You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

Imagine you have several small piles of debt, and you're thinking of combining them into one. That's the idea behind taking a loan to clear credit card debt. Many ask, How to pay off credit card debt without getting trapped in a cycle. Loans often have a fixed interest rate, which can be lower than what you're paying on your cards. This means you might end up paying less in the long run. But there's more to think about.

Some loans have hidden fees. And if you're not careful with your spending, you could end up back where you started. In this article, we'll look at the ups and downs of this approach and help you decide if it's right for you.

Why should you take Loan to pay off Credit Card Debt?

Using a personal loan to pay off debt, specifically high-interest credit card debt, can be a financially strategic move. Credit cards often come with variable interest rates that can reach up to 25%, with the interest compounding, making the debt grow rapidly. In contrast, a personal loan usually offers a fixed interest rate between 6% and 12% and employs simple interest, making the total repayment amount more predictable and generally lower.

Consolidating credit card balances into a single personal loan can also improve your credit score by reducing your credit utilization ratio. Unlike credit cards, a personal loan has a fixed repayment term, providing a set timeline for becoming debt-free. Therefore, using a personal loan to pay off debt can offer both financial and psychological benefits, making it a smart strategy for long-term financial health.

What are the options available to pay off Credit Card?

Paying off credit card debt can be tackled in multiple ways:

The snowball method focuses on clearing smaller debts first, offering psychological wins but not necessarily minimizing interest.

The avalanche method targets high-interest debts first, saving money but requiring patience. Balance transfer cards offer low introductory APRs, but watch out for transfer fees and rate hikes post-intro period.

Using a personal loan to pay off debt offers fixed interest rates, usually lower than credit cards, and sets a definite timeline for repayment, improving budgeting and potentially boosting your credit score.

Debt settlement or management plans are also options but can negatively affect your credit score. The right strategy depends on your financial situation and goals.

The real cost of Lower Interest Rates

Considering a loan to manage credit card debt? Lower interest rates might seem enticing, but there's more beneath the surface. Interest rates, while vital, aren't the full financial picture.

- Loan Origination Fees: These upfront costs, usually a percentage of the loan amount, are charges for processing a loan. A 2% fee on a $10,000 loan instantly adds $200 to your debt

- Administrative Fees: Some loans come with ongoing fees for account maintenance, often charged monthly or annually. These fees might seem negligible but can accumulate over time

- Prepayment Penalties: Intending to clear your loan early? Be cautious. Some lenders charge penalties for early loan settlement, reducing the potential savings from paying ahead

To truly gauge a loan's value, factor in these costs along with the advertised interest. Sum the interest over the loan term and add all associated fees. This total borrowing cost provides a clearer picture, aiding in a more accurate comparison against credit card debt.

How Debt Consolidation Strategy functions?

Debt consolidation can be a smart strategy for managing credit card debt, and here's why. By consolidating multiple high-interest credit card debts into a single loan with a lower interest rate, you can save money and simplify your monthly payments. Let's break this down with an example:

Example Debt Scenario

- Credit Card A: $5,000 at 20% APR

- Credit Card B: $3,000 at 18% APR

- Credit Card C: $2,000 at 22% APR

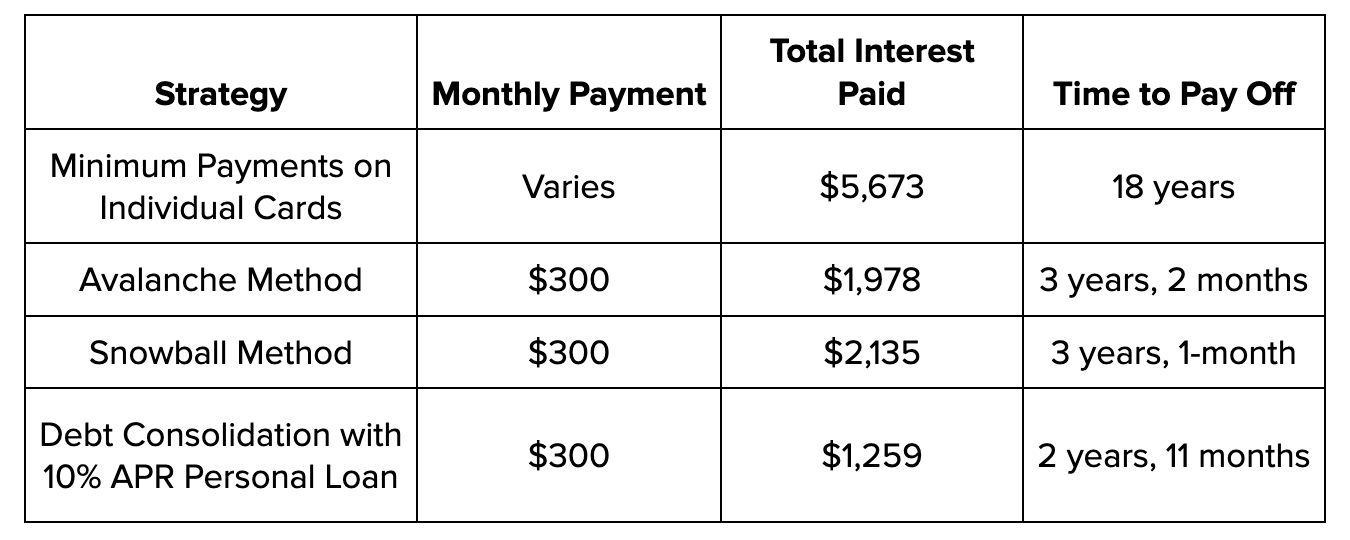

As seen in the table, using a personal loan for debt consolidation at a 10% APR would not only save you money in interest but also allow you to become debt-free faster compared to other methods.

Debt consolidation simplifies your financial life by turning multiple payments into a single monthly payment, making it easier to manage. It can also positively impact your credit score by reducing your credit utilization ratio and adding a different type of credit to your profile. Therefore, debt consolidation can be a beneficial strategy for handling credit card debt effectively.

The fine print of Debt Consolidation Loans

When determining how to pay off credit card debt, debt consolidation loans often emerge as a notable option. Their appeal? Merging multiple debts into one streamlined payment.

However, potential borrowers should be keenly aware of the intricacies involved.

- Fees: While a lower interest rate might be the headline feature, some consolidation loans offset this with high origination or administrative fees. It's essential to calculate the long-term cost of these fees against the savings from the reduced interest rate

- Loan Agreements: Contracts are binding. Before signing, take the time to review the entire agreement. Understand terms like early repayment policies and potential penalties. Ensure you're not trading one financial strain for another under different terms

- Hidden Costs: Some consolidation loans might come with costs not immediately evident. These can include penalties for missed payments, fees for account services, or charges related to account changes

For those evaluating if they should pursue debt pay off or invest, or consider the balance between debt pay off or save, it's crucial to be meticulous.

Thoroughly vetting a loan agreement can prevent future financial pitfalls and ensure the path chosen is genuinely beneficial. You can always enlist the help of Bright Money for a better financial future!

The impact on Cash Flow

When considering a loan to pay off credit card debt, understanding its impact on cash flow is crucial. Here are the specifics:

- Fixed Monthly Payments: Unlike credit card debts with fluctuating payments, personal loans offer fixed monthly payments. This means you'll owe the same amount each month until the loan is paid off

- Budgeting: Knowing the exact monthly amount makes budgeting straightforward. There's no guesswork; if your loan repayment is $200 monthly, that's a set amount you'll factor in each month

- Cash Flow Analysis: Before accepting any loan, assess your monthly cash flow. Calculate your income against all expenses, not forgetting unexpected ones like emergencies or sudden repairs. Does the loan payment comfortably fit?

- Potential Pitfalls: A significant chunk of your monthly income directed at loan repayment might not leave enough for unforeseen expenses. If your after-expense income doesn't comfortably cover the loan repayment, you might be setting yourself up for financial strain

The role of Collateral in Secured Loans

When delving into ways to pay off debt, especially credit card debt, secured loans often pop up as a potential solution. But what are they? And are they a good choice? Let's break it down.

First up, let us understand the basics. A secured loan is a type of loan where you offer an asset as collateral. This asset acts as a security blanket for lenders. If you default on the loan, the lender can claim this asset.

- Lower Interest Rates (Benefit)

The main lure of secured loans? They typically come with lower interest rates. This makes the journey of how to pay off credit card debt seem a bit lighter, at least in terms of the interest burden.

- Commonly Used Assets as Collateral

Houses and cars are on top of the list. But other assets can also be leveraged, like stocks or savings accounts. Know the worth of what you're putting down, and how it impacts your financial standing.

- Asset Forfeiture (Risk)

This is the dark cloud of secured loans. Miss a few payments and you risk losing the asset you've put up as collateral. If it's your home, the stakes are high. Weigh this risk when considering how to pay off debt using secured loans.

- Your Financial Risk Profile

This isn't just about numbers. It's about peace of mind. Pledging your car might seem okay until the reality of potentially losing it sets in. Understand your comfort level with risk before diving into secured loans.

When plotting out strategies for debt pay off or save decisions, or even juggling the idea of debt pay off or investment, consider the role of collateral in your decision-making.

The Hidden Opportunity Costs

Opportunity cost plays an important role when deciding how to allocate funds, particularly in situations like choosing between paying off debt and pursuing other financial ventures.

- Defining Opportunity Cost: Simply put, opportunity cost is the potential benefit that one gives up when choosing one option over another. In the financial arena, when you decide to use money to settle a debt instead of, say, investing, you're sacrificing the potential benefits of that alternate choice

- Comparing Interest Rates with Potential Returns: To calculate this cost, compare your loan's interest rate to the potential returns from other investments. If your loan incurs an interest of 15% annually and an investment offers an 8% return, paying off the debt seems more advantageous as the cost of holding the debt is higher than potential earnings

It's essential to grasp this concept thoroughly, especially when considering how to pay off debt.

Conclusion

Figuring out how to pay off credit card debt can be a turning point in one's financial journey. Taking a loan to consolidate your debts might seem like a smart move. It can offer a structured payment plan and often comes with a lower interest rate than credit cards. But it's essential to dive deeper.

Look for loans without hidden fees or rigid terms. Also, after consolidating, it's crucial to avoid accumulating new credit card debt. This means revisiting your spending habits and possibly setting a budget. With the right loan and a commitment to change, you can pave a smoother path to financial stability.

Financial stability comes with proper planning. Let Bright Money help you with it!

Read More:

- Are Debt Consolidation Loans A Good Idea?

- The Key To Financial Security: Secured Credit Card

- Score Big In Life: What’s the Magic Credit Score?

FAQs

- Are there apps to help with the snowball or avalanche methods?

In today's tech-driven world, there's an app for almost everything, including debt management. If you're trying to figure out how to pay off debt, using apps tailored for the snowball or avalanche methods can be invaluable. These apps not only track your debts but also provide visual representations of your progress. They can simulate outcomes based on different strategies, offering insights into how quickly you can achieve a debt-free status. Leveraging technology can simplify and expedite your debt pay off journey.

- How often should I review my debt pay off strategy?

Consistency and adaptability are key when tackling debt. A quarterly review of your strategy is advisable. As life changes – maybe you've had a change in income, or unexpected expenses have cropped up – your strategy might need tweaking. Regular check-ins allow you to assess your progress and make necessary adjustments. It's a proactive approach in the "debt pay off or save" debate, ensuring you're always on the most efficient path.

- Can I mix the snowball and avalanche methods?

Debt repayment isn't one-size-fits-all. While the snowball and avalanche methods are popular, some find success in blending the two. Starting with the snowball method can offer the motivation of clearing smaller debts quickly. As you build momentum and confidence, switching to the avalanche method for larger, high-interest debts can be more financially efficient. It's about personalizing your strategy to resonate with your financial situation and goals.

- What if my partner has a different debt pay off strategy?

Money discussions can be tricky in relationships. If you and your partner have differing views on debt repayment, it's essential to find common ground. Open, honest communication is the first step. Discuss your individual strategies, understand each other's perspectives, and work towards a unified approach. Together, you can create a joint plan that respects both viewpoints and optimizes how to pay off credit card debt and other liabilities.

- Are there community groups that can support my debt-clearing journey?

Absolutely. The journey to financial freedom is often more manageable with support. Numerous online forums and local community groups focus on financial well-being. Engaging with these communities can offer insights, especially when seeking advice on how to pay off credit card debt. Sharing experiences, asking questions, and learning from others can provide both motivation and valuable knowledge.

References:

- https://www.bankrate.com/finance/credit-cards/take-out-personal-loan-to-pay-credit-card-bill/

- https://www.forbes.com/advisor/personal-loans/personal-loan-to-pay-off-credit-card/

- https://www.cnbc.com/select/using-a-personal-loan-to-pay-off-credit-card-debt/

- https://www.lendingtree.com/personal/personal-loan-to-pay-off-credit-cards/