiled in this article. Investigate the unsecured Personal loan possibilities offered by banks, which may provide insightful information about the solutions accessible for your financial needs.

This comprehensive list will allow you to decide on a better financial future.

If you are looking for a comprehensive solution, Bright could be your go-to option:

- Personal Loan up to $8,000* to consolidate Credit Card Debt: Bright Credit

- Credit Builder Loan to Build Credit: Bright Builder

- Personalized AI budgeting and savings plan: Bright Plan

Bright gives you everything you need to control your Debt.

What Are the 6 Best Personal Loans for September 2023 to Meet My Financial Needs?

We have determined the top six Personal Loans for different financial needs as of September 2023. This page contains choices for those with weak or below-average credit, inexpensive interest rates, and quick funding. Discover the best Personal Loan choices that can help you get control over your Credit Card Debt by traveling with us on this financial adventure.

1. Sofi

Sofi is leading the pack as the best overall Personal Loans provider in September 2023. Known for its competitive interest rates and a wide range of loan options, Sofi is a trusted choice for many.

- Low rates: Low fixed rates won't change over time, protecting you from rising interest rates

- No fees required: No origination fees are required, no prepayment penalty fees, and no late fees whatsoever

- Same-day funding: If your loan is authorized, your money may be accessible as soon as that day

- Protection from unemployment: We'll help you adjust your payments and help you locate new employment

Forbes Advisor Rating: 4/5

Current APR Range: 8.99% to 25.81%

Loan Amount: $5,000-$100,000

2. LightStream

If your primary goal is to save on interest while paying off Credit Card Debt, LightStream is a top contender. They are known for their exceptionally low-interest rates and offer a Rate Beat Program, where they'll beat any qualifying rate from another lender by 0.10 percentage points.

Forbes Advisor Rating: 4/5

Current APR Range: 7.99% to 25.49%

Loan Amount: $5,000-$100,000

3. LendingPoint

LendingPoint caters to individuals who need fast access to funds, even if their Credit Score could be better. Their speedy approval procedure might be a lifesaver when you're struggling with urgent financial issues, like paying off high-interest Credit Card Debt. LendingPoint looks beyond your Credit Score and considers other factors when making lending decisions.

Forbes Advisor Rating: 4/5

Current APR Range: 7.99% to 35.99%

Loan Amount: $2,000-$36,500

4. Upgrade

If you have bad credit and are struggling with Credit Card Debt, an Upgrade might be the answer. They specialize in lending money to those with bad credit records for Personal Loans. You may gradually raise your Credit Score by paying off Credit Card Debt with an Upgrade loan.

Forbes Advisor Rating: 3.5/5

Current APR Range: 8.49% to 35.99%

Loan Amount: $1,000-$50,000

5. Universal Credit

Universal Credit is your one-stop platform for comparing multiple Personal Loan offers. They understand that borrowers have unique needs, and their service allows you to view multiple loan options from various lenders in one place. This feature lets you choose the finest loan to pay off your Credit Card Debt and make an educated decision.

Forbes Advisor Rating: 3.5/5

Current APR Range: 11.69% to 35.99%

Loan Amount: $1,000-$50,000

6. Discover

Discover offers a unique opportunity for those who can commit to repaying their loan quickly. If you can pay off your loan within 30 days, Discover charges zero interest. This feature benefits individuals who want to tackle Credit Card Debt without incurring additional interest charges.

- Great Rates- Fixed interest rates help you save money on interest.

- Flexible Terms- Borrow up to $40,000 and repay it over 3 to 7 years - it's your choice.

- No Up-Front Fees- With no fees, as long as you pay on time, you can put more of your money to work.

- Funds Sent Fast- After approval, funds may be disbursed within the following working day.

Forbes Advisor Rating: 3.5/5

Current APR Range: 7.99% to 24.99%

Loan Amount: $2,500-$40,000

These are based on the ratings and reviews from Forbes Advisor, a trusted source of financial advice. You can use online tools to compare options from different private lenders and find the best deal.

Tips To Remember

A few important considerations must be kept in mind when thinking about taking out a Personal Loan to pay off Credit Card Debt:

1. Amount of loan: It determines the borrowing amount you'll require to pay off your Credit Card Debt. Ensure the Personal Loans you select to provide the loan amount needed to pay your outstanding bills. The loan amount in the case of Personal Loans might be rather large. It depends on the person's income profile and credit history.

2. Rates of Interest: Pay special attention to the lender's stated interest rates. Lower interest rates make paying off your Debt much more affordable. The level of interest is vital. It is determined based on the applicant's profile and ranges from 10% to 22%.

3. Loan duration: Consider the loan duration that matches your financial objectives. If your monthly payments are high, Debt is paid off quickly. For Personal Loans, the payback period is comparatively long. For the majority of lenders, it typically ranges from 1 to 5 years.

4. Charges: Examine the loan's fees to see whether there are any origination fees, prepayment fines, or other costs. These may affect borrowing costs as a whole. Banks charge a variety of costs, including processing fees and late fees.

5. Credit Score: Know the lender's Credit Score criteria. While some lenders have higher requirements, others specialize in helping applicants with weaker credit ratings.

6. Documentation: Individuals must provide several papers, including income statements, bank statements, and tax returns, to apply for Personal Loans.

Final Words

These six Personal loan companies stand out as the top choices in September 2023 for anyone looking to pay off Credit Card Debt. There is a solution for all borrower's requirements, from Sofi's general excellence to Discover's no-interest offer. Remember that the correct Personal Loans may be a helpful instrument in your quest for financial stability, allowing you to recover control over your money and move closer to a future free of Debt.

Use financial tools like Bright Money as you set out on your road to manage Credit Card Debt with Personal Loans. It offers individualized financial advice and insights to assist you in reaching your financial objectives and making educated decisions. Bright Money is your dependable resource for Debt consolidation, Credit Score improvement, and future savings. So, are you prepared to manage your Credit Card Debt? Discover the best Personal Loan choices for September 2023 and immediately start on the path to financial independence on Bright Money.

Further Reading

- Should I get a Personal Loans if I’m on unemployment?

- Three reasons to use Personal Loans to pay off Debt

- APR VS Interest rates - Understand the difference and details

FAQs

1. What is a Personal Loan, and how does it operate?

A Personal Loan is a financial instrument made available by banks and other financial organizations to meet a variety of purposes, such as consolidating Debt, paying for medical expenditures, making home improvements, and more. It is a common alternative since it often has set interest rates and flexible repayment choices.

2. Why is Debt consolidation with Personal Loans so standard?

Personal Loans are frequently unsecured, so you don't need to provide any security. They can thus offer reduced interest rates and more reasonable monthly payments, making them a desirable choice for consolidating high-interest Credit Card Debt.

3. What aspects must be considered when selecting a Personal Loan for Debt consolidation?

When choosing a Personal Loan to pay off Credit Card Debt, consider the loan amount, interest rates, loan terms, fees, needed paperwork, and Credit Score criteria. These elements may affect the final cost and the loan's appropriateness for your requirements.

4. Where can I compare Personal Loan choices and obtain additional information?

You may utilize internet resources like Credible to evaluate Personal Loan offers from various private lenders and pick the ideal one for your particular financial condition.

5. Are there any tools or services that could assist me in using Personal Loans to manage my Credit Card Debt?

To help you with Debt reduction, Credit Score improvement, and future savings, try using financial tools like Bright Money, which provides individualized financial guidance and insights.

Reference

- Personal Loans Interest Rates Today, September 25, 2023 | Today's Top Personal Loans Rates (msn.com)

- Best Personal Loans of September 2023 | Money (msn.com)

- Best Personal Loans Of September 2023 – Forbes Advisor

*For credit building related: payment history has the biggest impact on Credit Score, accounting for 40% of how score is calculated per transunion (https://www.transunion.com/credit-score). Bright Builder helps you build payment history that may positively improve your Credit Score. Credit Score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will have a negative effect on your Credit Score. Products and services subject to state residency and regulatory requirements. Bright Builder is currently not available in all states.