You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

When it comes to securing a personal loan, your credit score plays a pivotal role. Lenders use this three-digit number as a quick way to assess your creditworthiness.

Think of it as a snapshot of your financial behavior, one that lenders use to gauge the risk of lending to you. A higher score often translates to better loan terms, including lower interest rates and higher borrowing limits.

The minimum credit score needed for a personal loan typically ranges from 580 to 660, but having a higher score, around 670 or more, can improve your chances of qualifying for better loan terms and rates.

Credit Score Needed For A Personal Loan

A credit score is a numerical representation of your creditworthiness, which is essentially an estimate of how likely you are to repay borrowed money. Here’s a complete overview of how different credit score ranges can impact your personal loan applications:

- Poor Credit (300-579): With a score in this range, your options for a personal loan are limited. You may still find specialized lenders willing to offer you a loan but be prepared for high interest rates and additional fees

- Fair Credit (580-669): A fair credit score gives you a fighting chance for a personal loan. You're a candidate for loans from online lenders and possibly some credit unions, but expect higher-than-average interest rates

- Good Credit (670-739): If you're in this bracket, congratulations! You have a good shot at securing a personal loan from a variety of lenders, including traditional banks. You can also expect more favorable interest rates

- Very Good to Excellent Credit (740-850): With a score in this range, you're in the driver's seat. You can expect the best interest rates and terms that lenders have to offer for personal loans

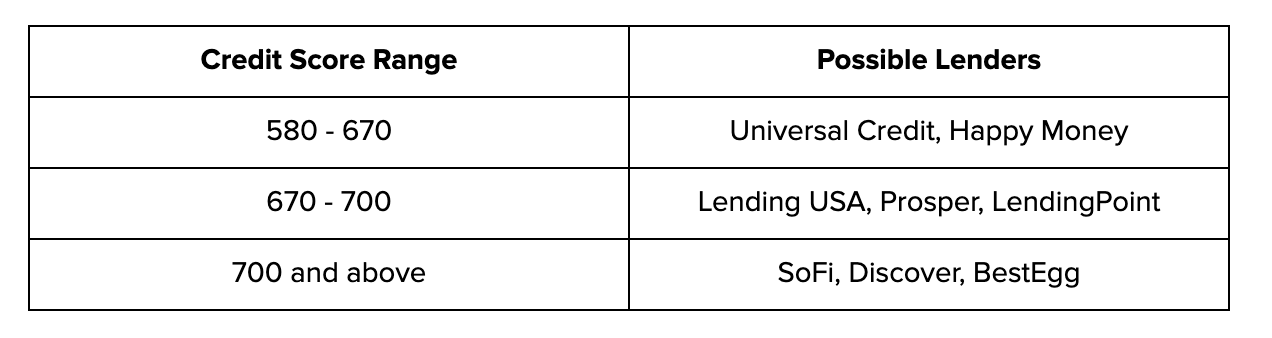

Here are some lenders you can approach with each of these credit scores for a personal loan.

Please note that this is a general overview, and specific eligibility requirements can vary among lenders. It's advisable to research and compare offers from multiple lenders to find the best personal loan that suits your needs and credit score.

Other Factors that Affect Personal Loan Approval

Your credit score isn't the only factor that lenders consider when reviewing your loan application. Other elements like your debt-to-income ratio and employment history also play a role. Here's how to make these factors work in your favor.

- Debt-to-income Ratio: Calculate your debt-to-income ratio by dividing your monthly debt payments by your monthly gross income. Lenders often prefer a ratio under 36%. If your ratio is higher, consider paying down some debt before applying for a personal loan

- Employment History: A stable employment history can sometimes offset a less-than-perfect credit score. If you've been at your job for several years, make sure to highlight this in your loan application. Some lenders give extra weight to steady employment

- Free Cash Flow: Lenders may also look at your free cash flow, which is the money left over after all expenses are paid. A positive free cash flow can make you a more attractive loan candidate. Review your budget and see where you can cut expenses to improve your free cash flow before applying

How to increase the chances of Personal Loan Approval with a Low Credit Score?

When you're considering a personal loan, you'll find that lenders often have a range of credit scores they find acceptable. This range varies depending on the lender's risk tolerance and the type of loan you're seeking.

Having a low credit score can feel like a significant hurdle when applying for a personal loan, but it's not the end of the road. So, what can you do to navigate this landscape effectively?

Step 1 - Improve Your Credit Score: A higher credit score enhances your eligibility for a personal loan. You can build credit by getting a credit builder loan or credit builder card, which helps you establish or rebuild your credit history. These tools are designed to improve your creditworthiness, making you a more attractive borrower to lenders

Step 2 - Get a Co-Signer: If your credit score is not ideal, consider having a co-signer with a strong credit history. A co-signer essentially guarantees the loan and can boost your chances of approval. However, both you and your co-signer are equally responsible for the loan

Step 3 - Prefer Secured Loans: Secured personal loans are backed by collateral, such as your savings account or a valuable asset. Lenders are often more willing to approve secured loans because they have a guarantee if you fail to repay. These loans typically come with lower interest rates as well. However, it's important to be cautious as you risk losing the collateral if you can't make payments

How to Gauge your Loan Options

Once you've determined your eligibility and explored your options, the next step is to gauge which loan is right for you.

Step 1 - Pre-Qualification: Use pre-qualification tools to get an idea of what kind of loan terms you might be offered. This usually involves a soft credit check, which won't impact your credit score. It's a risk-free way to shop around for the best deal.

Step 2 - Compare APRs: When comparing loans, look at the Annual Percentage Rate (APR), not just the interest rate. The APR includes both the interest rate and any additional fees, giving you a more complete picture of the loan's cost

Step 3 - Read the Fine Print: Before finalizing your loan, read all the terms and conditions carefully. Look for any additional fees, the flexibility of repayment options, and what happens in case of a late payment. Understanding these details can save you from unpleasant surprises down the line

Bonus Tip

Before you apply for a personal loan, pull your credit scores from both FICO and VantageScore. You can usually do this for free through your bank or other financial apps. Next, make a list of lenders you're interested in; some may specifically use FICO scores or VantageScore, so knowing both scores will help you target the right lenders.

If your credit history is on the shorter side, aim for lenders that use VantageScore, as it's generally more lenient with shorter credit histories. Lastly, use online pre-qualification tools to see which loans you might qualify for without affecting your credit score. This will help you compare rates and terms, so you can make an informed decision.

Conclusion

Securing a personal loan can seem daunting, especially if you're navigating the landscape for the first time. However, by taking a systematic approach – starting with understanding your credit score, researching lender requirements, and carefully comparing your options – you can make the process easy and increase your chances of approval. The key to a successful loan application is preparation and making informed decisions.

Financial planning can be tedious. Let Bright Money help you sail through it!

Read More:

- Is It Better To Invest Or Pay Off Debt First For Retirement?

- Personal Loan vs Credit Card: Which Is Best For You?

- What is the Difference Between Credit Score 'Hard Inquiry' vs 'Soft Inquiry'?

FAQs

- Can I Get a Personal Loan if I Just Moved to the U.S. and Have No Credit History?

Yes, it's possible but challenging. Some lenders specialize in loans for newcomers. They may consider other factors like your job, income, and educational background instead of just focusing on a credit score. You might also need a co-signer or collateral to secure the loan.

- Do Personal Loans Affect My Credit Score More Than Credit Cards?

Not necessarily. Both personal loans and credit cards impact your credit score based on your payment history and credit utilization ratio. However, a personal loan can actually improve your credit mix and potentially boost your credit score.

- Can I Use Cryptocurrency as Collateral for a Personal Loan?

While traditional lenders usually don't accept cryptocurrency as collateral, some specialized financial institutions do. However, be cautious; the volatile nature of cryptocurrencies could put your collateral at risk.

- What Happens if I Get a Raise at Work While Paying Off My Personal Loan?

A raise won't directly affect your loan terms, but it could be an opportunity to pay off your loan faster. You might want to consider making extra payments or even refinancing for a better interest rate if your improved income qualifies you for one.

- Is It Easier to Get a Personal Loan from a Credit Union if I Volunteer in the Community?

Credit unions often focus on community involvement, but it's not a standard metric for loan approval. However, a strong relationship with your credit union, built through community involvement, could give you an edge in negotiations or even qualify you for special loan programs.