You are now leaving the Bright website and entering a third-party website. Bright has no control over the content, products, or services offered, nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. Bright does not guarantee or endorse the products, information, or recommendations provided on any third-party website.

When managing personal finances, the decision to pay off a Personal Loan ahead of schedule could be affecting your Credit Score. This choice becomes particularly crucial for individuals looking to use a Personal Loan to consolidate and eliminate various types of Debt. In 2020, Experian reported that the average Personal Loan Debt per consumer in the United States stood at $16,458, emphasizing the prevalence of such financial obligations.

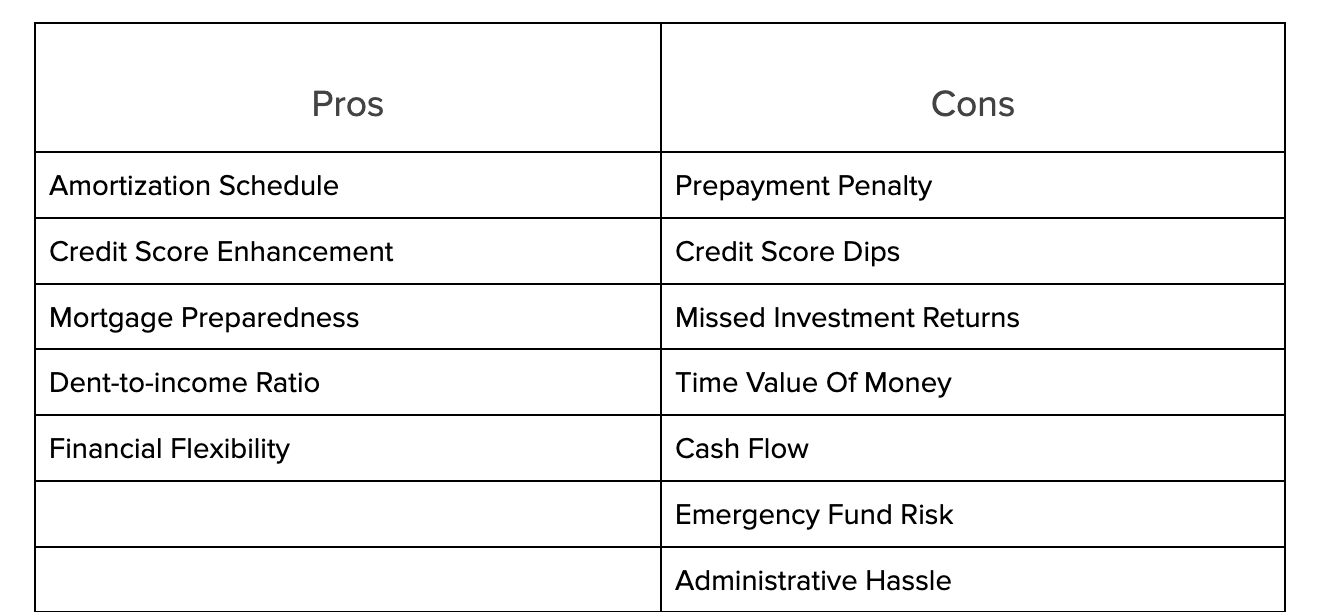

Early repayment of a Personal Loan has its advantages and disadvantages. On one hand, it can lead to interest savings, enhanced financial flexibility, and reduced stress. On the other hand, potential drawbacks like prepayment penalties and the opportunity cost of diverting funds from other investments or financial goals must be considered.

Should You Pay Off a Personal Loan Early to Delete Debt?

If you have a personal loan with a high interest rate, then you should pay it as early as possible. For example: Pay Day Loan

This will help you save money on interest amount.

But if you have Personal Loans that have low-interest rates, you don't need to foreclose them. You can close them late, and utilize the savings to invest.

For example: Student Loan

low interest

The Pros and Cons Of Paying Off Personal Loan Early

While paying off your loan comes with many advantages like reduced total interest due to an amortization schedule, Credit Score enhancement, etc., it also comes with some downsides like prepayment penalties and missed investment returns.

This example will help you understand what happens when you pre-pay loans.

Let’s say you have a loan of $100,000, with an interest rate of 4% per annum, and the loan term is 30 years. Now, there are two years left for the loan to end. You have saved up quite a bit and want to pre-pay your loan. Paying off the loan two years early will bring you approximately 12% savings on interest. But you will have to pay a 1.6% prepayment penalty.

Pros of Paying Off a Personal Loan Early

1. Amortization schedule

The amortization schedule delineates the structure of your loan repayments over a predetermined time frame. Accelerating this schedule by making early payments substantially diminishes your overall interest expense.

For instance, consider a loan of $10,000 with an interest rate of 5% over 60 months. Adhering to the original schedule would result in approximately $2,728 in interest payments. If, however, the loan is paid off in 36 months, interest payments are reduced to roughly $1,579. This early repayment results in a saving of $1,149 in interest expenses. [1]

2. Credit Score Enhancement

Paying off your loan early and regularly will lead to a positive effect on your Credit Score. Essentially, your lender will report your regular payments to credit agencies, which in turn helps boost your Credit Score. Thus, early payments can potentially increase your Credit Scores through credit reporting.

3. Mortgage Preparedness

Preexisting Debt is a considerable factor affecting mortgage eligibility and interest rates. Research indicates that if an individual has no Debt or Debts lower than 20%, their chances of getting an additional mortgage are 15% higher.

Therefore, paying off the loan early gives you a better chance of getting a better loan in the future.

4. Debt-to-Income Ratio

The Debt-to-income ratio is a criterion lenders use to determine your ability to manage repayments. A good Debt-to-income ratio, lower than 35%, enhances your attractiveness as a borrower. Early repayment of a Personal Loan improves this ratio, making you a more desirable candidate for future financing.

A better ratio opens up a world of opportunities. Not just any Credit Card or loan, but the ones with the most favorable terms and lowest interest rates. If you're planning on a bigger financial move in the future, like getting a mortgage for a house, this improved ratio can be your golden ticket.

5. Financial Flexibility

Liberation from Debt opens up numerous financial avenues. The absence of loan responsibilities provides room for strategic financial planning, such as reinvestment, building an emergency fund, or undertaking home improvements. Additionally, your favorable credit profile may allow you to secure new loans at preferential rates.

Cons of Paying Off a Personal Loan Early

1. Prepayment Penalties

In some loan agreements, there's a clause that charges prepayment penalties. This fee activates when you repay the loan before the agreed-upon term ends. The penalty is usually a percentage of the remaining loan balance or a flat fee. For example, if the remaining loan amount is $10,000 and there's a 2% prepayment penalty, you'll incur an additional charge of $200.

2. Credit Score Dips

Eliminating a loan from your credit report might temporarily reduce your Credit Score and lead to higher interest rates on future loans. When you close a credit account, especially one with a history of timely payments, you can negatively impact your credit history's length. This factor makes up about 15% of your Credit Score and could affect future loan approval rates.

Bright Money can help you plan for a healthier Credit Score and control your Debt!

3. Missed Investment Returns

Allocating funds to clear a loan can divert them from other potentially profitable investments. According to historical stock market trends, average annual returns in the last ten years are around 12% after accounting for inflation. Therefore, using money for early loan repayment instead of investments may result in lost long-term growth opportunities.

4. Time Value of Money

The value of money diminishes over time due to inflation, which currently averages around 2% per year. If you pay off a Personal Loan early, that money used could have been invested to at least keep pace with inflation. This is an important consideration when assessing the opportunity cost of early repayment of Personal Loans. However, the case might be different for high-interest loans.

5. Cash Flow

Early repayment demands a substantial upfront payment, affecting monthly cash flow. This reduced liquidity could make it challenging to cover unexpected financial emergencies, such as medical bills, without relying on high-interest credit options.

6. Emergency Fund Risk

Using your emergency fund for early loan repayment could leave you financially vulnerable. A depleted emergency fund can force you into a cycle of Debt when facing unplanned expenses, as the only available option may be high-interest Credit Cards or another loan.

7. Administrative Hassles

Early repayment often requires dealing with bureaucratic procedures, including forms and official authorizations. Each of these steps takes time and can prolong the repayment process, making it less straightforward than simply continuing with scheduled payments.

Debt Consolidation

Debt consolidation can play a huge role in managing your financial health. Taking a Personal Loan to consolidate high-interest Debt is a viable strategy. Repaying the Personal Loan ahead of schedule maximizes this benefit, potentially reducing the cost of your Debt by more than 50% through interest rate savings. Bright Money can help you consolidate your Debt and build finances, leading to better financial health.

Conclusion

In wrapping up, the choice to pay off a Personal Loan early isn't one-size-fits-all. The benefits are tempting: less interest paid, a better Credit Score, and more freedom to move with your finances. But it's crucial to evaluate your unique circumstances.

If you're juggling higher-interest Debts or eyeing a mortgage, these factors will weigh in. And remember, using a Personal Loan to knock out other Debts can be a smart move if done thoughtfully. So take a good look at your financial picture. Crunch those numbers. Make the call that's right for you. No shortcuts, just smart planning. And Bright Money is always here to help you with smart planning.

Read More:

- 3 Reasons To Use Personal Loans To Pay Off Debt

- Mastering Loan Repayment: Your Ultimate Guide To Calculate It!

- Is It Better to Invest or Pay Off Debt First For Retirement?

FAQs

1. Can Paying Off a Personal Loan Early Affect My Credit Score?

Paying off a Personal Loan early can have a complex impact on your Credit Score. On one hand, early repayment reduces your Debt-to-income ratio, which is generally beneficial for your credit profile. On the other hand, closing an active installment account can affect your credit mix, which makes up a smaller portion of your Credit Score.

Therefore, while using a Personal Loan to pay off Debt early may seem like a straightforward positive action, it can have nuanced implications for your Credit Score. It's advisable to consult with a financial advisor to understand how early repayment will affect your specific financial situation.

2. What Happens to the Interest When I Pay Off a Personal Loan Early?

When you use a Personal Loan to pay off Debt, the interest rate is a significant factor. Early repayment often reduces the amount of interest you'll pay over the life of the loan. However, some lenders impose prepayment penalties or utilize precomputed interest, which can negate some of the benefits of early repayment. Therefore, it's crucial to read the loan agreement carefully to understand how interest is calculated and whether any penalties apply to early repayment.

3. Can I Partially Prepay a Personal Loan to Reduce Debt?

Partial prepayment is an option where you pay more than the minimum required amount but don't settle the entire loan. This strategy can be beneficial for reducing the overall interest and the loan's tenure. When you partially prepay a Personal Loan to reduce Debt, you make a significant reduction in the principal amount, which in turn reduces the interest burden. This is an effective strategy for individuals who have received a lump sum of money but do not wish to close the loan entirely.

4. Can I Use Another Loan to Pay Off a Personal Loan Early?

The decision to use extra funds to pay off a Personal Loan early or to invest those funds elsewhere is often a matter of comparing interest rates. If the interest rate on the loan is higher than the expected return on investment, it is generally advisable to pay off the loan. On the other hand, if the expected return on investment is higher, investing the funds could be more beneficial. It's essential to conduct a thorough analysis, taking into account factors like investment risk, loan terms, and your financial goals.

5. Can I Use Another Loan to Pay Off a Personal Loan Early?

Refinancing involves taking out a new loan with more favorable terms to pay off an existing loan. This strategy can be effective in reducing interest rates and improving loan conditions. However, it's essential to consider the costs associated with refinancing, such as origination fees and any penalties for early repayment of the existing loan. While using another loan to pay off a Personal Loan early can be beneficial, it's crucial to ensure that the benefits outweigh the costs.

References

- https://www.telhio.org/blog/the-pros-and-cons-of-paying-off-loans-early

- https://www.lendingclub.com/resource-center/personal-loan/the-pros-and-cons-of-paying-off-a-personal-loan-early

- https://www.nasdaq.com/articles/pros-and-cons-of-paying-off-your-personal-loan-early

- https://www.cnbc.com/select/can-you-pay-off-a-personal-loan-early/

- https://www.investopedia.com/ask/answers/021215/what-good-Debt-ratio-and-what-bad-Debt-ratio.asp

Disclaimer:

1. Payment history has the biggest impact on Credit Score accounting for 40% of how score is calculated per transunion (https://www.transunion.com/credit-score). Bright Builder helps you build payment history that may positively improve your Credit Score. Credit Score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will have a negative effect on your Credit Score. Products and services subject to state residency and regulatory requirements. Bright builder is currently not available in all states.

2. Bright credit is a line of credit that can be used to pay off your Credit Cards. Subject to credit approval. Variable apr range from 9% –24.99%, credit limit ranges from $500 - $8,000. Apr will vary based on prime rates. Final terms may vary depending on credit review. Monthly minimum payments are as low as 3% of the outstanding principle balance plus the accrued interest. Also, you can choose to pay more than the minimum due if you want to pay down the loan faster. Credit line originated by bright or cbw bank, member fdic. Products and services subject to state residency and regulatory requirements. Bright credit is currently not available in all states