You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

The world of credit can often be confusing. There are many terms that often go misunderstood.

So, when it comes to credit card bills, are you making mistakes that can cost you?

Mastering your credit card's billing cycle is crucial for maintaining credit scores and your financial health. At the heart of this cycle are two pivotal dates: the due date and the statement closing date. While they may seem similar, understanding their differences is key to avoiding costly mistakes. Confusion between these dates can lead to late payments, interest charges, and a dent in your credit score.

So what does due time mean? How many days after the due date is a payment considered late? Can you make a payment on the due date? In this article, we'll answer all these questions, clarifying how they impact your finances and offering tips to stay on top of your credit card payments. By grasping these fundamental concepts, you can confidently navigate your credit card statements and build a solid foundation for your financial future.

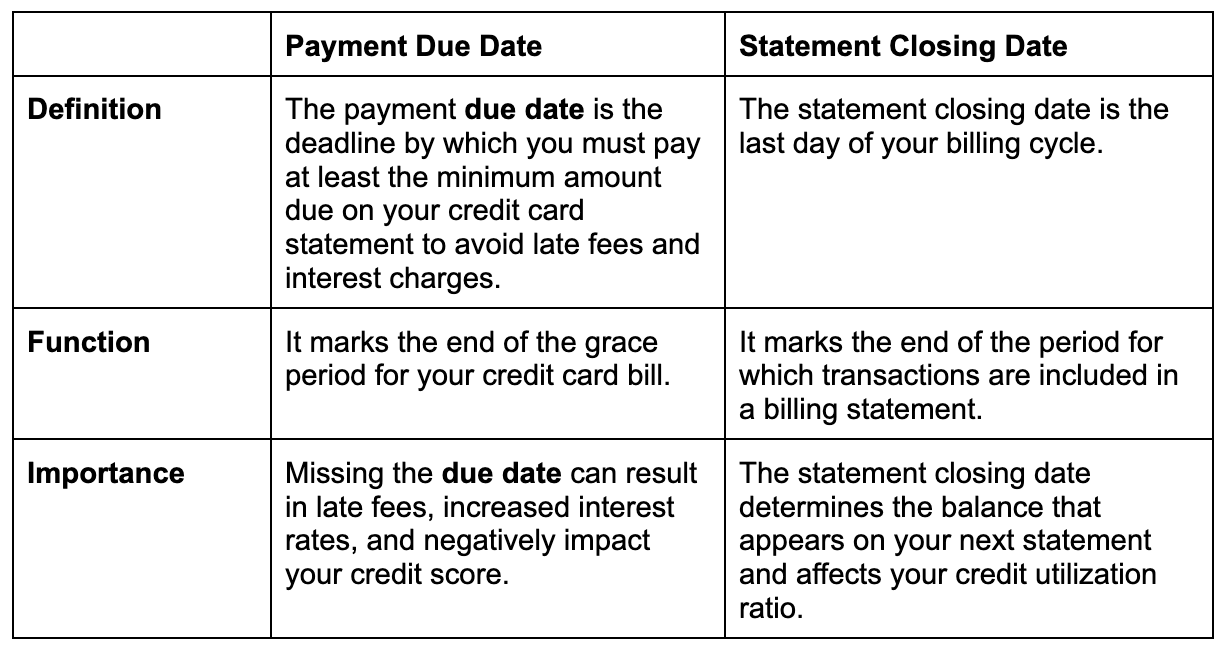

Payment Due Date vs Statement Closing Date

Your payment due date is the deadline for making at least the minimum payment on your credit card balance to avoid late fees and penalties. On the other hand, the closing date marks the end of your billing cycle. It's when your credit card issuer calculates your statement balance and reports it to the credit bureaus.

What is a payment due date?

When you owe money on your credit card, you must pay some back every month. Your credit card company sets a date for this payment, which is called the payment due date. You might have to pay extra fees if you don't pay by this date.

You can pay your bill before the due date without any extra fees. Just be careful not to pay too early, or your payment might be counted for the next month instead. You can also make more than one monthly payment if you pay at least the minimum amount by the due date.

For example, if your credit card statement is generated on the 1st of each month, and your payment due date is the 25th of the month. You must make at least the minimum payment (as specified in your statement) by 5 p.m. or 11:59 p.m. (check with your credit card company for the exact time) on the 25th to avoid late fees.

Suppose your January statement shows a balance of $1,000, and the minimum payment required is $50.

Let’s say you decide to pay $500 on the 10th of January, well before the due date. Your credit card company applies this payment to your January balance. On the 1st of February, a new statement is generated, showing a remaining statement balance of $500 (assuming no additional charges or payments). You are still required to make at least the minimum payment of $50 by the due date of February 25th.

Now, if you make a payment of $50 on January 21st, and your credit card company applies this payment to your January balance, any remaining balance from January, plus any new charges, will be included in your February statement, which will have a new due date in February.

What Is A Statement Closing Date?

The statement closing date establishes the billing cycle, typically lasting 28 to 31 days, with a maximum variation of four days as per the Consumer Financial Protection Bureau (CFPB). This date can vary each month.

For example, let's say your credit card statement closing date is the 15th of every month. Purchasing on the 10th of the month will be included in your current billing cycle. However, if you purchase the 16th, it will be included in the following month's statement.

Your card's closing date determines which purchases are included in the current statement's balance and the minimum payment due. Any purchases after this date will appear on next month's statement.

The closing date also calculates finance charges (interest) on your card. Most issuers provide a grace period for new purchases made after the closing date, extending until the payment due date, during which no interest is charged.

While many issuers offer a credit card payment grace period, reviewing your card's terms carefully is not mandatory.

Difference Between Due Date And Statement Closing Date

Let’s compare the statement closing date and due date to better understand both.

What Is Grace Period?

Your credit card payment grace period is the time between the closing of your credit card statement and the due date. You can pay off your balance during this period without incurring any interest charges.

While the law doesn't mandate a credit card payment grace period, most companies provide one. They must send you your statement at least 21 days before your payment due date. It's important to check with your credit card issuer to understand if a grace period is offered and its duration to avoid any misunderstandings.

When Is My Bill Due?

Your payment due date is typically shown on your monthly billing statement. If you can't find your statement, you can check your due date by logging in to your online banking account or by contacting your credit card issuer's customer service. It's also good to note your due dates on a calendar to ensure you don't miss any payments and incur late fees.

How To Determine Your Next Credit Card Closing Date?

Understanding your credit card bill can help you figure out your statement or credit card closing date. Look at the top of your bill for the due date, often labeled as "opening/closing dates" and shown as a range of dates.

Calculate the number of days between these dates. Then, from the closing date, count forward to find your next statement closing date. This way, you can track when your credit card statement ends and your next payment is due.

How To Change The Payment Due Date?

Your credit card payment due date is the same date each month. For instance, if your payment is due on the 10th of this month, it will be due on the 10th of every month.

Most credit card issuers let you change your due date to another date within the month. To do this, review your paydays and when your other bills are due, then call your credit card issuer to request the change. Remember that the new due date typically takes one to two billing cycles to become effective.

Impact of Statement Closing Date On Your Credit Score

On your credit card statement closing date, your card issuer typically reports your account activity, including your card’s outstanding balance, to the three credit bureaus — Experian, Equifax, and TransUnion. This information impacts your credit utilization ratio, the ratio of credit in use compared to the amount of credit you can access.

For example, let’s say your closing date is June 10, and you made a $1,500 purchase on your credit card on June 5. That purchase will be reported and can increase your credit utilization ratio. A high credit utilization ratio can adversely affect your credit score.

Now, let’s assume the purchase isn’t urgent and you waited until June 11 to put the charge on your credit card. In this scenario, your $1,500 credit card purchase wouldn’t be reported to the credit bureaus until the end of your next billing cycle. If you pay it off before then, it might not affect your credit utilization ratio.

When To Pay Credit Card?

If you’re wondering when you should pay your credit card bill, the best time to pay it is before or on the due date. Paying late can cost you interest and hurt your credit score.

When paying a credit card bill, paying before the due date helps lower your credit utilization rate, which is good for your credit score. It also helps you avoid late fees. If you have a balance from past months, paying early saves you money because you stop paying interest sooner.

Impact Of A High-Interest Credit Card

High-interest credit cards can harm your financial health due to the substantial interest charges they impose. These cards often come with annual percentage rates (APRs) well above 20%, meaning that carrying a balance can quickly accumulate costly interest charges, making it challenging to pay off your debt.

To refinance high-interest credit card debt, consider using Bright Credit. Bright Credit offers a revolving line of credit, allowing you to consolidate your high-interest credit card debt into a single, more manageable loan. Refinancing with Bright Credit can lower your monthly payments, reduce the total interest you pay, and simplify your debt repayment process.

Conclusion

Understanding the difference between your payment due date and closing date is crucial for managing your credit card effectively. These dates are not interchangeable and play distinct roles in your credit card billing cycle.

Being mindful of both dates can help you plan your spending, avoid interest charges, and maintain a healthy credit score. By knowing when your statement closes, you can strategize your purchases to manage your credit utilization rate and ensure timely payments to avoid penalties.

Bright Builder can help you manage your money by staying on top of payments. Check it out!

Suggested Readings:

- Why is a loan for Debt Consolidation a smart choice?

- Is it best to get a loan to pay off your credit card debt?

- Balance Transfer vs. Debt Consolidation: What to Choose?

FAQs

1. Should I pay on the statement closing date or due date?

Paying your credit card bill by the due date is important to avoid late fees and potential damage to your credit score. The due date is the deadline set by your credit card issuer for you to make at least the minimum payment on your balance.

Paying on the statement closing date is unnecessary, as the statement closing date is when your billing cycle ends, and your statement is generated. Any payments made after this date but before the due date will be applied to the balance on your next statement.

To avoid confusion, aim to make your payment on or before the due date. This ensures that your payment is processed on time and helps you avoid late fees and interest charges.

2. Why is my statement closing date after due date?

Your credit card issuer typically sets your statement closing date and due date, which can vary based on your specific card terms. However, it's uncommon for the statement closing date to be after the due date, as the statement closing date marks the end of your billing cycle, and the due date is the deadline for paying your bill for that cycle.

If you believe there is an error or discrepancy in your statement closing date or due date, it's best to contact your credit card issuer directly for clarification. They can provide you with accurate information regarding your billing cycle and due dates.

3. Should I do minimum payment due or last statement balance?

Making at least the minimum payment on your credit card account is crucial to maintaining a positive credit report with Experian, Equifax, and TransUnion and avoiding late fees. However, you should pay your statement balance in full to prevent interest charges from accruing.